- China

- /

- Medical Equipment

- /

- SZSE:301367

3 Asian Stocks Estimated To Be Undervalued By Up To 36.1%

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and evolving trade dynamics, Asian markets have been navigating through mixed signals with varying impacts on different sectors. In this environment, identifying undervalued stocks can be particularly appealing as investors seek opportunities that may offer potential value based on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alexander Marine (TWSE:8478) | NT$149.00 | NT$291.69 | 48.9% |

| Lingbao Gold Group (SEHK:3330) | HK$9.11 | HK$18.16 | 49.8% |

| Renesas Electronics (TSE:6723) | ¥1712.50 | ¥3410.94 | 49.8% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩537000.00 | ₩1072806.39 | 49.9% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.47 | CN¥34.66 | 49.6% |

| Globe-ing (TSE:277A) | ¥1700.00 | ¥3367.42 | 49.5% |

| Seegene (KOSDAQ:A096530) | ₩26500.00 | ₩52791.90 | 49.8% |

| Bloks Group (SEHK:325) | HK$127.80 | HK$255.58 | 50% |

| Yuhan (KOSE:A000100) | ₩109800.00 | ₩219128.89 | 49.9% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.87 | HK$1.73 | 49.7% |

Here's a peek at a few of the choices from the screener.

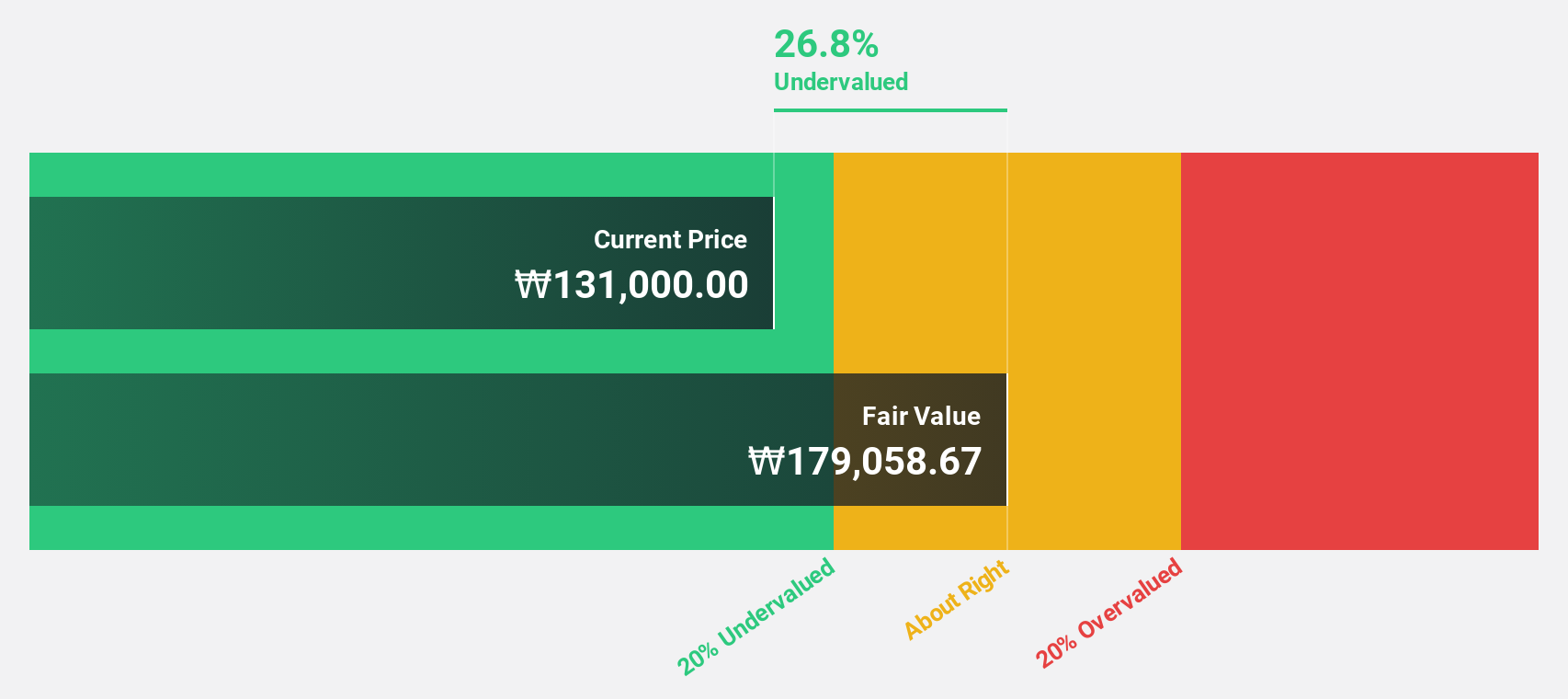

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for men and women, with a market cap of ₩3.60 trillion.

Operations: The company's revenue is primarily derived from its Cosmetics Sector, which accounts for ₩853.96 billion, followed by the Clothing Fashion Sector at ₩56.82 billion.

Estimated Discount To Fair Value: 10.2%

APR Co., Ltd. appears undervalued based on discounted cash flow analysis, trading at 10.2% below its estimated fair value of ₩109,607.88. The company recently completed a share buyback worth KRW 30 billion, potentially enhancing shareholder value. Earnings and revenue are forecast to grow significantly at 26.6% and 22.2% per year respectively, outpacing the Korean market averages. Despite high non-cash earnings and share price volatility, APR's growth prospects remain strong in the Asian market.

- Our comprehensive growth report raises the possibility that APR is poised for substantial financial growth.

- Navigate through the intricacies of APR with our comprehensive financial health report here.

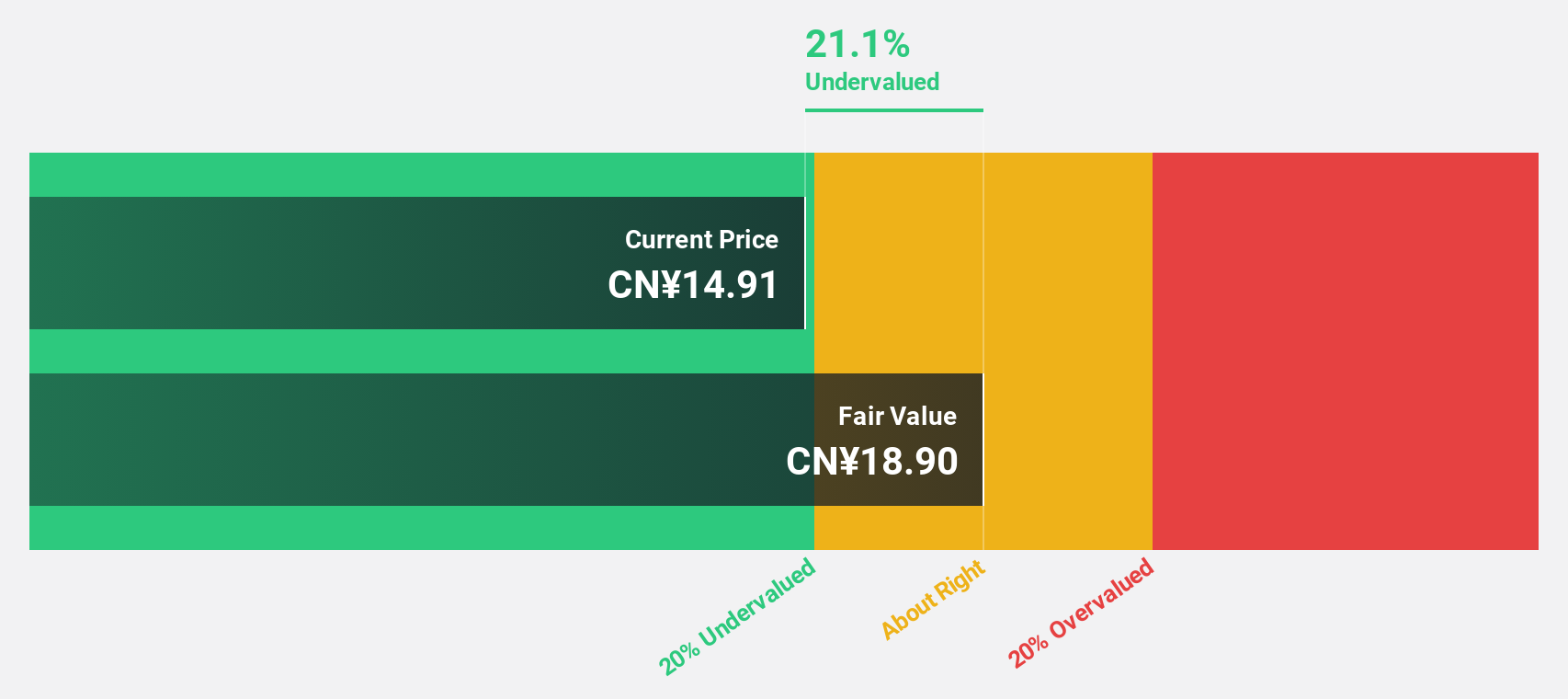

Venustech Group (SZSE:002439)

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥19.49 billion.

Operations: The company's revenue is primarily derived from its Information Network Security segment, which generated CN¥3.01 billion.

Estimated Discount To Fair Value: 15.2%

Venustech Group is trading at a good value, 15.2% below its estimated fair value of CN¥19, based on cash flow analysis. Despite a challenging year with declining sales from CN¥4.51 billion to CN¥3.32 billion and a net loss of CN¥226.3 million in 2024, the company turned profitable in Q1 2025 with net income of CN¥1.6 million. Revenue growth is expected to outpace the Chinese market, and profitability is anticipated within three years.

- The growth report we've compiled suggests that Venustech Group's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Venustech Group's balance sheet health report.

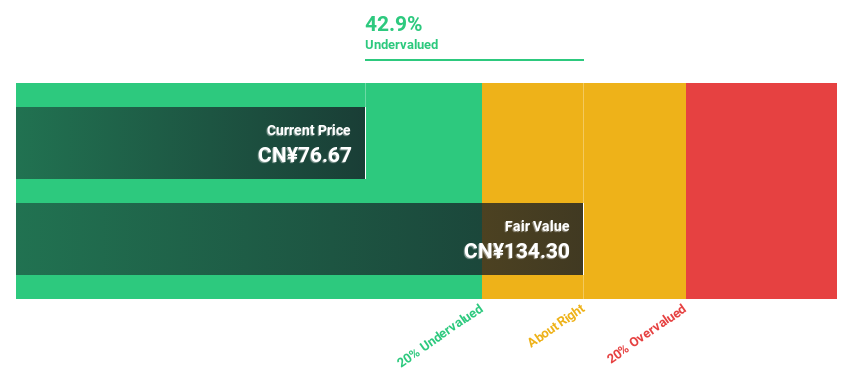

BMC Medical (SZSE:301367)

Overview: BMC Medical Co., Ltd. focuses on researching, developing, manufacturing, and supplying respiratory health medical equipment and consumables in China, with a market cap of CN¥7.16 billion.

Operations: BMC Medical generates revenue from its operations in researching, developing, manufacturing, and supplying respiratory health medical equipment and consumables within China.

Estimated Discount To Fair Value: 36.1%

BMC Medical is trading at CN¥80.5, significantly below its estimated fair value of CN¥126.06, highlighting potential undervaluation based on cash flows. Despite a decrease in full-year 2024 sales to CN¥842.24 million from the previous year's CN¥1,119.41 million, Q1 2025 showed improvement with sales rising to CN¥265.29 million and net income increasing to CN¥71.93 million year-on-year, suggesting robust earnings growth prospects ahead of the market average in China.

- Our earnings growth report unveils the potential for significant increases in BMC Medical's future results.

- Click here to discover the nuances of BMC Medical with our detailed financial health report.

Next Steps

- Gain an insight into the universe of 262 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BMC Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301367

BMC Medical

Researches, develops, manufactures, and supplies medical equipment and consumable in the field of respiratory health in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives