3 Stocks That May Be Trading Below Their Estimated Value In February 2025

Reviewed by Simply Wall St

As global markets experience significant movements, with U.S. stock indexes nearing record highs and inflation data driving expectations for prolonged higher interest rates, investors are closely monitoring opportunities for value in a volatile environment. In such conditions, identifying stocks that may be trading below their estimated value can offer potential avenues for investment, as these stocks might provide attractive entry points amidst the broader market trends.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.41 | CN¥51.88 | 49.1% |

| Vimi Fasteners (BIT:VIM) | €0.97 | €1.91 | 49.2% |

| Hibino (TSE:2469) | ¥2770.00 | ¥5502.58 | 49.7% |

| Shanghai Haohai Biological Technology (SEHK:6826) | HK$26.30 | HK$52.47 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$110.50 | NT$220.43 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$15.07 | MX$29.71 | 49.3% |

| Accent Group (ASX:AX1) | A$2.11 | A$4.19 | 49.6% |

| Saigon Thuong Tin Commercial Bank (HOSE:STB) | ₫38750.00 | ₫76325.14 | 49.2% |

| Com2uS (KOSDAQ:A078340) | ₩48250.00 | ₩96043.58 | 49.8% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.75 | CN¥36.88 | 49.2% |

Let's explore several standout options from the results in the screener.

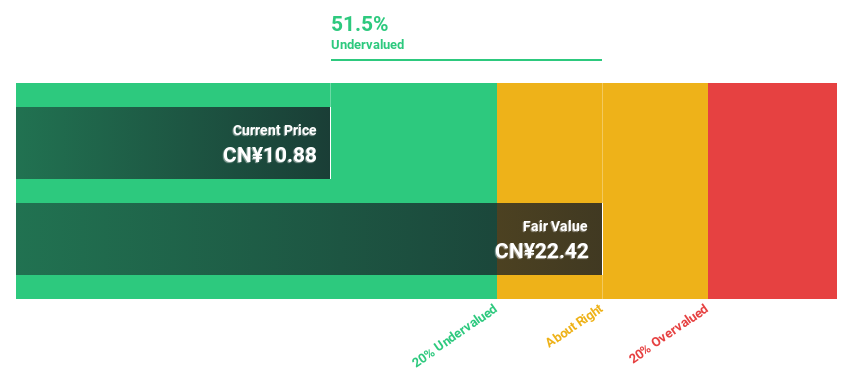

North Electro-OpticLtd (SHSE:600184)

Overview: North Electro-Optic Co., Ltd. engages in the research, development, production, and sale of optoelectronic materials and devices both in China and internationally, with a market cap of CN¥5.93 billion.

Operations: Unfortunately, the Business operations text provided does not include specific details about the company's revenue segments, so I'm unable to summarize them for you. If you have more detailed information or another source with revenue segment data, I'd be happy to help further.

Estimated Discount To Fair Value: 41.1%

North Electro-Optic Ltd. is trading at CN¥11.66, significantly below its estimated fair value of CN¥19.81, suggesting it may be undervalued based on discounted cash flows. Despite forecasted earnings growth of 45.96% per year, profit margins have declined from 2.6% to 1.5%. Revenue growth is expected to outpace the Chinese market at 19.9% annually, though return on equity remains low at a projected 3.4%. Recent shareholder meetings and transaction cancellations indicate strategic adjustments underway.

- Our growth report here indicates North Electro-OpticLtd may be poised for an improving outlook.

- Dive into the specifics of North Electro-OpticLtd here with our thorough financial health report.

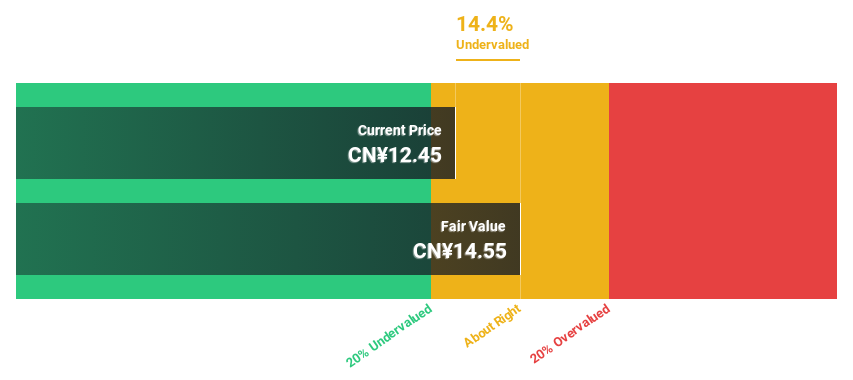

Zhuzhou Times New Material Technology (SHSE:600458)

Overview: Zhuzhou Times New Material Technology Co., Ltd. operates in the field of advanced materials, focusing on the development and production of polymer composites and vibration control products, with a market cap of CN¥9.79 billion.

Operations: Zhuzhou Times New Material Technology's revenue is primarily derived from its advanced materials segment, which includes the development and production of polymer composites and vibration control products.

Estimated Discount To Fair Value: 17.1%

Zhuzhou Times New Material Technology is trading at CN¥11.88, below its estimated fair value of CN¥14.33, indicating potential undervaluation based on discounted cash flows. The company is expected to see significant earnings growth of 33.76% per year, outpacing the Chinese market's 25%. However, revenue growth at 13.4% annually lags behind the desired benchmark of 20%, and return on equity is forecasted to remain low at 12.5%.

- In light of our recent growth report, it seems possible that Zhuzhou Times New Material Technology's financial performance will exceed current levels.

- Click here to discover the nuances of Zhuzhou Times New Material Technology with our detailed financial health report.

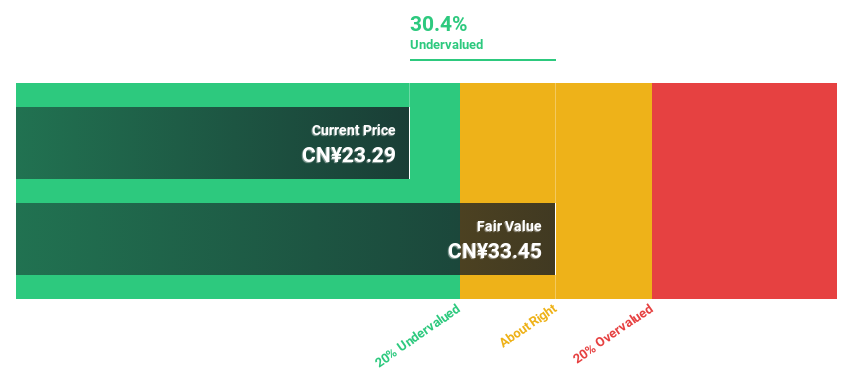

Perfect Group (SHSE:603059)

Overview: Perfect Group Corp., Ltd specializes in producing manual and electric toothbrushes in the People’s Republic of China and has a market capitalization of CN¥2.34 billion.

Operations: The company's revenue segment is focused on Personal Care, generating CN¥1.24 billion.

Estimated Discount To Fair Value: 30.5%

Perfect Group, trading at CN¥23.29, is 30.5% below its estimated fair value of CN¥33.51, highlighting significant undervaluation based on discounted cash flows. Earnings are projected to grow at 40.26% annually, surpassing the Chinese market's growth rate of 25%, with revenue also expected to increase by 20.4% per year. Despite a high debt level and unstable dividend history, it offers good relative value compared to peers and industry standards.

- The growth report we've compiled suggests that Perfect Group's future prospects could be on the up.

- Take a closer look at Perfect Group's balance sheet health here in our report.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 903 more companies for you to explore.Click here to unveil our expertly curated list of 906 Undervalued Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Times New Material Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600458

Zhuzhou Times New Material Technology

Zhuzhou Times New Material Technology Co., Ltd.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives