Unveiling Three Undiscovered Gems For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets navigate a mix of economic indicators, including declining U.S. consumer confidence and fluctuating manufacturing data, investors are keenly observing opportunities in various sectors. In this dynamic environment, small-cap stocks often present unique potential for portfolio enhancement due to their capacity for growth and adaptability amid changing market conditions. Identifying undiscovered gems requires a focus on companies with strong fundamentals and innovative strategies that can thrive even when broader market sentiment is uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Tianjin Yiyi Hygiene ProductsLtd (SZSE:001206)

Simply Wall St Value Rating: ★★★★★★

Overview: Tianjin Yiyi Hygiene Products Co., Ltd focuses on the research, design, production, and sale of disposable pet and personal hygiene care products both in China and internationally, with a market capitalization of CN¥3.07 billion.

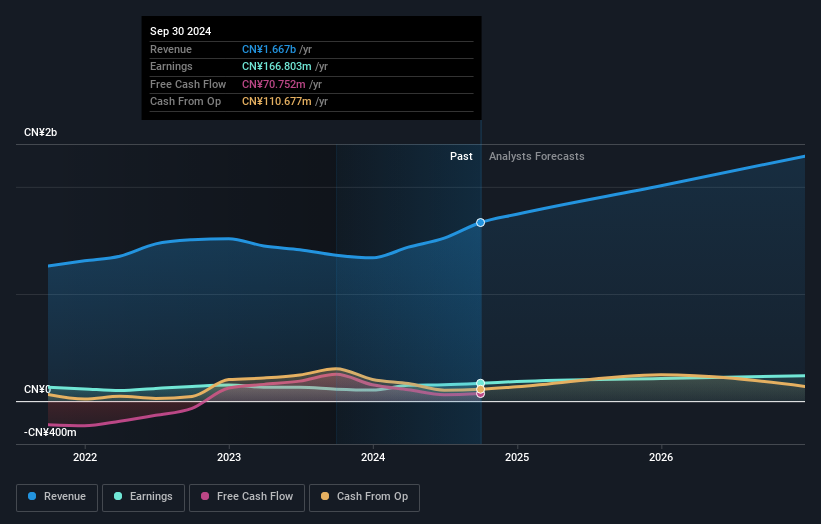

Operations: Yiyi Hygiene generates revenue primarily through the sale of disposable pet and personal hygiene care products. The company's financial performance is influenced by its cost structure, which includes expenses related to research, design, production, and distribution. Gross profit margin trends provide insight into the company's pricing strategy and cost management effectiveness.

Tianjin Yiyi Hygiene Products, a relatively small player in its industry, showcases promising financial health with a debt-free status and earnings growth of 50.1% over the past year, outpacing the broader Household Products sector's -6.7%. Its price-to-earnings ratio stands at 19x, notably below the CN market average of 34x, suggesting potential value for investors. For the nine months ending September 2024, sales reached CNY 1.32 billion from CNY 986 million previously, and net income rose to CNY 150.93 million from CNY 87.38 million last year. This performance highlights its capacity for high-quality earnings and profitability prospects moving forward.

- Click to explore a detailed breakdown of our findings in Tianjin Yiyi Hygiene ProductsLtd's health report.

Understand Tianjin Yiyi Hygiene ProductsLtd's track record by examining our Past report.

Nova Technology (TPEX:6613)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nova Technology Corporation offers specialized services to semiconductor, photonics, solar energy, biotech, pharmaceutical, and chemical industrial manufacturers across Taiwan, China, and internationally with a market capitalization of NT$13.52 billion.

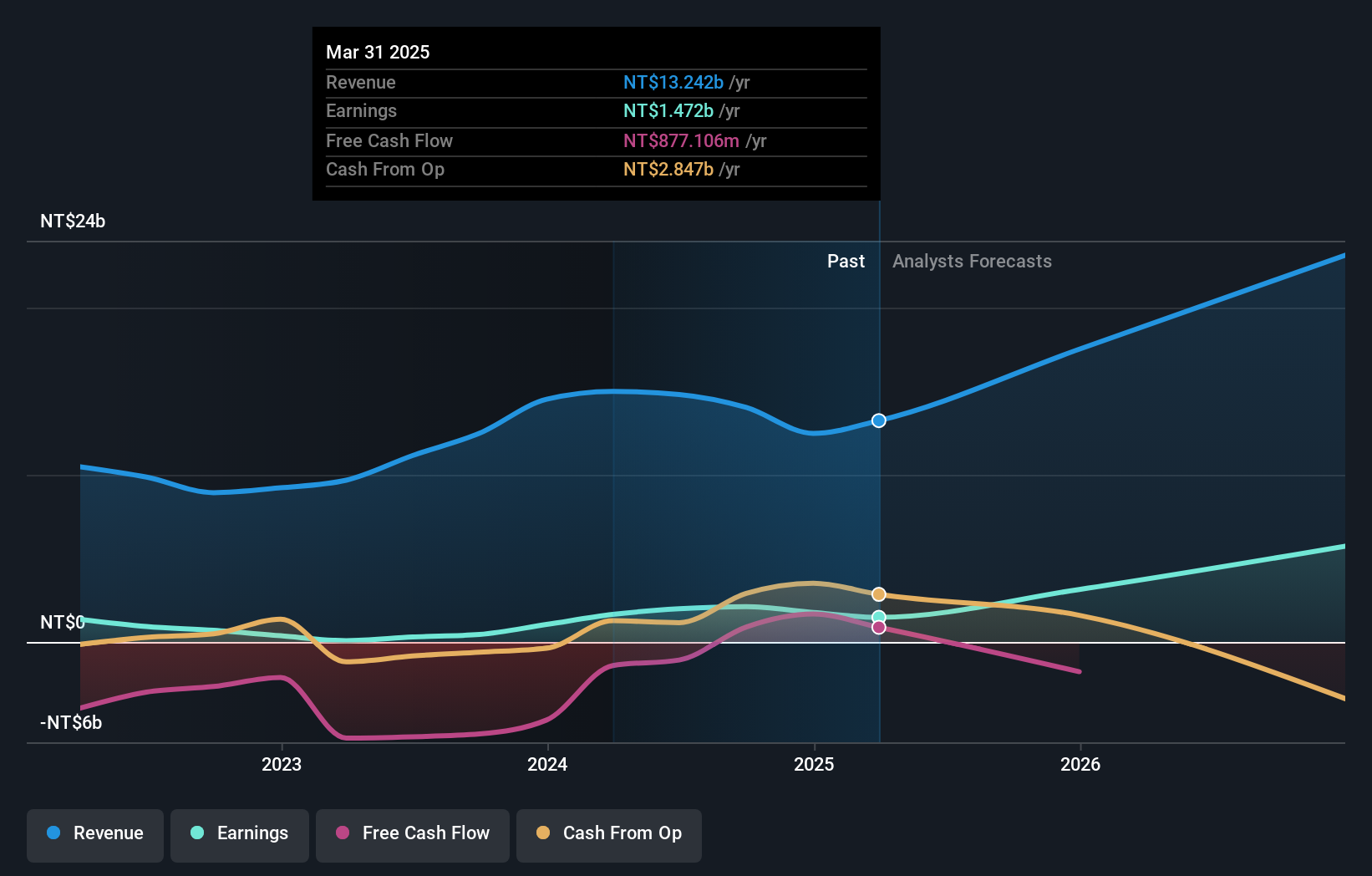

Operations: Nova Technology Corporation generates its revenue primarily from China and Taiwan, with NT$6.22 billion and NT$3.73 billion respectively.

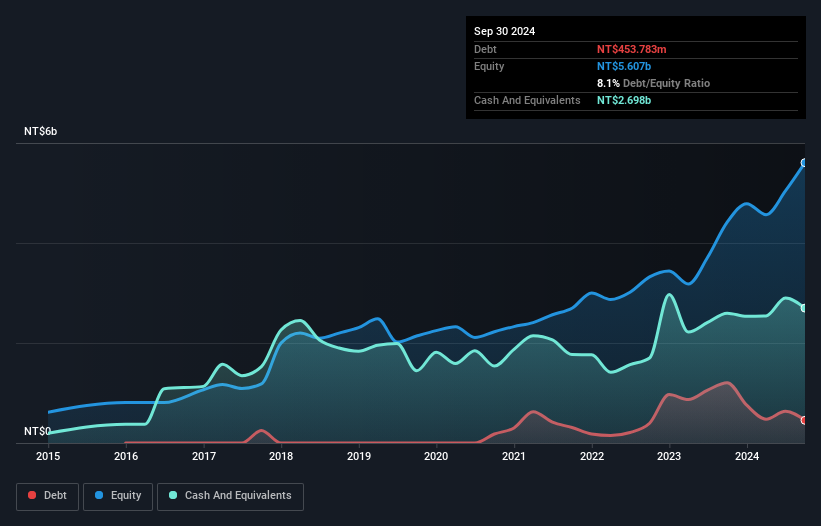

Nova Technology is making waves with its impressive earnings growth of 35% over the past year, outpacing the Machinery industry's 14.6%. The company seems to offer great value, trading at 66.5% below its estimated fair value. Despite a slight increase in debt-to-equity ratio to 8.1% over five years, Nova maintains a strong financial footing with more cash than total debt and positive free cash flow. Recent quarterly results show sales climbing to TWD 2.75 billion from TWD 2.41 billion last year, while net income jumped to TWD 453 million from TWD 248 million, highlighting robust operational performance and potential for future growth.

- Get an in-depth perspective on Nova Technology's performance by reading our health report here.

Examine Nova Technology's past performance report to understand how it has performed in the past.

Century Iron and Steel IndustrialLtd (TWSE:9958)

Simply Wall St Value Rating: ★★★★★☆

Overview: Century Iron and Steel Industrial Ltd (TWSE:9958) is a company engaged in the production and sale of steel structures, with a market capitalization of NT$41.87 billion.

Operations: Century Iron and Steel Industrial Co., Ltd. generates revenue primarily from its Building Reinforcing Steel Structure segment, amounting to NT$14.03 billion.

Century Iron and Steel Industrial Ltd. seems to be a dynamic player in the metals and mining arena, with recent earnings growth of 369.4% outpacing the industry average of 12.3%. Despite a volatile share price over the past three months, its price-to-earnings ratio of 19.7x remains attractive compared to the TW market's 20.9x. The company's net debt to equity ratio is at a satisfactory level of 35.2%, indicating manageable leverage, while EBIT covers interest payments by an impressive margin of 18 times, suggesting robust financial health amidst operational changes like leadership adjustments and strategic financing moves such as convertible bond placements for TWD 4 billion in October 2024.

Summing It All Up

- Discover the full array of 4644 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6613

Nova Technology

Provides services for semiconductor plants, photonics plants, solar energy, biotech, pharmaceutical, and chemical industrial manufacturers in Taiwan, China, and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives