- China

- /

- Medical Equipment

- /

- SZSE:300396

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core inflation and strong earnings in the financial sector, investors are increasingly optimistic about potential rate cuts later in the year. In this environment of rising stock indices and shifting economic conditions, dividend stocks stand out as a compelling option for those seeking steady income and potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.17% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

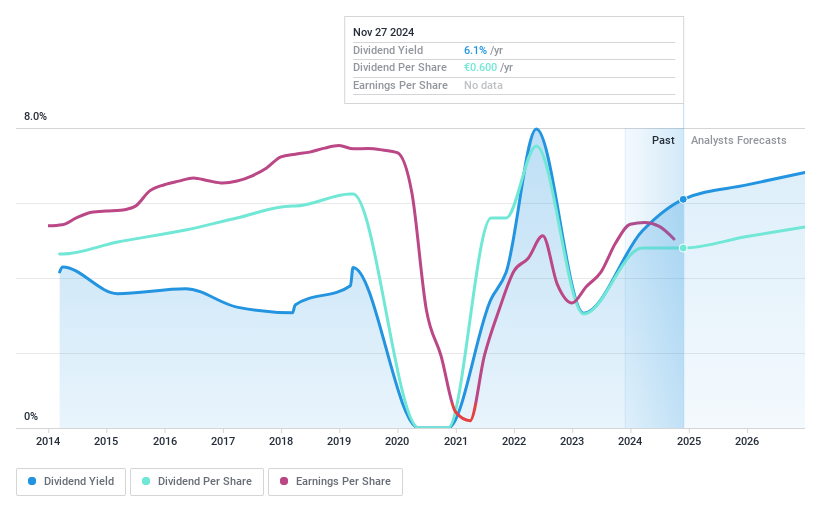

MARR (BIT:MARR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MARR S.p.A. is involved in the marketing and distribution of fresh, dried, and frozen food products for catering services in Italy, the European Union, and internationally, with a market cap of €644.76 million.

Operations: MARR S.p.A. generates its revenue primarily through the distribution of food products, amounting to €2.02 billion.

Dividend Yield: 6%

MARR's dividend yield of 6.04% ranks in the top 25% of Italian dividend payers, supported by a cash payout ratio of 54%, indicating coverage by cash flows. Despite this, its dividend history has been volatile over the past decade with periods of significant drops. The stock trades at a substantial discount to estimated fair value and analysts expect price appreciation. Recent earnings show slight declines in revenue and net income compared to last year.

- Click to explore a detailed breakdown of our findings in MARR's dividend report.

- Our valuation report here indicates MARR may be undervalued.

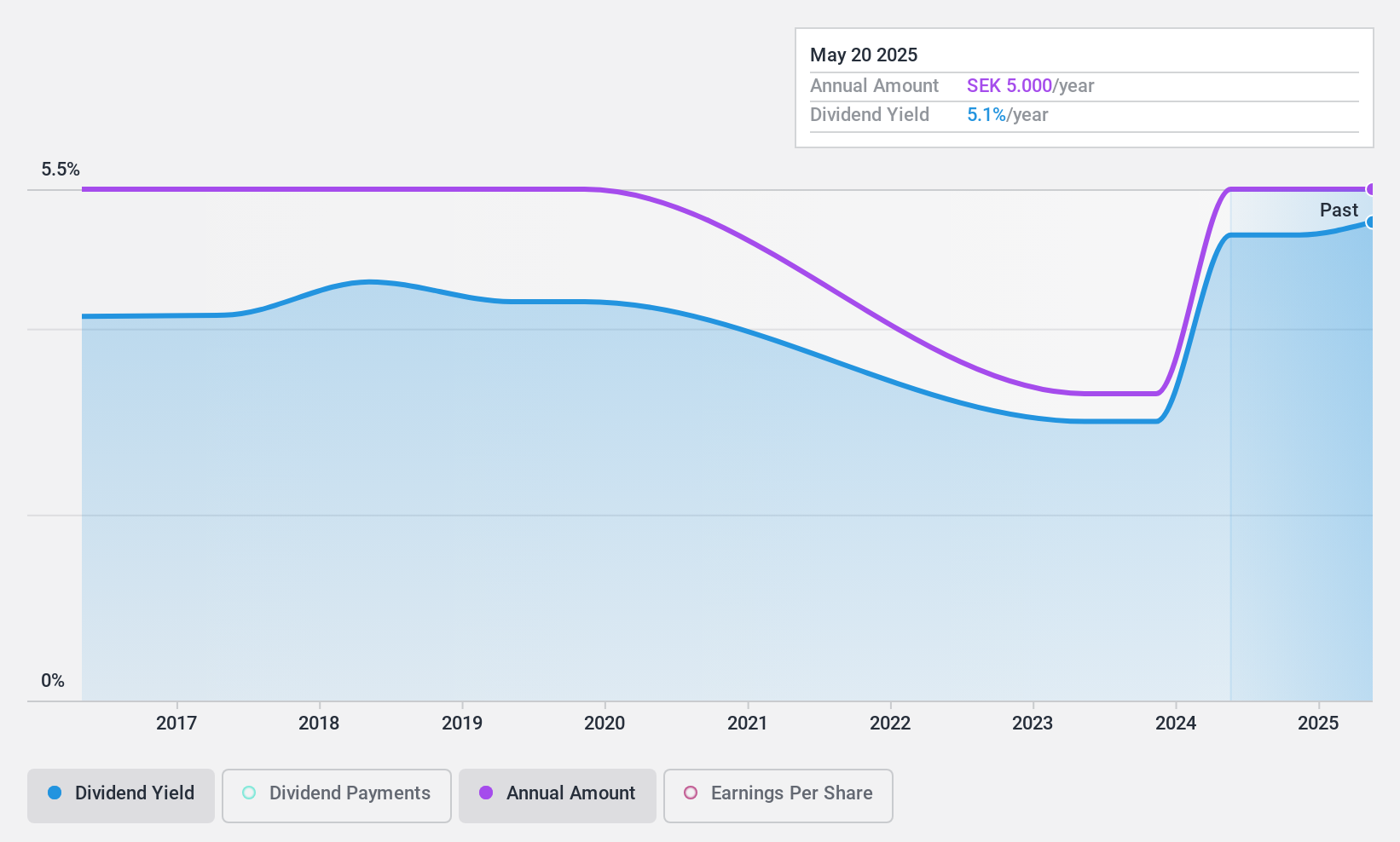

Duni (OM:DUNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Duni AB (publ) is a company that develops, manufactures, and sells meal serving, take-away, and packaging products in Sweden and internationally, with a market cap of SEK4.50 billion.

Operations: Duni AB's revenue is primarily derived from its Dining solutions segment, which accounts for SEK4.43 billion, and its Food packaging solutions segment, contributing SEK3.11 billion.

Dividend Yield: 5.2%

Duni's dividend yield of 5.22% ranks among the top 25% in Sweden, though its payout ratio of 100.4% indicates dividends are not covered by earnings, despite being supported by a cash payout ratio of 57.5%. Dividend payments have been volatile and unreliable over the past decade, with recent financials showing a net loss for Q3 and decreased profits year-over-year. Executive changes may impact future stability.

- Dive into the specifics of Duni here with our thorough dividend report.

- The analysis detailed in our Duni valuation report hints at an inflated share price compared to its estimated value.

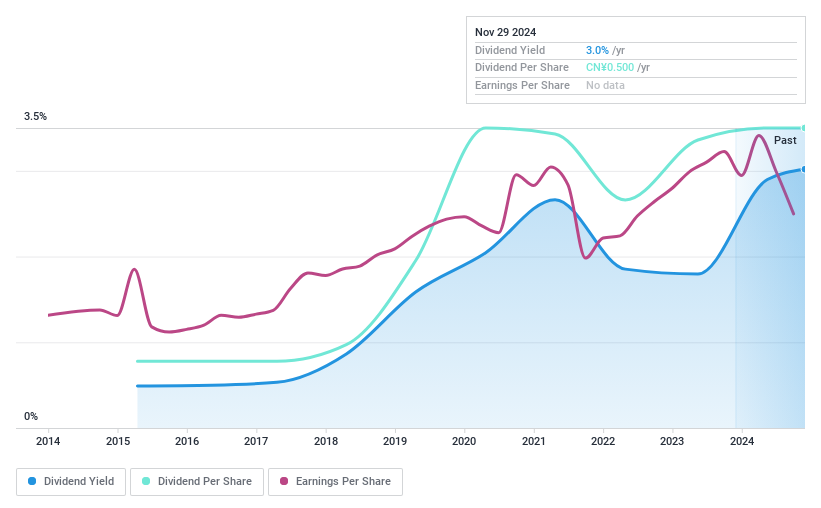

Dirui IndustrialLtd (SZSE:300396)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dirui Industrial Co., Ltd. focuses on the research, development, production, and sale of medical inspection products in China with a market capitalization of CN¥3.99 billion.

Operations: Dirui Industrial Co., Ltd.'s revenue is primarily derived from its Medical Instruments segment, which generated CN¥1.50 billion.

Dividend Yield: 3.4%

Dirui Industrial Ltd. offers a dividend yield of 3.39%, placing it in the top 25% of CN market payers, but its dividends have been volatile and unreliable over the past decade. Despite a reasonable payout ratio of 58.4%, dividends are not covered by free cash flows or earnings consistently. Recent earnings showed increased sales to CNY 1.18 billion, yet net income declined to CNY 192.58 million, reflecting potential challenges in sustaining dividend payments long-term.

- Click here to discover the nuances of Dirui IndustrialLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Dirui IndustrialLtd is priced lower than what may be justified by its financials.

Key Takeaways

- Reveal the 1997 hidden gems among our Top Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300396

Dirui IndustrialLtd

Engages in the research and development, production, and sale of medical inspection products in the People's Republic of China.

High growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives