- China

- /

- Medical Equipment

- /

- SZSE:300318

Beijing Bohui Innovation Biotechnology Group (SZSE:300318) rises 8.6% this week, taking five-year gains to 72%

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Beijing Bohui Innovation Biotechnology Group share price has climbed 72% in five years, easily topping the market return of 22% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 2.3% in the last year.

Since the stock has added CN¥433m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Beijing Bohui Innovation Biotechnology Group

Given that Beijing Bohui Innovation Biotechnology Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Beijing Bohui Innovation Biotechnology Group saw its revenue grow at 10% per year. That's a fairly respectable growth rate. While the share price has beat the market, compounding at 11% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

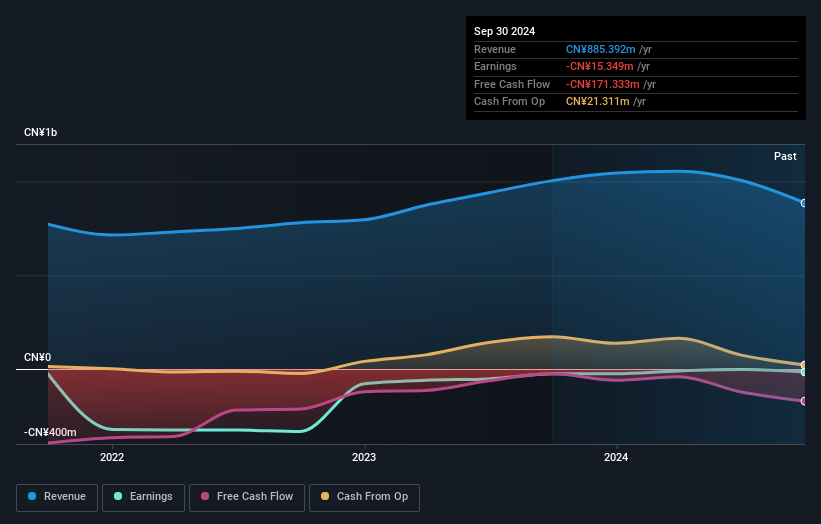

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Beijing Bohui Innovation Biotechnology Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Beijing Bohui Innovation Biotechnology Group shareholders are up 2.3% for the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 11% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Beijing Bohui Innovation Biotechnology Group better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Beijing Bohui Innovation Biotechnology Group you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Beijing Bohui Innovation Biotechnology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Bohui Innovation Biotechnology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300318

Beijing Bohui Innovation Biotechnology Group

Beijing Bohui Innovation Biotechnology Group Co., Ltd.

Adequate balance sheet and slightly overvalued.