Fujian Wanchen Biotechnology Group Co., Ltd. (SZSE:300972) Stock Rockets 28% But Many Are Still Ignoring The Company

Despite an already strong run, Fujian Wanchen Biotechnology Group Co., Ltd. (SZSE:300972) shares have been powering on, with a gain of 28% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 12% is also fairly reasonable.

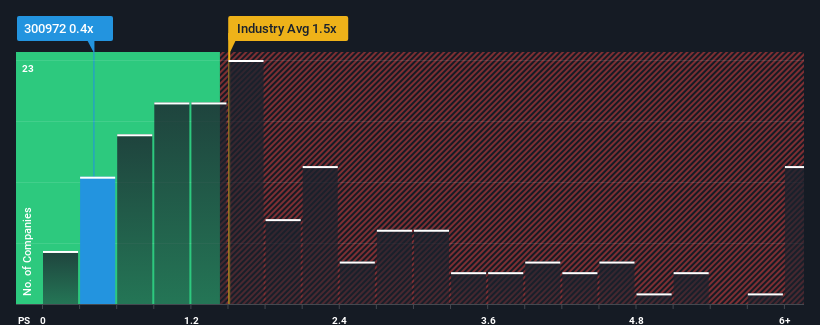

Even after such a large jump in price, given about half the companies operating in China's Food industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Fujian Wanchen Biotechnology Group as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Fujian Wanchen Biotechnology Group

How Has Fujian Wanchen Biotechnology Group Performed Recently?

Recent times have been advantageous for Fujian Wanchen Biotechnology Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fujian Wanchen Biotechnology Group.How Is Fujian Wanchen Biotechnology Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Fujian Wanchen Biotechnology Group's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 79% over the next year. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Fujian Wanchen Biotechnology Group's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Fujian Wanchen Biotechnology Group's P/S Mean For Investors?

Despite Fujian Wanchen Biotechnology Group's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Fujian Wanchen Biotechnology Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Fujian Wanchen Biotechnology Group is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300972

Fujian Wanchen Biotechnology GroupLtd

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives