74Software And 2 Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In a week marked by cautious sentiment following the Federal Reserve's rate cut and hawkish outlook, global markets experienced broad declines, with U.S. stocks particularly affected by political uncertainty and interest rate concerns. Despite strong economic data indicating growth, investor confidence was shaken as major indices like the S&P 500 faced their longest streak of more decliners than gainers since 1978. In such an environment, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer potential value when broader market conditions are volatile.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Bank (SHSE:601187) | CN¥5.69 | CN¥11.34 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| T'Way Air (KOSE:A091810) | ₩2505.00 | ₩4994.20 | 49.8% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409580.73 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥13.24 | CN¥26.38 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.47 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

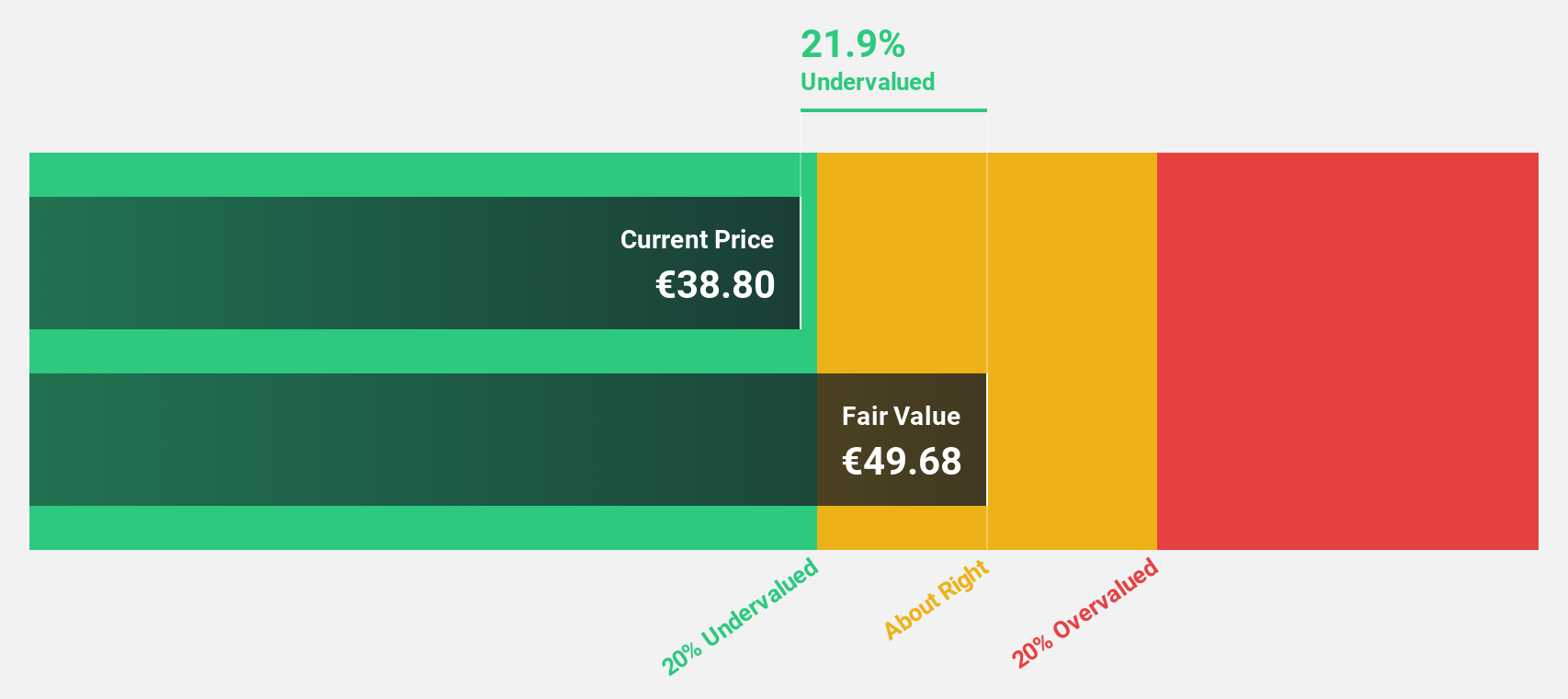

74Software (ENXTPA:74SW)

Overview: 74Software is an infrastructure software publisher operating in France, the rest of Europe, the Americas, and the Asia Pacific with a market cap of €794.04 million.

Operations: The company's revenue segments include License (€8.46 million), Maintenance (€77.04 million), Subscription (€201.19 million), and Services (Excl. Subscription) (€35.49 million).

Estimated Discount To Fair Value: 48.5%

74Software, formerly Axway Software SA, is trading at €27.3, which is 48.5% below its estimated fair value of €52.98, indicating it may be undervalued based on cash flows. Despite past shareholder dilution, the company became profitable this year and forecasts show earnings growth of 20.9% annually—outpacing the French market's 12.3%. Recent revenue growth of €112.4 million in Q3 reflects a total increase of 62.1%, showcasing strong performance relative to peers and industry standards.

- The growth report we've compiled suggests that 74Software's future prospects could be on the up.

- Get an in-depth perspective on 74Software's balance sheet by reading our health report here.

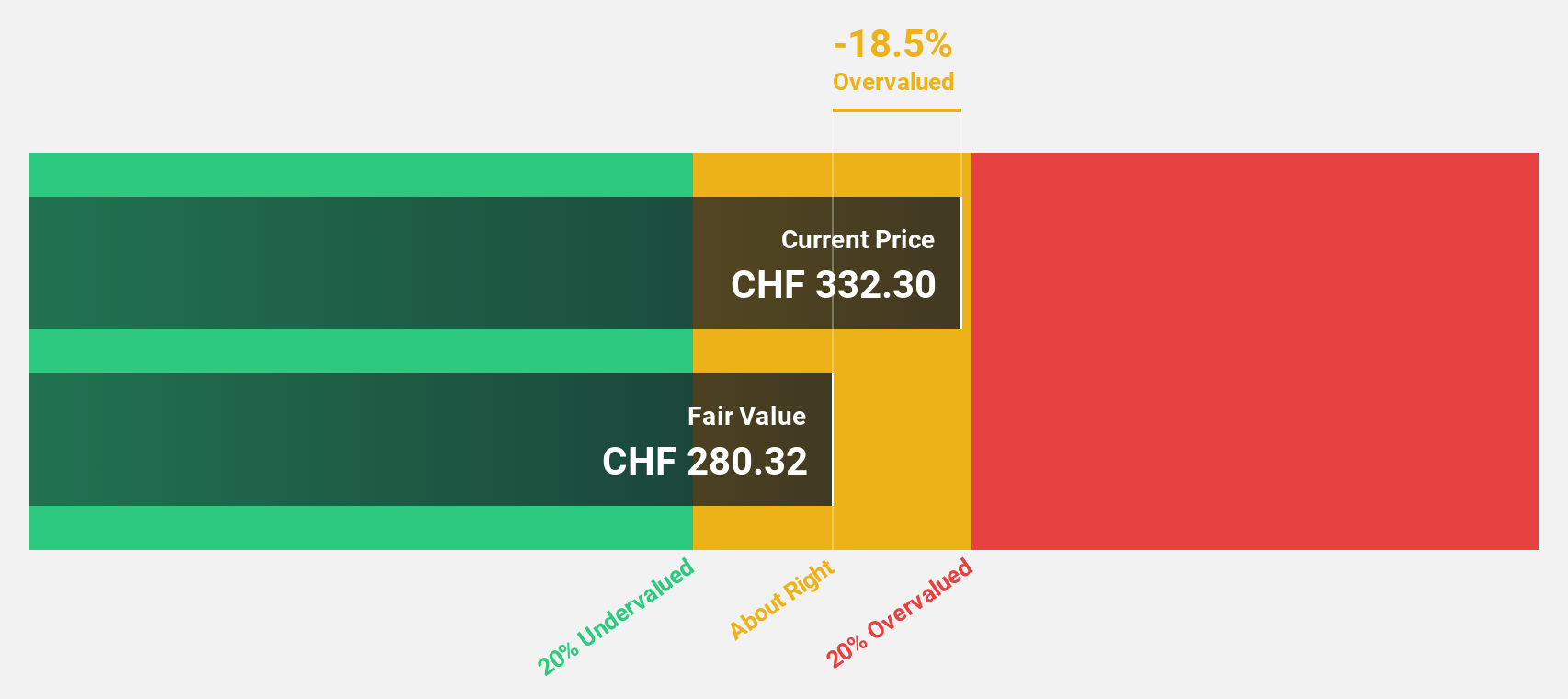

VAT Group (SWX:VACN)

Overview: VAT Group AG, with a market cap of CHF10.32 billion, develops, manufactures, and supplies vacuum valves and related products across Switzerland, Europe, the United States, Asia, and other international markets.

Operations: The company's revenue segments are comprised of Valves at CHF783.51 million and Global Service at CHF163.83 million.

Estimated Discount To Fair Value: 34%

VAT Group is trading at CHF344.2, significantly below its estimated fair value of CHF521.81, highlighting potential undervaluation based on cash flows. The company's earnings are anticipated to grow 21.6% annually, surpassing the Swiss market's 11.6% growth rate, while revenue growth is projected at 17.7%. Its return on equity is expected to reach a very high level of 41.2% in three years, despite revenue growth being slower than the desired threshold of 20%.

- The analysis detailed in our VAT Group growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in VAT Group's balance sheet health report.

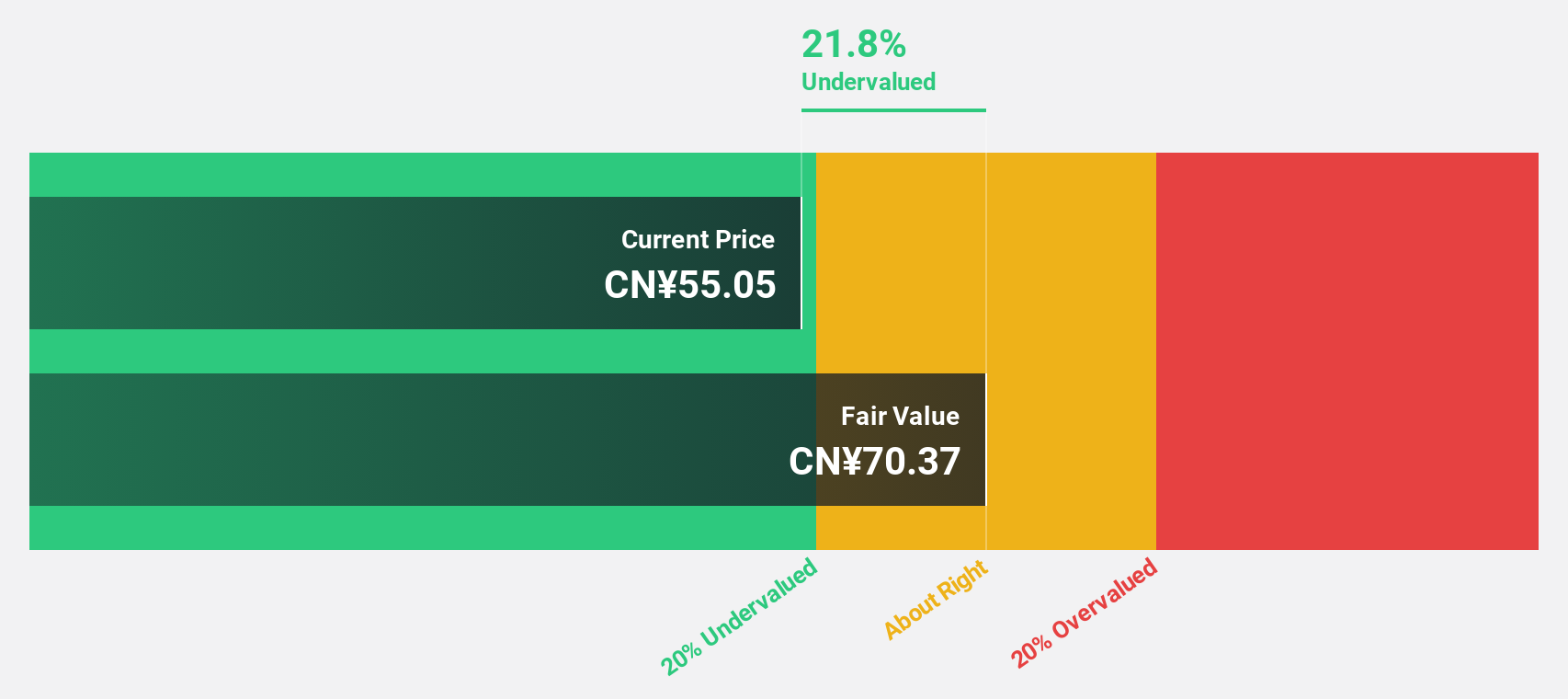

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. is a bio-medical company involved in the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals both in China and internationally, with a market cap of CN¥55.87 billion.

Operations: The company generates revenue of CN¥4.44 billion from its in vitro diagnostic segment, supplying products to hospitals domestically and abroad.

Estimated Discount To Fair Value: 15.9%

Shenzhen New Industries Biomedical Engineering is trading at CN¥71.11, below its estimated fair value of CN¥84.53, indicating potential undervaluation. The company's revenue grew to CN¥3.41 billion for the first nine months of 2024 from CN¥2.91 billion a year ago, with net income rising to CN¥1.38 billion from CN¥1.19 billion in the same period. Earnings are forecasted to grow significantly over the next three years, although slower than the broader Chinese market's pace.

- In light of our recent growth report, it seems possible that Shenzhen New Industries Biomedical Engineering's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Shenzhen New Industries Biomedical Engineering stock in this financial health report.

Key Takeaways

- Click this link to deep-dive into the 868 companies within our Undervalued Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:74SW

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives