Jiangsu Cnano Technology And 2 Other Growth Stocks With High Insider Confidence

Reviewed by Simply Wall St

In a week marked by volatility and cautious earnings reports, global markets saw major indexes finish mostly lower, with growth stocks generally lagging behind their value counterparts. Amidst this backdrop of economic uncertainty and fluctuating market conditions, companies with high insider ownership can often signal strong internal confidence in their future prospects. In this article, we explore Jiangsu Cnano Technology and two other growth stocks that exemplify such insider confidence, offering insights into what makes them stand out in today's challenging investment landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Jiangsu Cnano Technology (SHSE:688116)

Simply Wall St Growth Rating: ★★★★★☆

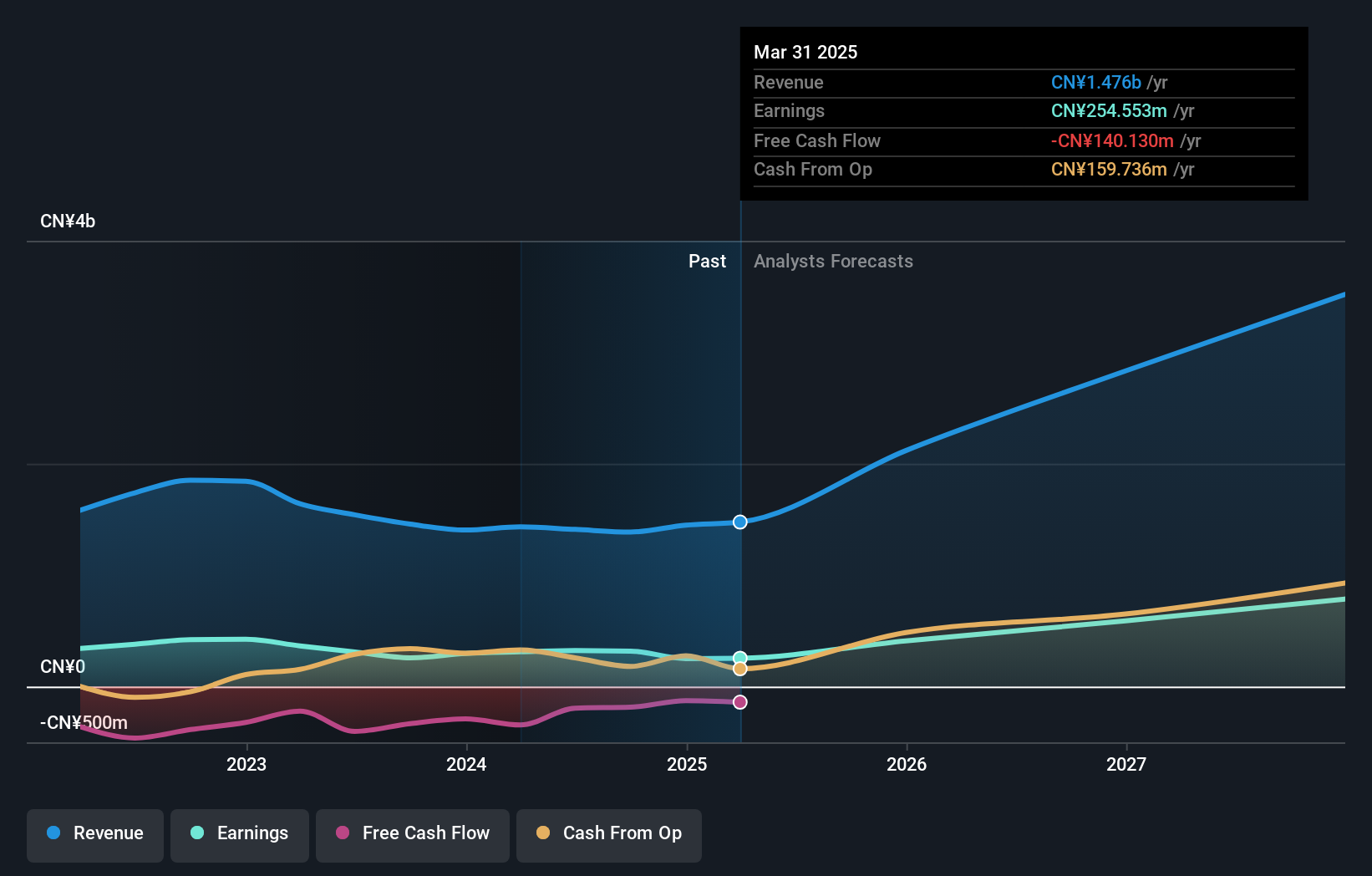

Overview: Jiangsu Cnano Technology Co., Ltd. is engaged in the research, development, production, and sale of carbon nanotube materials and related products in China, with a market cap of approximately CN¥10.40 billion.

Operations: Jiangsu Cnano Technology's revenue is derived from its activities in researching, developing, producing, and selling carbon nanotube materials and related products within China.

Insider Ownership: 18%

Jiangsu Cnano Technology shows strong growth potential with earnings expected to grow significantly at 38.5% annually, outpacing the Chinese market average. Despite a volatile share price recently, its Price-To-Earnings ratio of 32.7x is below the market average, suggesting good relative value. Revenue is also forecasted to increase by 37.8% per year, exceeding market expectations. The company's net income for the first nine months of 2024 rose to CNY 182.61 million from CNY 161.52 million last year, indicating solid performance amidst high insider ownership stability.

- Delve into the full analysis future growth report here for a deeper understanding of Jiangsu Cnano Technology.

- The valuation report we've compiled suggests that Jiangsu Cnano Technology's current price could be quite moderate.

Fujian Wanchen Biotechnology Group (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★★

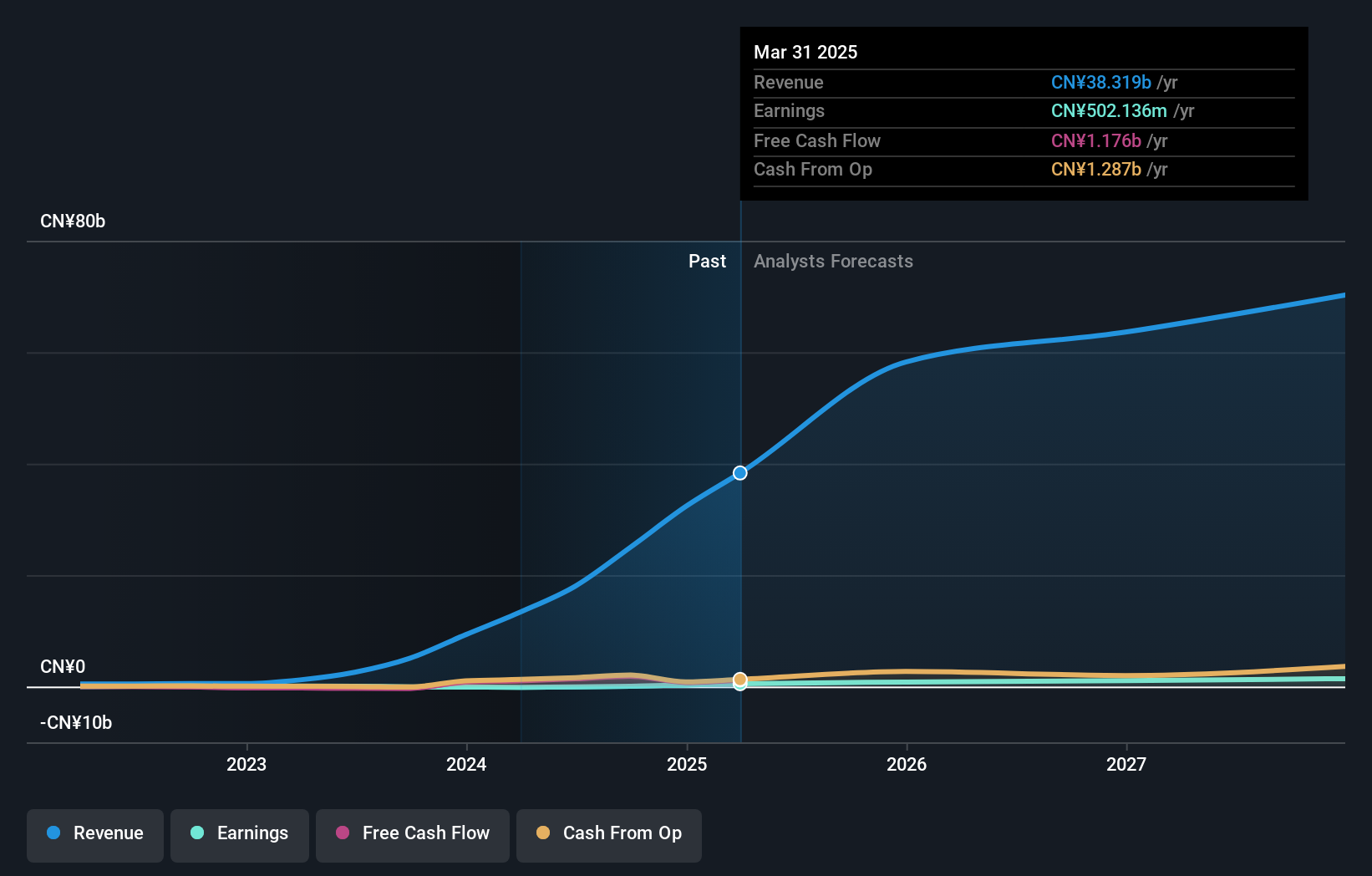

Overview: Fujian Wanchen Biotechnology Co., Ltd is involved in the research, development, cultivation, production, and sale of edible fungi in China with a market cap of CN¥13 billion.

Operations: The company's revenue segments include the research, development, cultivation, production, and sale of edible fungi in China.

Insider Ownership: 14.7%

Fujian Wanchen Biotechnology Group demonstrates significant growth potential, with earnings forecasted to increase by 87.45% annually, surpassing the Chinese market average. Recent earnings results show a substantial revenue rise to CNY 20.61 billion for the first nine months of 2024, up from CNY 4.9 billion last year, marking profitability this year despite past shareholder dilution. The company's shares are considered undervalued compared to fair value estimates and industry peers amidst stable insider ownership dynamics following recent acquisition activity.

- Take a closer look at Fujian Wanchen Biotechnology Group's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Fujian Wanchen Biotechnology Group is trading behind its estimated value.

Mercari (TSE:4385)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. is a company that plans, develops, and operates marketplace applications in Japan and the United States, with a market cap of ¥356.19 billion.

Operations: The company's revenue segments are comprised of ¥43.65 billion from the US and ¥138.11 billion from Japan.

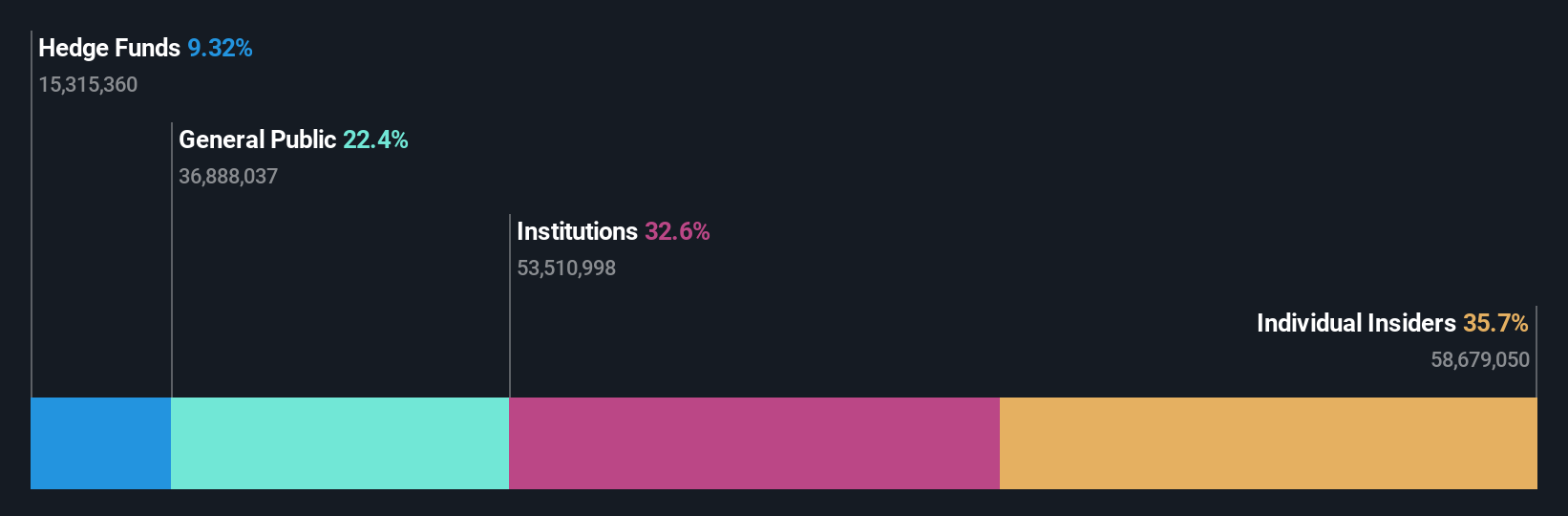

Insider Ownership: 36%

Mercari's earnings have grown 66.5% annually over five years, with future earnings projected to increase by 17.6% per year, outpacing Japan's market average of 8.9%. Despite high volatility in its share price, the stock trades at a significant discount to estimated fair value. Revenue is expected to grow at 7.2% annually, faster than the Japanese market's growth rate of 4.2%. Insider ownership remains stable with no recent insider trading activity reported.

- Click here to discover the nuances of Mercari with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Mercari shares in the market.

Summing It All Up

- Navigate through the entire inventory of 1528 Fast Growing Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4385

Mercari

Plans, develops, and operates Mercari marketplace applications in Japan and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives