Kunming Chuan Jin Nuo Chemical (SZSE:300505) stock falls 9.0% in past week as three-year earnings and shareholder returns continue downward trend

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Kunming Chuan Jin Nuo Chemical Co., Ltd. (SZSE:300505) shareholders have had that experience, with the share price dropping 30% in three years, versus a market decline of about 17%. More recently, the share price has dropped a further 15% in a month. We do note, however, that the broader market is down 6.1% in that period, and this may have weighed on the share price.

Since Kunming Chuan Jin Nuo Chemical has shed CN¥371m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Kunming Chuan Jin Nuo Chemical

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Kunming Chuan Jin Nuo Chemical moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

The modest 0.8% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 23% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Kunming Chuan Jin Nuo Chemical further; while we may be missing something on this analysis, there might also be an opportunity.

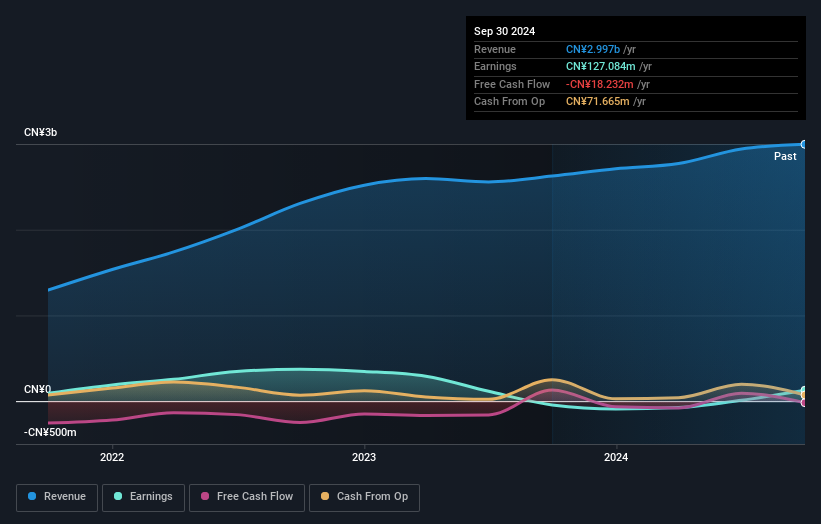

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Kunming Chuan Jin Nuo Chemical's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Kunming Chuan Jin Nuo Chemical had a tough year, with a total loss of 18% (including dividends), against a market gain of about 7.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Kunming Chuan Jin Nuo Chemical better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Kunming Chuan Jin Nuo Chemical (including 1 which doesn't sit too well with us) .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kunming Chuan Jin Nuo Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300505

Kunming Chuan Jin Nuo Chemical

Produces and sells phosphate products in China.

Excellent balance sheet and slightly overvalued.