- China

- /

- Medical Equipment

- /

- SHSE:603309

Unveiling 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing a strong year despite recent slumps and European indices showing varied performances, investors are keenly observing economic indicators such as the Chicago PMI and inflation trends in Spain. Amidst these fluctuations, identifying stocks that may be trading below their estimated value becomes crucial for those looking to capitalize on potential market inefficiencies. In the current climate, a good stock is often characterized by solid fundamentals and resilience to broader market volatility, offering opportunities for growth when others may overlook them.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1888.00 | ¥3757.10 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.98 | CA$11.88 | 49.7% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.725 | €5.45 | 50% |

| EnomotoLtd (TSE:6928) | ¥1450.00 | ¥2887.97 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.45 | SEK122.25 | 49.7% |

| W5 Solutions (OM:W5) | SEK46.85 | SEK93.57 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$93.54 | US$186.41 | 49.8% |

| Exosens (ENXTPA:EXENS) | €22.42 | €44.72 | 49.9% |

| Cicor Technologies (SWX:CICN) | CHF59.80 | CHF118.90 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.93 | €5.85 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

Well Lead Medical (SHSE:603309)

Overview: Well Lead Medical Co., Ltd. develops, produces, and sells medical devices for anaesthesia, urology, endourology, respiratory care, pain management, and hemodialysis globally with a market cap of CN¥3.34 billion.

Operations: The company's revenue from medical instruments is CN¥1.47 billion.

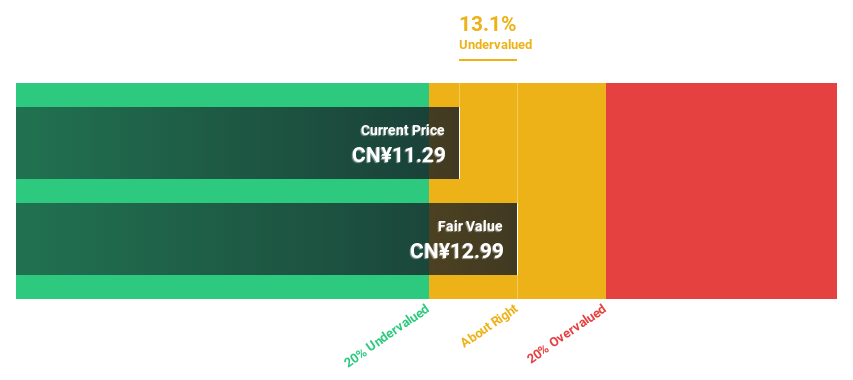

Estimated Discount To Fair Value: 12.2%

Well Lead Medical is trading at CN¥11.4, 12.2% below its estimated fair value of CN¥12.99, indicating potential undervaluation based on cash flows. The company has demonstrated revenue growth with sales reaching CNY 1,060.43 million for the first nine months of 2024, up from CNY 977.12 million the previous year. While earnings are expected to grow significantly at over 20% annually, the dividend yield of 4.39% isn't well covered by free cash flows.

- In light of our recent growth report, it seems possible that Well Lead Medical's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Well Lead Medical.

Parade Technologies (TPEX:4966)

Overview: Parade Technologies, Ltd. is a fabless semiconductor company operating in South Korea, China, Taiwan, Japan, and internationally with a market capitalization of NT$59.56 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$15.95 billion.

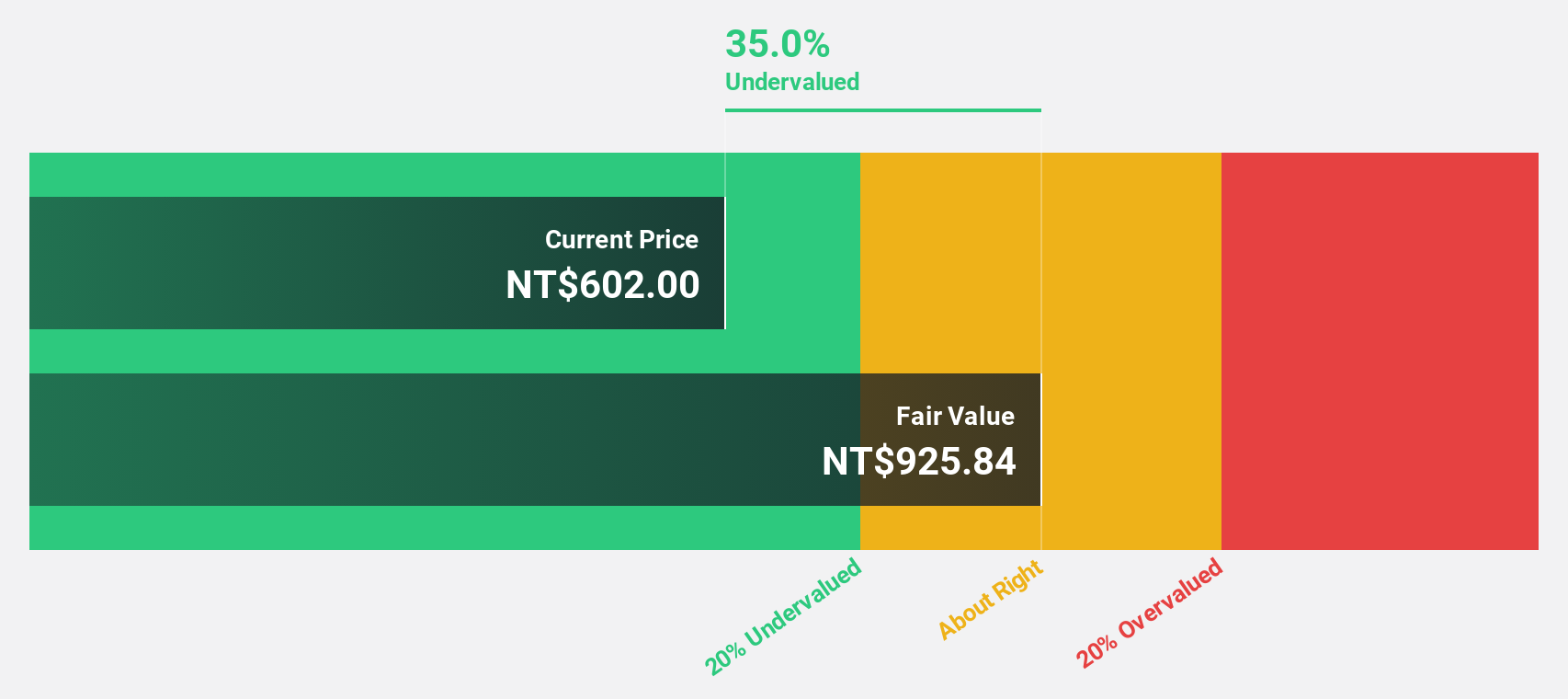

Estimated Discount To Fair Value: 31.8%

Parade Technologies is trading at NT$751, significantly below its estimated fair value of NT$1101.11, suggesting it may be undervalued based on cash flows. The company reported robust earnings growth, with net income for the first nine months of 2024 reaching TWD 1.90 billion compared to TWD 1.39 billion the previous year. Earnings are expected to grow substantially at over 20% annually, though revenue growth is anticipated to be moderate at 12.9% per year.

- Our earnings growth report unveils the potential for significant increases in Parade Technologies' future results.

- Click here to discover the nuances of Parade Technologies with our detailed financial health report.

Simplex Holdings (TSE:4373)

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally with a market cap of ¥139.95 billion.

Operations: Revenue Segments (in millions of ¥): Simplex Holdings generates revenue through strategic consulting, design and development, and operation and maintenance services provided to financial institutions, corporations, and public sectors globally.

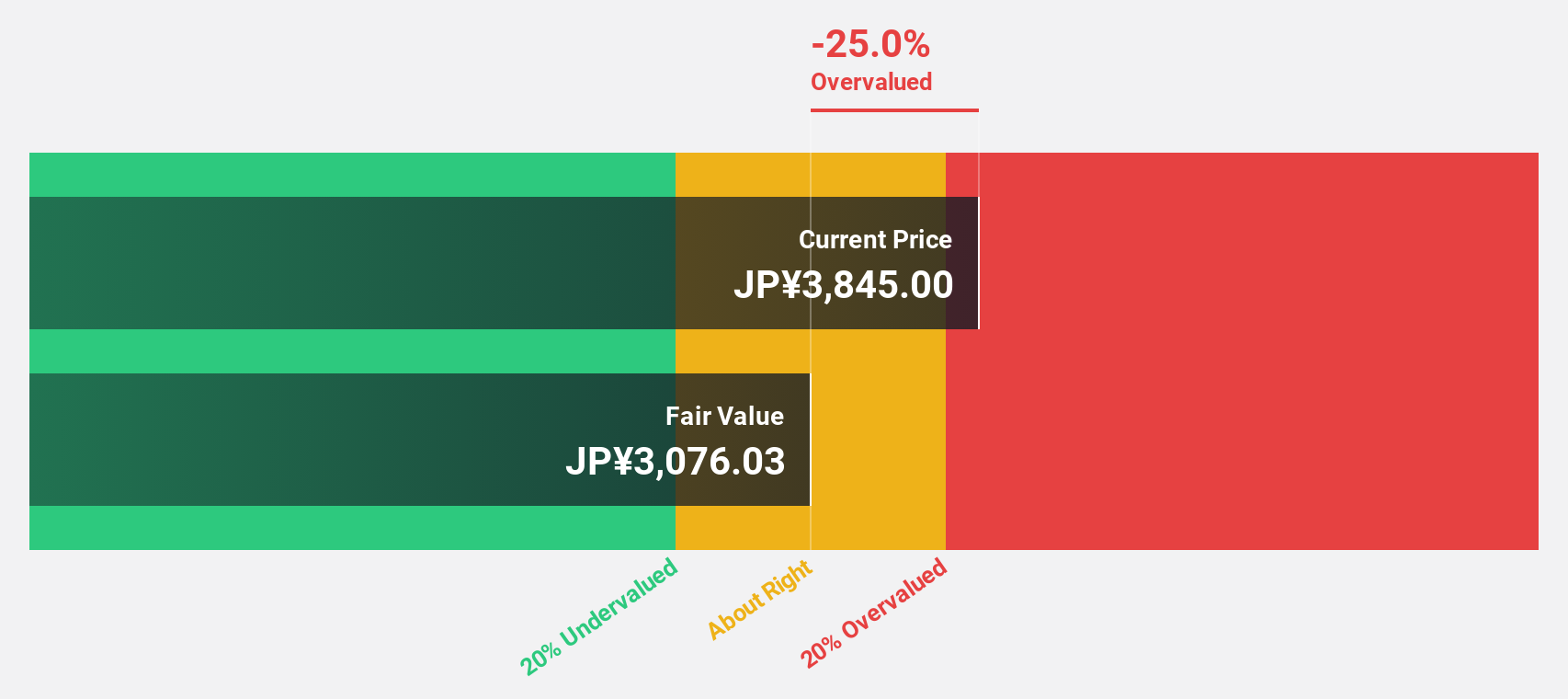

Estimated Discount To Fair Value: 32.2%

Simplex Holdings is trading at ¥2394, well below its estimated fair value of ¥3528.67, pointing to potential undervaluation based on cash flows. Despite a slower revenue growth forecast of 13.6% annually compared to the market's 4.2%, earnings are expected to grow significantly at over 21% per year, outpacing the Japanese market's average growth rate of 7.9%. However, return on equity is projected to remain modest at 15.9%.

- According our earnings growth report, there's an indication that Simplex Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Simplex Holdings stock in this financial health report.

Key Takeaways

- Gain an insight into the universe of 881 Undervalued Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Well Lead Medical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Well Lead Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603309

Well Lead Medical

Engages in the development, production, and sale of medical devices in anaesthesia, urology, endourology, respiratory, pain management, and hemodialysis areas worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives