- China

- /

- Real Estate

- /

- SHSE:600052

Zhejiang Dongwang Times Technology And 2 Other Promising Penny Stocks For Savvy Investors

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are keenly observing sector-specific impacts and broader economic indicators. For those looking to invest in smaller or newer companies, penny stocks—despite their somewhat outdated moniker—still present intriguing opportunities. By focusing on stocks with robust financials and clear growth potential, investors can uncover valuable prospects among these often-overlooked securities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.15 | £810.04M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR771.82M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.895 | £387.38M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Genetec Technology Berhad (KLSE:GENETEC) | MYR0.82 | MYR643.61M | ★★★★★★ |

Click here to see the full list of 5,788 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Zhejiang Dongwang Times Technology (SHSE:600052)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Dongwang Times Technology Co., Ltd. operates in China, offering energy-saving services and film and television culture solutions, with a market cap of CN¥3.92 billion.

Operations: The company generates CN¥412.81 million in revenue from its operations within China.

Market Cap: CN¥3.92B

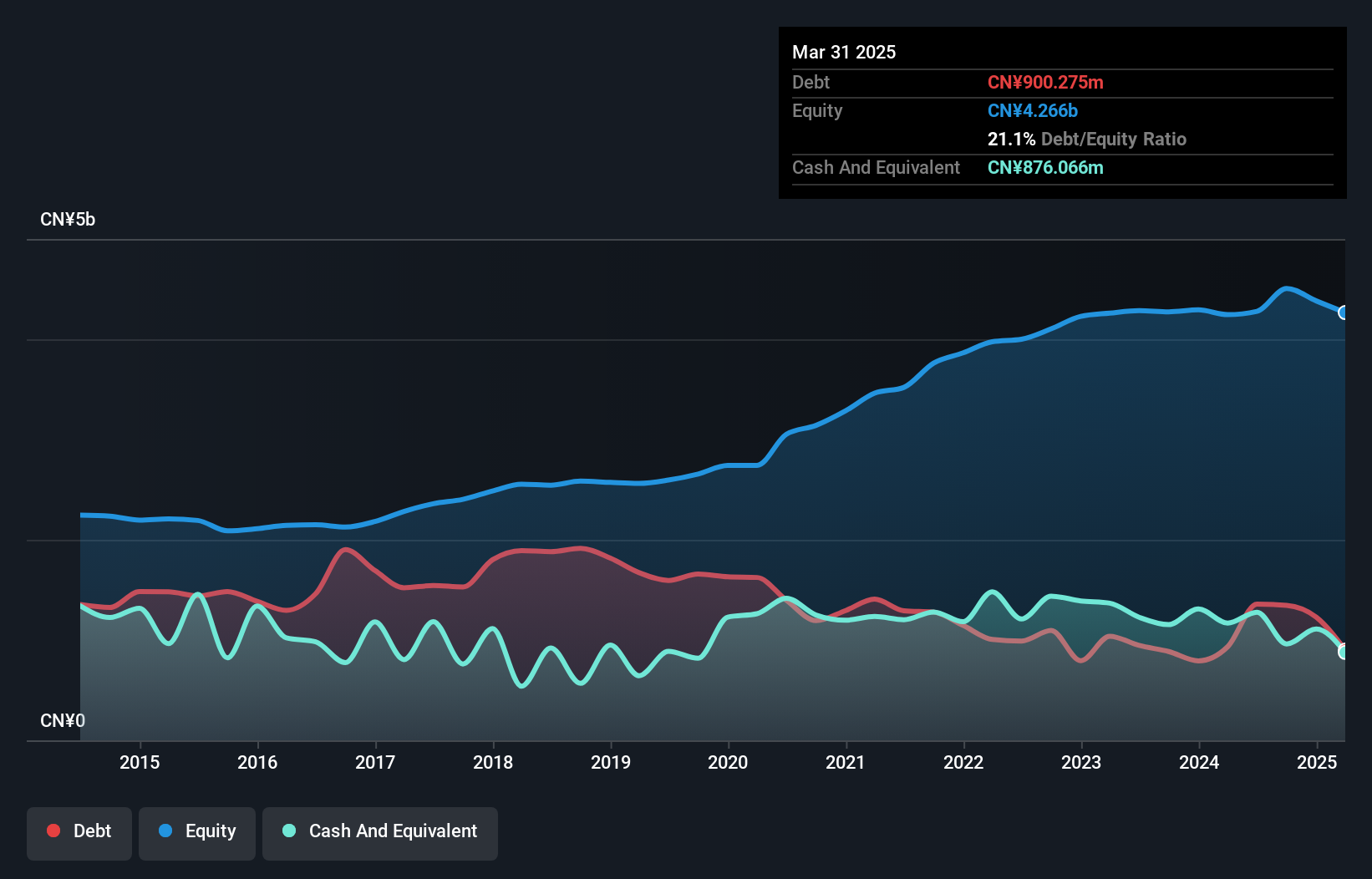

Zhejiang Dongwang Times Technology has shown a turnaround by becoming profitable in the past year, with net income rising to CN¥93.19 million for the nine months ending September 2024. The company's financial stability is supported by its short-term assets exceeding both short and long-term liabilities, and its debt being well covered by operating cash flow. However, earnings have been impacted by a large one-off gain of CN¥82.8 million. The recent acquisition of a 7% stake by Dongyang Fuchuang Information Technology highlights investor interest, despite challenges such as low return on equity and declining earnings over five years.

- Unlock comprehensive insights into our analysis of Zhejiang Dongwang Times Technology stock in this financial health report.

- Gain insights into Zhejiang Dongwang Times Technology's historical outcomes by reviewing our past performance report.

Yechiu Metal Recycling (China) (SHSE:601388)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry across Asia and the United States, with a market cap of CN¥5.92 billion.

Operations: Revenue segments for Yechiu Metal Recycling (China) Ltd. are not reported.

Market Cap: CN¥5.92B

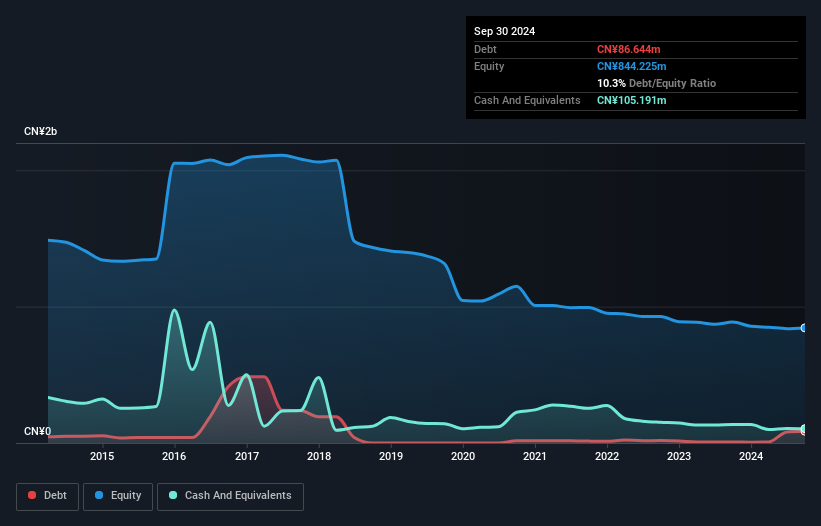

Yechiu Metal Recycling (China) Ltd. has faced challenges with declining earnings, reporting a net income of CN¥77.27 million for the nine months ending September 2024, down from CN¥124.08 million the previous year. Despite this, its financial position remains stable as short-term assets exceed liabilities and debt levels have decreased significantly over five years. The company's interest payments are well covered by EBIT, indicating manageable debt servicing capabilities. However, negative operating cash flow suggests caution is warranted regarding its ability to cover debts through internal cash generation in the near term.

- Click here and access our complete financial health analysis report to understand the dynamics of Yechiu Metal Recycling (China).

- Explore Yechiu Metal Recycling (China)'s analyst forecasts in our growth report.

Hainan Shennong Seed Industry Technology (SZSE:300189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan Shennong Seed Industry Technology Co., Ltd., with a market cap of CN¥3.72 billion, is engaged in the development, production, and sale of agricultural seeds.

Operations: Hainan Shennong Seed Industry Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.72B

Hainan Shennong Seed Industry Technology Co., Ltd. has shown modest revenue growth, reporting sales of CN¥122.68 million for the nine months ending September 2024, up from CN¥116.28 million the previous year. However, it remains unprofitable with a net loss of CN¥21.76 million for the same period and a negative return on equity at -5.04%. The company has a cash runway sufficient for 1.4 years if current free cash flow trends persist, though short-term assets comfortably cover both short- and long-term liabilities, indicating financial stability despite increased debt levels over five years.

- Jump into the full analysis health report here for a deeper understanding of Hainan Shennong Seed Industry Technology.

- Review our historical performance report to gain insights into Hainan Shennong Seed Industry Technology's track record.

Seize The Opportunity

- Get an in-depth perspective on all 5,788 Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zhejiang Dongwang Times Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Dongwang Times Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600052

Zhejiang Dongwang Times Technology

Engages in the provision of energy-saving services, and film and television culture solutions in China.

Excellent balance sheet low.