- China

- /

- Medical Equipment

- /

- SHSE:603880

Jiangsu Nanfang Medical (SHSE:603880) shareholders are up 14% this past week, but still in the red over the last three years

It is a pleasure to report that the Jiangsu Nanfang Medical Co., Ltd. (SHSE:603880) is up 61% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 18% in the last three years, significantly under-performing the market.

While the last three years has been tough for Jiangsu Nanfang Medical shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Jiangsu Nanfang Medical

Jiangsu Nanfang Medical wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Jiangsu Nanfang Medical grew revenue at 2.7% per year. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 6% over the last three years. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

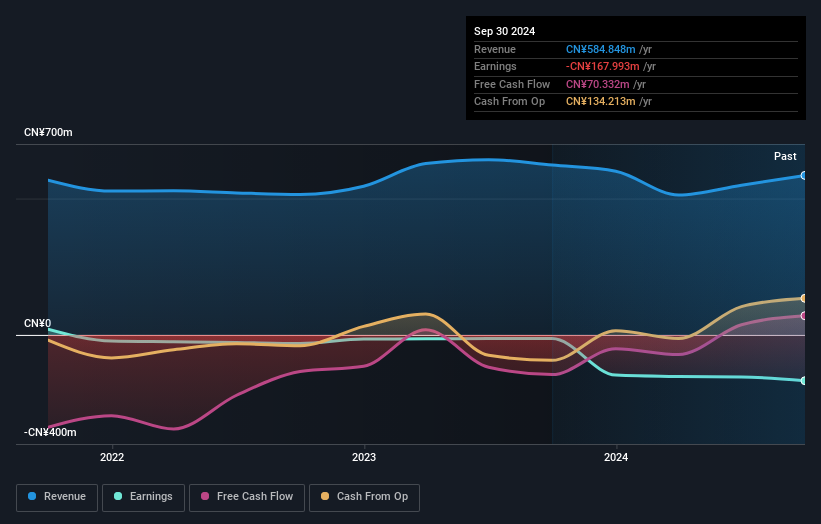

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Jiangsu Nanfang Medical provided a TSR of 8.5% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 0.4% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Jiangsu Nanfang Medical is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

We will like Jiangsu Nanfang Medical better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603880

Jiangsu Nanfang Medical

Engages in the research and development, production, and sale of transdermal products, medical adhesive tapes and bandages, first aid kits, sports protection products, protective products, and nursing products in China and internationally.

Good value with imperfect balance sheet.