- China

- /

- Personal Products

- /

- SZSE:300740

SYoung Group Co., Ltd. (SZSE:300740) Stock Catapults 43% Though Its Price And Business Still Lag The Market

SYoung Group Co., Ltd. (SZSE:300740) shares have had a really impressive month, gaining 43% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

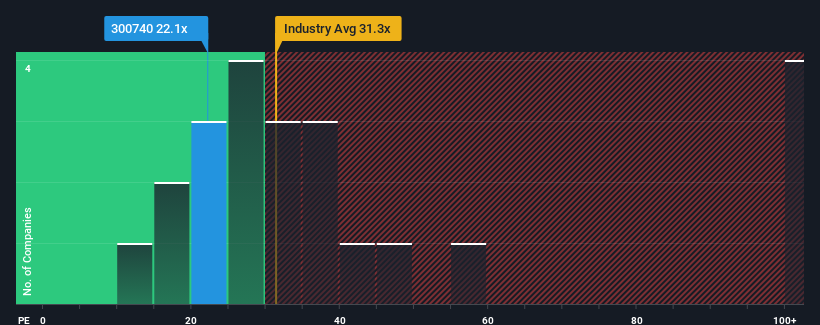

In spite of the firm bounce in price, SYoung Group's price-to-earnings (or "P/E") ratio of 22.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for SYoung Group as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for SYoung Group

Is There Any Growth For SYoung Group?

The only time you'd be truly comfortable seeing a P/E as low as SYoung Group's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. As a result, it also grew EPS by 28% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 16% each year over the next three years. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader market.

With this information, we can see why SYoung Group is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite SYoung Group's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that SYoung Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with SYoung Group (including 1 which is potentially serious).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300740

SYoung Group

Engages in the research and development, production, and sale of cosmetic products in China.

Undervalued with proven track record.

Market Insights

Community Narratives