- China

- /

- Medical Equipment

- /

- SHSE:688607

Even With A 39% Surge, Cautious Investors Are Not Rewarding CareRay Digital Medical Technology Co., Ltd.'s (SHSE:688607) Performance Completely

CareRay Digital Medical Technology Co., Ltd. (SHSE:688607) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

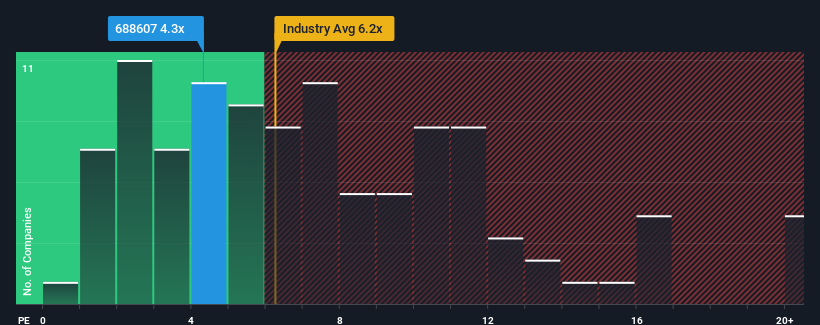

Even after such a large jump in price, CareRay Digital Medical Technology may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.3x, since almost half of all companies in the Medical Equipment industry in China have P/S ratios greater than 6.2x and even P/S higher than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for CareRay Digital Medical Technology

What Does CareRay Digital Medical Technology's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, CareRay Digital Medical Technology has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CareRay Digital Medical Technology.What Are Revenue Growth Metrics Telling Us About The Low P/S?

CareRay Digital Medical Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 36% gain to the company's top line. Still, revenue has fallen 26% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 33% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

With this in consideration, we find it intriguing that CareRay Digital Medical Technology's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From CareRay Digital Medical Technology's P/S?

The latest share price surge wasn't enough to lift CareRay Digital Medical Technology's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems CareRay Digital Medical Technology currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for CareRay Digital Medical Technology with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688607

CareRay Digital Medical Technology

CareRay Digital Medical Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives