Ligao Foods Co.,Ltd. (SZSE:300973) Stocks Shoot Up 28% But Its P/E Still Looks Reasonable

Ligao Foods Co.,Ltd. (SZSE:300973) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 53% share price drop in the last twelve months.

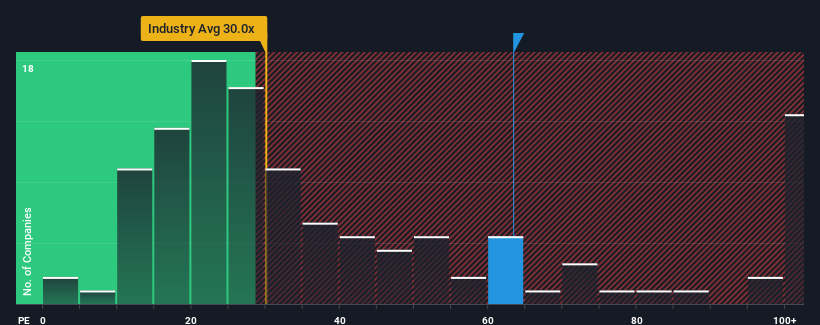

Following the firm bounce in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 32x, you may consider Ligao FoodsLtd as a stock to avoid entirely with its 63.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Ligao FoodsLtd's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Ligao FoodsLtd

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Ligao FoodsLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. This means it has also seen a slide in earnings over the longer-term as EPS is down 74% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 62% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 26% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Ligao FoodsLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Ligao FoodsLtd have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Ligao FoodsLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Ligao FoodsLtd has 3 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Ligao FoodsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300973

Ligao FoodsLtd

Engages in the research and development, production, and selling of baked food raw material and frozen baked foods in China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives