- China

- /

- Healthtech

- /

- SHSE:688246

Goodwill E-Health Info Co., Ltd. (SHSE:688246) Soars 25% But It's A Story Of Risk Vs Reward

Despite an already strong run, Goodwill E-Health Info Co., Ltd. (SHSE:688246) shares have been powering on, with a gain of 25% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

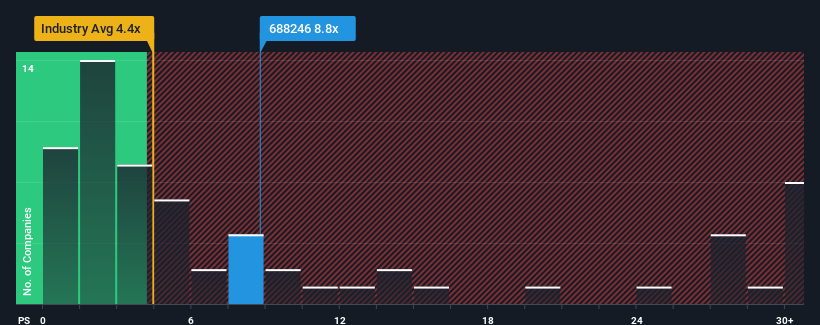

In spite of the firm bounce in price, it's still not a stretch to say that Goodwill E-Health Info's price-to-sales (or "P/S") ratio of 8.8x right now seems quite "middle-of-the-road" compared to the Healthcare Services industry in China, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Goodwill E-Health Info

How Goodwill E-Health Info Has Been Performing

While the industry has experienced revenue growth lately, Goodwill E-Health Info's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Goodwill E-Health Info will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Goodwill E-Health Info would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. As a result, revenue from three years ago have also fallen 7.9% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 53% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Goodwill E-Health Info's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Goodwill E-Health Info's P/S

Its shares have lifted substantially and now Goodwill E-Health Info's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Goodwill E-Health Info currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Goodwill E-Health Info that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688246

Goodwill E-Health Info

Engages in the research and development of medical information software in China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives