- China

- /

- Medical Equipment

- /

- SZSE:301367

Market Cool On BMC Medical Co., Ltd.'s (SZSE:301367) Earnings Pushing Shares 27% Lower

BMC Medical Co., Ltd. (SZSE:301367) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

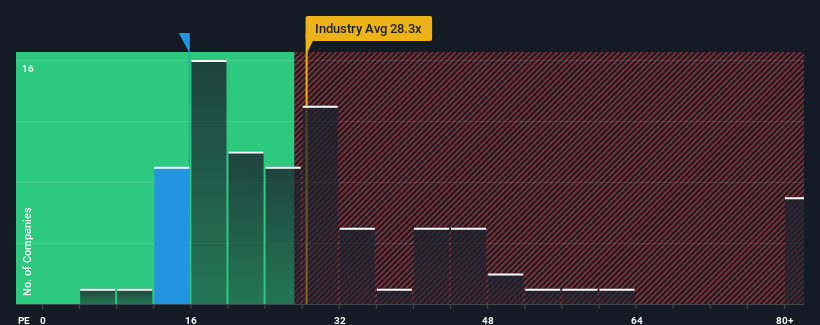

Following the heavy fall in price, BMC Medical's price-to-earnings (or "P/E") ratio of 15.7x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 54x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, BMC Medical's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for BMC Medical

Is There Any Growth For BMC Medical?

There's an inherent assumption that a company should underperform the market for P/E ratios like BMC Medical's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. The last three years don't look nice either as the company has shrunk EPS by 2.1% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 55% over the next year. Meanwhile, the rest of the market is forecast to only expand by 36%, which is noticeably less attractive.

In light of this, it's peculiar that BMC Medical's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From BMC Medical's P/E?

The softening of BMC Medical's shares means its P/E is now sitting at a pretty low level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that BMC Medical currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for BMC Medical (1 makes us a bit uncomfortable!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade BMC Medical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BMC Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301367

BMC Medical

Researches, develops, manufactures, and supplies medical equipment and consumable in the field of respiratory health in China.

Flawless balance sheet with high growth potential.