- China

- /

- Household Products

- /

- SHSE:603515

Downgrade: Here's How Analysts See Opple Lighting Co.,LTD (SHSE:603515) Performing In The Near Term

The latest analyst coverage could presage a bad day for Opple Lighting Co.,LTD (SHSE:603515), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

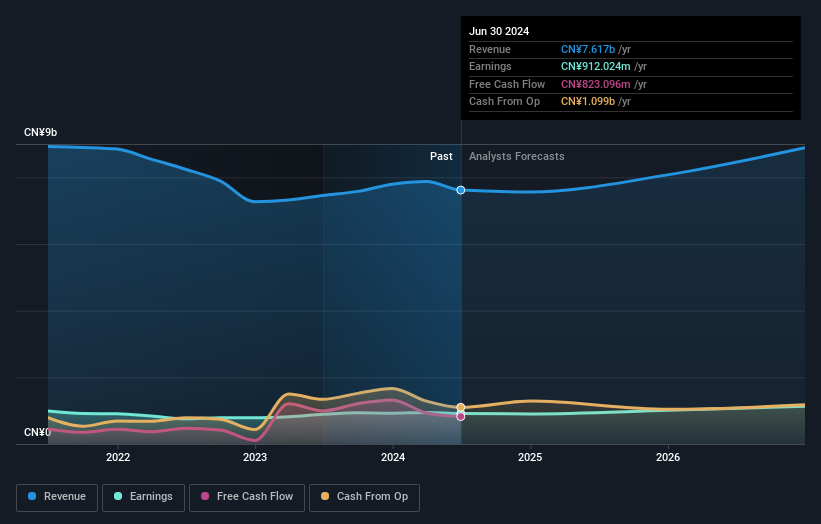

Following this downgrade, Opple LightingLTD's five analysts are forecasting 2024 revenues to be CN¥7.6b, approximately in line with the last 12 months. Statutory earnings per share are supposed to reduce 2.5% to CN¥1.21 in the same period. Prior to this update, the analysts had been forecasting revenues of CN¥8.6b and earnings per share (EPS) of CN¥1.38 in 2024. Indeed, we can see that the analysts are a lot more bearish about Opple LightingLTD's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Opple LightingLTD

It'll come as no surprise then, to learn that the analysts have cut their price target 17% to CN¥18.47.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing that stands out from these estimates is that revenues are expected to keep falling until the end of 2024, roughly in line with the historical decline of 1.6% per annum over the past five years. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 14% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Opple LightingLTD to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Opple LightingLTD.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Opple LightingLTD analysts - going out to 2026, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603515

Opple LightingLTD

Engages in the research and development, production, and sale of lighting products in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives