- China

- /

- Healthcare Services

- /

- SZSE:301103

Optimistic Investors Push Liaoning He Eye Hospital Group Co., LTD. (SZSE:301103) Shares Up 42% But Growth Is Lacking

Liaoning He Eye Hospital Group Co., LTD. (SZSE:301103) shares have had a really impressive month, gaining 42% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

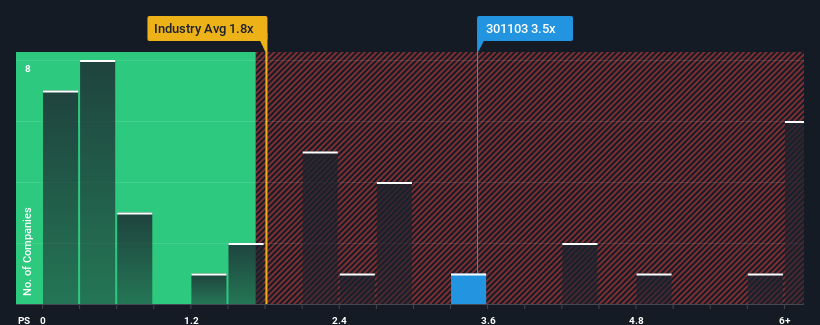

Following the firm bounce in price, given close to half the companies operating in China's Healthcare industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider Liaoning He Eye Hospital Group as a stock to potentially avoid with its 3.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Liaoning He Eye Hospital Group

What Does Liaoning He Eye Hospital Group's Recent Performance Look Like?

The recent revenue growth at Liaoning He Eye Hospital Group would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Liaoning He Eye Hospital Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Liaoning He Eye Hospital Group?

Liaoning He Eye Hospital Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 3.7% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 19% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 14% shows it's noticeably less attractive.

With this in mind, we find it worrying that Liaoning He Eye Hospital Group's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Liaoning He Eye Hospital Group's P/S Mean For Investors?

The large bounce in Liaoning He Eye Hospital Group's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Liaoning He Eye Hospital Group currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Liaoning He Eye Hospital Group (2 are significant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301103

Liaoning He Eye Hospital Group

Provides eye medical service and optometry services.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives