- China

- /

- Personal Products

- /

- SHSE:688793

Investors Still Aren't Entirely Convinced By Shenzhen Breo Technology Co., Ltd.'s (SHSE:688793) Revenues Despite 37% Price Jump

The Shenzhen Breo Technology Co., Ltd. (SHSE:688793) share price has done very well over the last month, posting an excellent gain of 37%. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

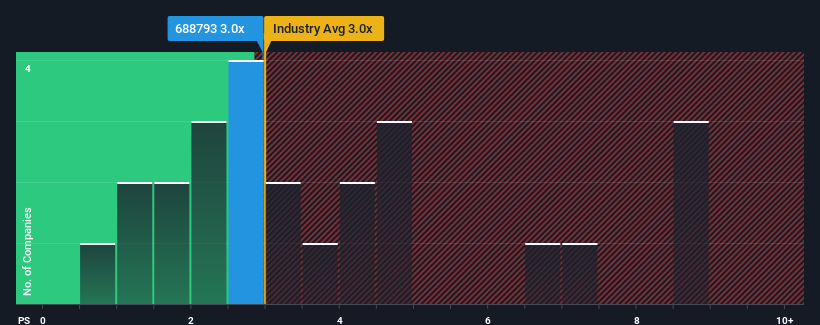

Even after such a large jump in price, it's still not a stretch to say that Shenzhen Breo Technology's price-to-sales (or "P/S") ratio of 3x right now seems quite "middle-of-the-road" compared to the Personal Products industry in China, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Shenzhen Breo Technology

What Does Shenzhen Breo Technology's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Shenzhen Breo Technology has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Breo Technology.Is There Some Revenue Growth Forecasted For Shenzhen Breo Technology?

The only time you'd be comfortable seeing a P/S like Shenzhen Breo Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The latest three year period has also seen a 23% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 24% over the next year. That's shaping up to be materially higher than the 19% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Shenzhen Breo Technology's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Shenzhen Breo Technology's P/S Mean For Investors?

Its shares have lifted substantially and now Shenzhen Breo Technology's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Shenzhen Breo Technology's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 2 warning signs for Shenzhen Breo Technology (1 is potentially serious!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688793

Shenzhen Breo Technology

Researches and develops portable massage products for headache swelling, eye fatigue, and shoulder and neck pain.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives