Beijing Scitop Bio-tech (SZSE:300858) Will Pay A Smaller Dividend Than Last Year

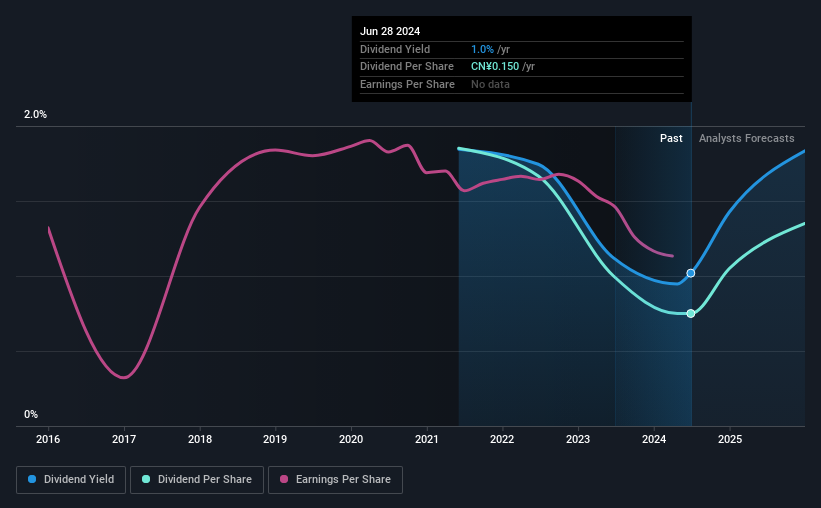

Beijing Scitop Bio-tech Co., Ltd. (SZSE:300858) is reducing its dividend from last year's comparable payment to CN¥0.15 on the 3rd of July. This means that the annual payment is 1.0% of the current stock price, which is lower than what the rest of the industry is paying.

See our latest analysis for Beijing Scitop Bio-tech

Beijing Scitop Bio-tech's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, Beijing Scitop Bio-tech was earning enough to cover the dividend, but it wasn't generating any free cash flows. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

Looking forward, earnings per share is forecast to rise by 34.4% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 23%, which is in the range that makes us comfortable with the sustainability of the dividend.

Beijing Scitop Bio-tech's Dividend Has Lacked Consistency

Looking back, the company hasn't been paying the most consistent dividend, but with such a short dividend history it could be too early to draw solid conclusions. Since 2021, the dividend has gone from CN¥0.37 total annually to CN¥0.15. Dividend payments have fallen sharply, down 60% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Potential Is Shaky

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Beijing Scitop Bio-tech's EPS has fallen by approximately 12% per year during the past three years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Beijing Scitop Bio-tech's Dividend Doesn't Look Sustainable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Beijing Scitop Bio-tech is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Beijing Scitop Bio-tech that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Scitop Bio-tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300858

Beijing Scitop Bio-tech

Researches, develops, produces, and sells probiotic, postbiotics, and microecologival preparations for animals and plants in China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026