- Singapore

- /

- Industrial REITs

- /

- SGX:9A4U

3 Stocks Estimated To Be Trading Up To 46% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly on the lookout for opportunities that may offer value amidst volatility. With major indices like the S&P 500 and Nasdaq Composite having experienced significant gains in recent years, identifying stocks trading below their intrinsic value can be a strategic approach to potentially capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.90 | CN¥55.57 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.605 | £13.12 | 49.7% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.68 | CN¥43.25 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.05 | CN¥42.00 | 49.9% |

| AeroEdge (TSE:7409) | ¥1763.00 | ¥3511.45 | 49.8% |

| Vault Minerals (ASX:VAU) | A$0.33 | A$0.66 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$94.43 | US$187.71 | 49.7% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.03 | CN¥47.76 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.91 | €5.81 | 49.9% |

| Genscript Biotech (SEHK:1548) | HK$9.63 | HK$19.15 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

ESR-REIT (SGX:J91U)

Overview: ESR-LOGOS REIT is a leading New Economy and future-ready Asia Pacific S-REIT with a market cap of SGD2.09 billion.

Operations: The company's revenue segment consists of investing in industrial properties, generating SGD374.31 million.

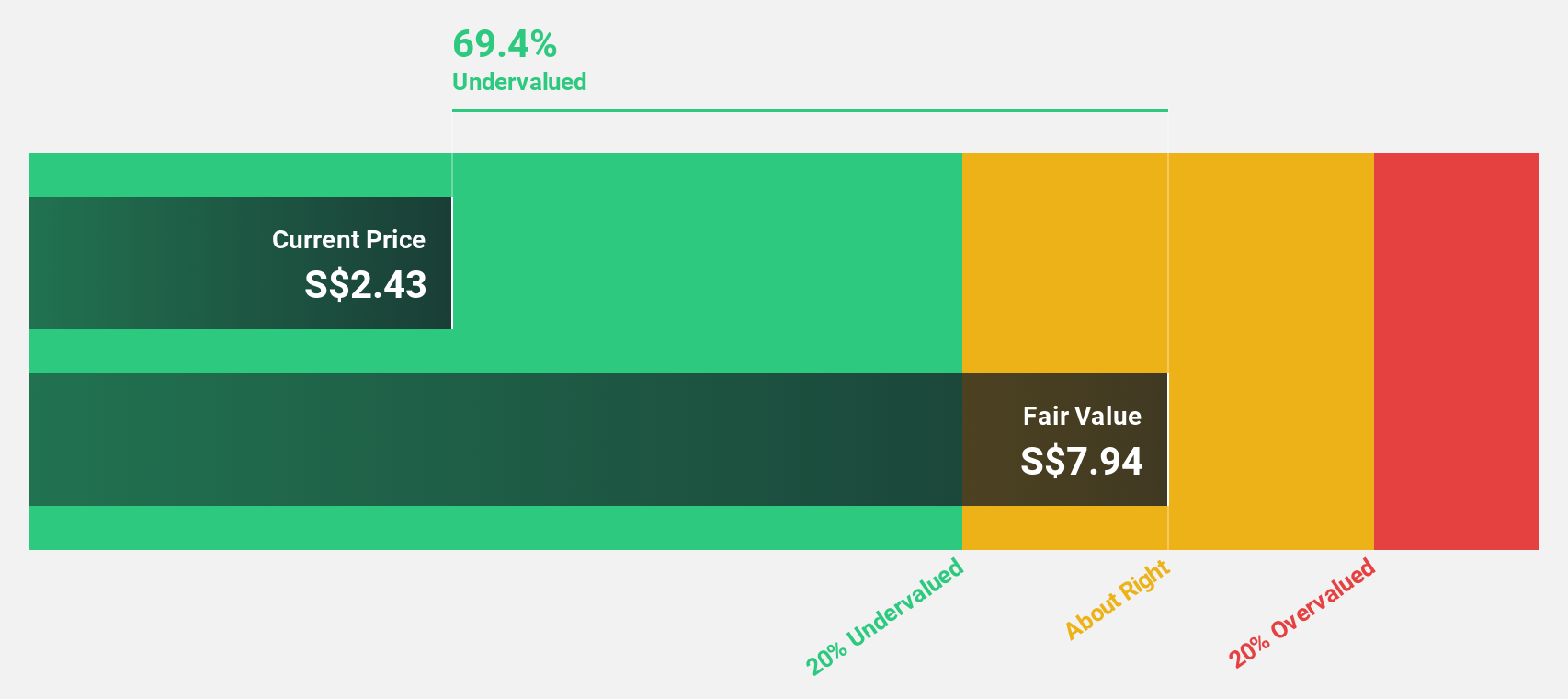

Estimated Discount To Fair Value: 30.8%

ESR-REIT is trading at S$0.26, below its estimated fair value of S$0.38, suggesting undervaluation based on cash flows. Despite past shareholder dilution, recent share buybacks aim to enhance return on equity and stabilize market confidence. Earnings are forecasted to grow significantly at 48.24% annually, with profitability expected within three years, surpassing average market growth rates. However, the dividend track record remains unstable amidst these financial maneuvers and strategic adjustments.

- In light of our recent growth report, it seems possible that ESR-REIT's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of ESR-REIT stock in this financial health report.

Shanghai Aohua Photoelectricity Endoscope (SHSE:688212)

Overview: Shanghai AoHua Photoelectricity Endoscope Co., Ltd. is a medical device company focused on the research, development, manufacture, and sale of electronic endoscopic equipment and consumables in China and internationally, with a market cap of CN¥5.42 billion.

Operations: The company generates revenue from its diagnostic kits and equipment segment, amounting to CN¥750.04 million.

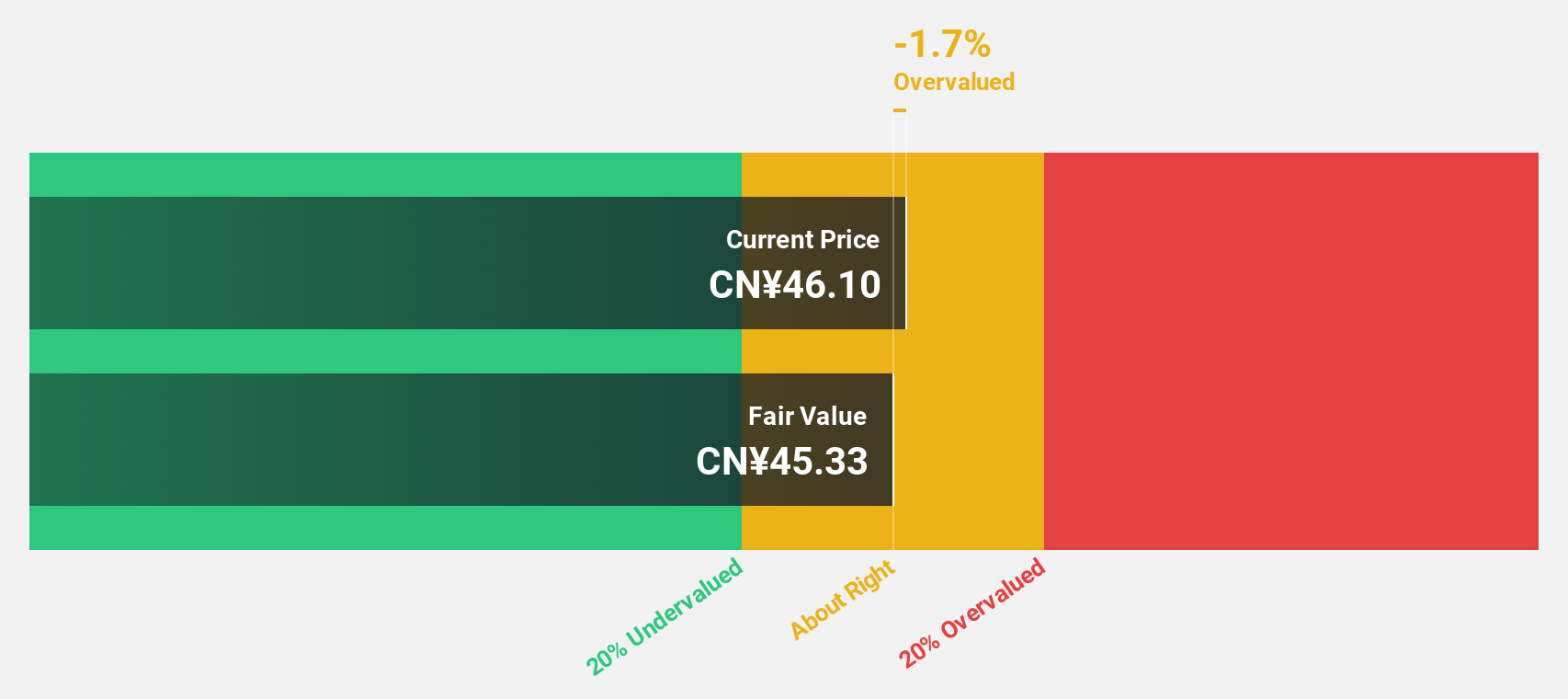

Estimated Discount To Fair Value: 31.4%

Shanghai Aohua Photoelectricity Endoscope is trading at CNY 40.28, significantly below its estimated fair value of CNY 58.73, indicating potential undervaluation based on cash flows. The company forecasts robust earnings growth of 59.9% annually over the next three years, outpacing market averages, although profit margins have declined from 9.8% to 6.7%. Recent share buyback initiatives worth up to CNY 200 million could further enhance shareholder value and market confidence amidst these dynamics.

- The growth report we've compiled suggests that Shanghai Aohua Photoelectricity Endoscope's future prospects could be on the up.

- Dive into the specifics of Shanghai Aohua Photoelectricity Endoscope here with our thorough financial health report.

TOC (TSE:8841)

Overview: TOC Co., Ltd. operates in the real estate sector in Japan and has a market capitalization of approximately ¥58.96 billion.

Operations: The company's revenue is primarily derived from its Real Estate Business, which generates ¥10.16 billion, and its Linen Supply and Laundry Business, contributing ¥1.69 billion.

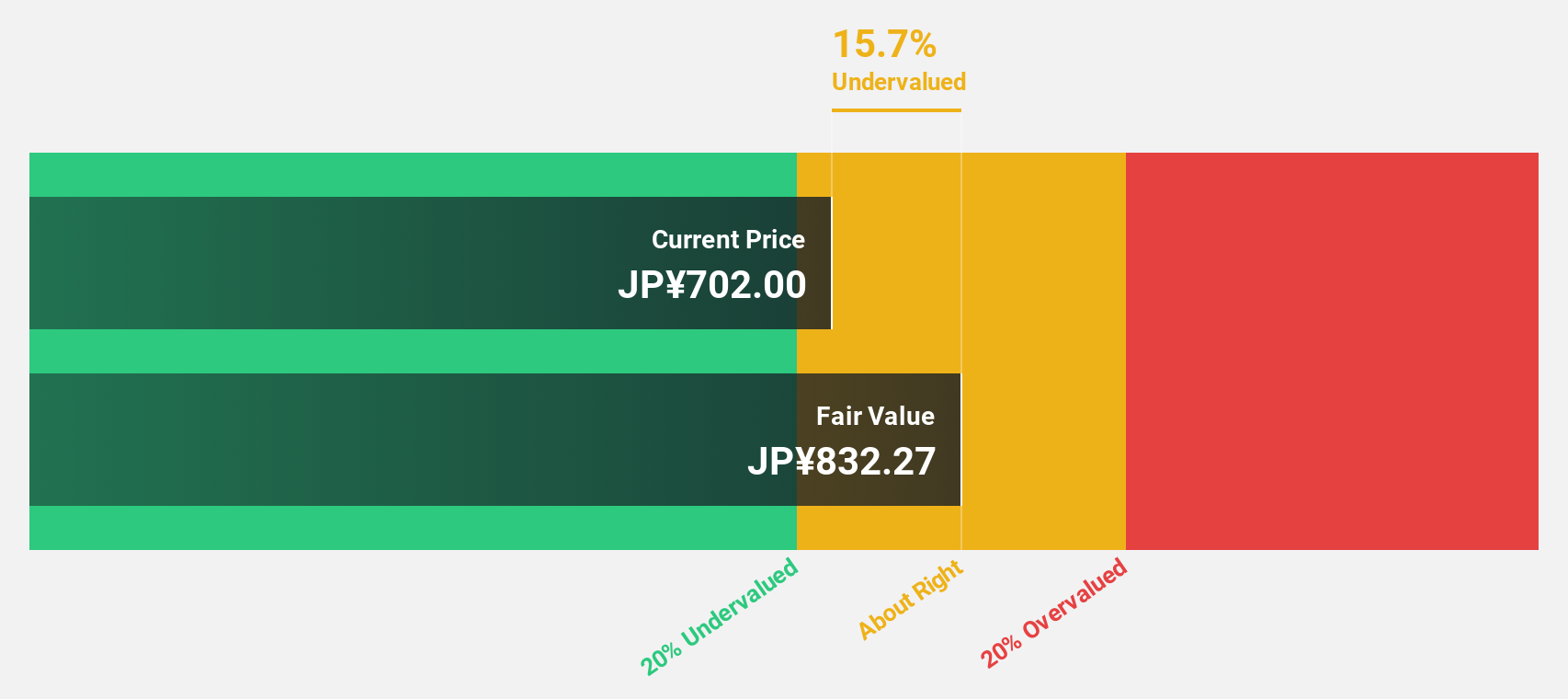

Estimated Discount To Fair Value: 46%

TOC is trading at ¥633, considerably below its estimated fair value of ¥1172.47, highlighting potential undervaluation based on cash flows. Despite lower profit margins of 3.6% compared to last year's 49.3%, earnings are projected to grow significantly at 59.5% annually over the next three years, surpassing market averages. However, revenue growth is slower than desired and return on equity remains low, with large one-off items affecting financial results.

- Upon reviewing our latest growth report, TOC's projected financial performance appears quite optimistic.

- Click here to discover the nuances of TOC with our detailed financial health report.

Key Takeaways

- Click through to start exploring the rest of the 890 Undervalued Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESR-REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:9A4U

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives