- China

- /

- Medical Equipment

- /

- SHSE:688358

Three Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets experienced fluctuations, with major U.S. indexes ending lower despite some recovery in manufacturing activity and corporate earnings surpassing expectations. As investors navigate these complex conditions, companies with high insider ownership often attract attention due to the potential alignment between management's interests and shareholder value. In this context, growth companies where insiders hold significant stakes can be particularly intriguing for those looking to understand where leaders are putting their confidence amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 101% |

Let's explore several standout options from the results in the screener.

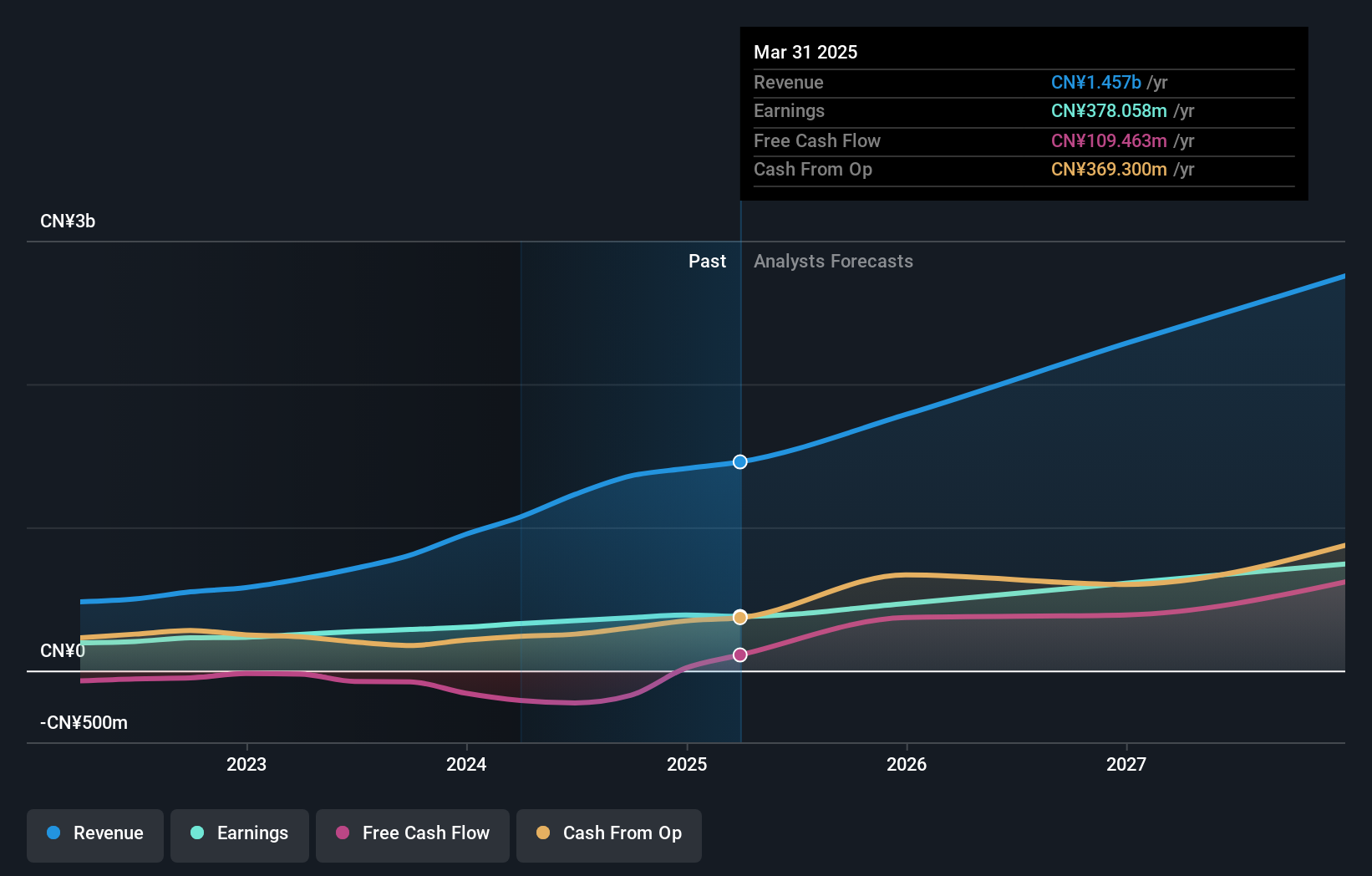

Eyebright Medical Technology (Beijing) (SHSE:688050)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector and has a market cap of CN¥18.25 billion.

Operations: The company generates revenue primarily from its Medical Products segment, which amounts to CN¥1.36 billion.

Insider Ownership: 21.5%

Earnings Growth Forecast: 28.8% p.a.

Eyebright Medical Technology (Beijing) is experiencing robust growth, with revenue and earnings forecasted to grow significantly above the market average. Despite no recent insider trading activity, high insider ownership aligns management interests with shareholders. The company's innovative product developments, like the Loong Crystal PR intraocular lens receiving regulatory approval, underscore its commitment to technological advancement and market expansion. Recent buyback activities further reflect confidence in its strategic direction.

- Delve into the full analysis future growth report here for a deeper understanding of Eyebright Medical Technology (Beijing).

- According our valuation report, there's an indication that Eyebright Medical Technology (Beijing)'s share price might be on the expensive side.

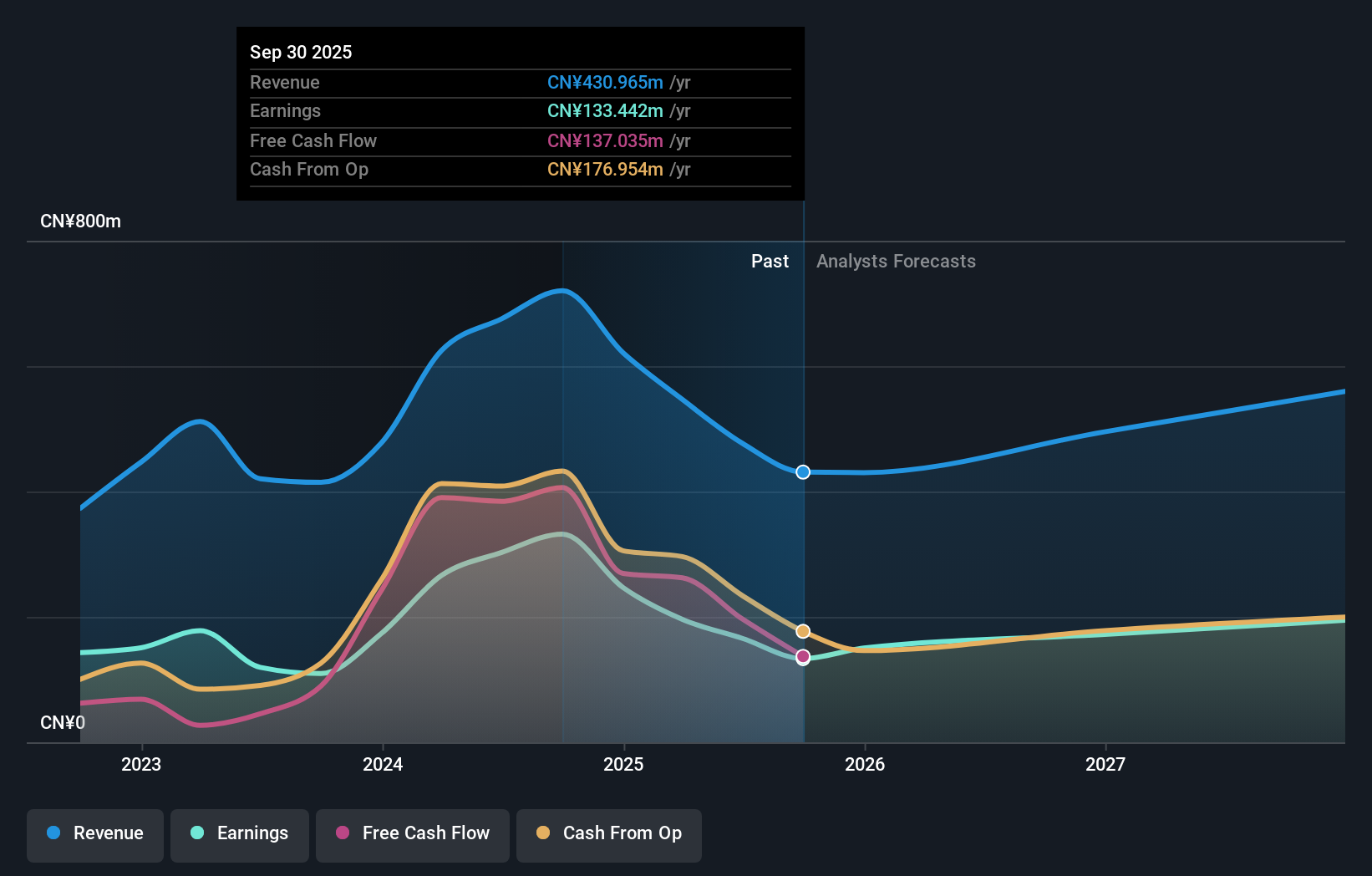

Innovita Biological Technology (SHSE:688253)

Simply Wall St Growth Rating: ★★★★★★

Overview: Innovita Biological Technology Co., Ltd. focuses on the research, development, manufacturing, marketing, and sales of POCT rapid diagnostic products and has a market cap of CN¥4.10 billion.

Operations: The company generates revenue of CN¥720.40 million from its diagnostic kits and equipment segment.

Insider Ownership: 37.1%

Earnings Growth Forecast: 32.4% p.a.

Innovita Biological Technology is poised for strong growth, with revenue expected to outpace the Chinese market significantly at 29.9% annually. The company's earnings are forecasted to grow 32.4% per year, surpassing market averages, while trading at a substantial discount to its estimated fair value. Despite no recent insider transactions, high insider ownership suggests aligned interests with shareholders. Recent share buybacks totaling CNY 50 million highlight management's confidence in its strategic trajectory.

- Unlock comprehensive insights into our analysis of Innovita Biological Technology stock in this growth report.

- According our valuation report, there's an indication that Innovita Biological Technology's share price might be on the cheaper side.

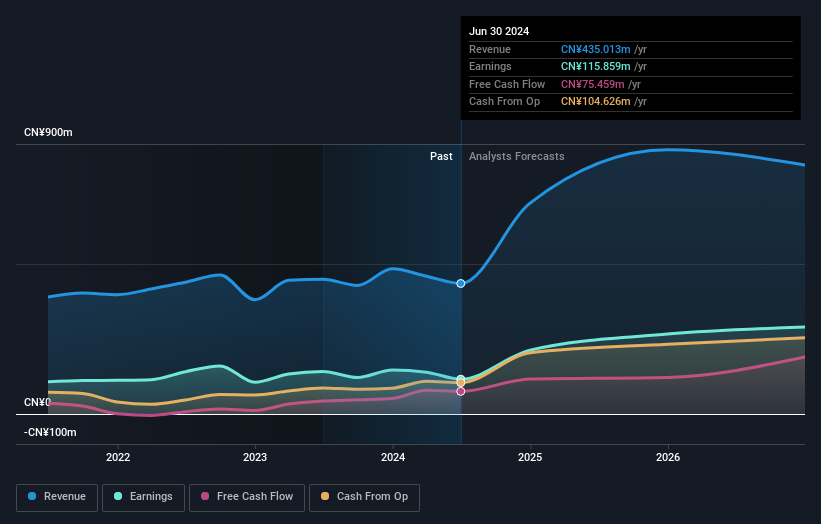

Chison Medical Technologies (SHSE:688358)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chison Medical Technologies Co., Ltd. manufactures and sells diagnostic ultrasound systems both in China and internationally, with a market cap of CN¥3.09 billion.

Operations: The company generates revenue primarily from its Ultrasound Medical Imaging Equipment Business, amounting to CN¥444.28 million.

Insider Ownership: 23.6%

Earnings Growth Forecast: 34.9% p.a.

Chison Medical Technologies is positioned for robust growth, with earnings projected to increase by 34.9% annually, outpacing the Chinese market average. Revenue growth is expected to reach 25.1% per year, surpassing market expectations. The stock trades at a notable discount of 55.3% below its estimated fair value, indicating potential undervaluation. Although there are no recent insider transactions reported, substantial insider ownership aligns management's interests with those of shareholders.

- Click to explore a detailed breakdown of our findings in Chison Medical Technologies' earnings growth report.

- Our expertly prepared valuation report Chison Medical Technologies implies its share price may be too high.

Taking Advantage

- Explore the 1439 names from our Fast Growing Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688358

Chison Medical Technologies

Manufactures and sells diagnostic ultrasound systems in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives