Ligao Foods Co.,Ltd.'s (SZSE:300973) Stock Retreats 28% But Earnings Haven't Escaped The Attention Of Investors

Ligao Foods Co.,Ltd. (SZSE:300973) shares have had a horrible month, losing 28% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

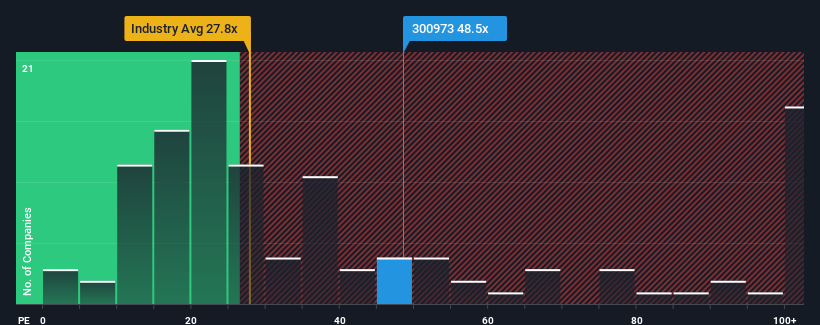

In spite of the heavy fall in price, Ligao FoodsLtd's price-to-earnings (or "P/E") ratio of 48.5x might still make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 32x and even P/E's below 19x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings that are retreating more than the market's of late, Ligao FoodsLtd has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Ligao FoodsLtd

How Is Ligao FoodsLtd's Growth Trending?

In order to justify its P/E ratio, Ligao FoodsLtd would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 63% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 168% as estimated by the eleven analysts watching the company. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's understandable that Ligao FoodsLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Despite the recent share price weakness, Ligao FoodsLtd's P/E remains higher than most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Ligao FoodsLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ligao FoodsLtd (1 is significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Ligao FoodsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300973

Ligao FoodsLtd

Engages in the research and development, production, and selling of baked food raw material and frozen baked foods in China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives