Amid heightened global trade tensions, Asian markets are navigating a complex landscape influenced by recent tariff announcements. Investors are keenly observing how these developments might impact smaller companies, which often exhibit resilience and adaptability in uncertain times. Despite the vintage feel of the term "penny stocks," these investments can still offer significant potential for growth when backed by strong financials, providing an intriguing opportunity for those seeking value in lesser-known companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.28 | THB1.78B | ✅ 4 ⚠️ 5 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.32 | THB2.68B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.365 | SGD147.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.193 | SGD38.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.17 | SGD8.57B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.11 | HK$1.28B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.01 | HK$45.93B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.16 | CN¥3.66B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,111 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Shenzhen Jinjia GroupLtd (SZSE:002191)

Simply Wall St Financial Health Rating: ★★★★☆☆

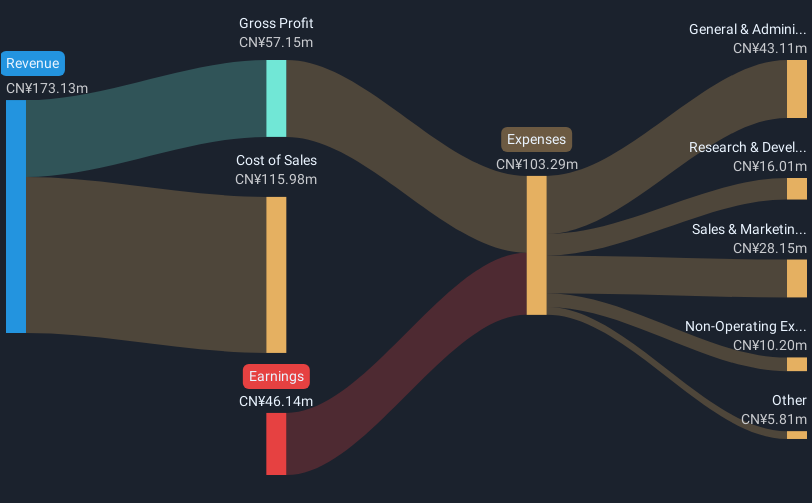

Overview: Shenzhen Jinjia Group Co., Ltd. is involved in the research, development, and production of packaging materials in China with a market cap of CN¥5.46 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥3.18 billion.

Market Cap: CN¥5.46B

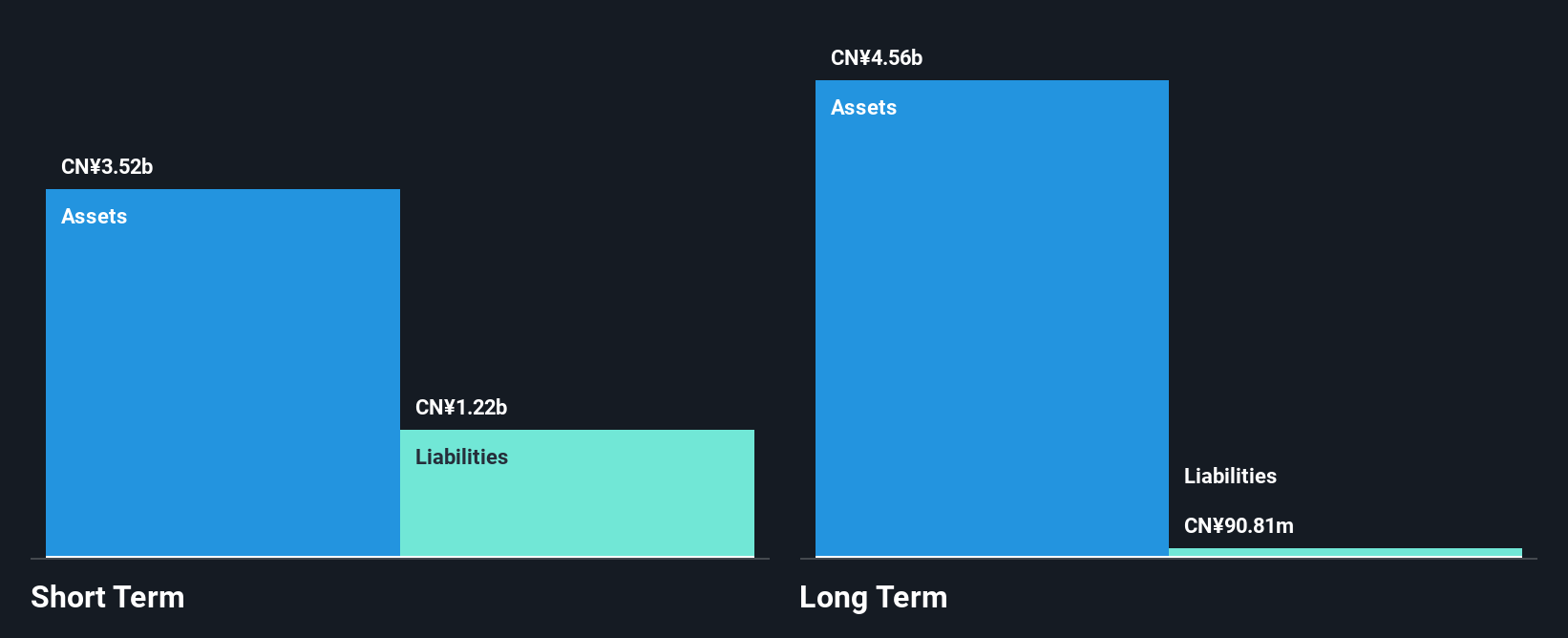

Shenzhen Jinjia Group Ltd. has recently become profitable, although its earnings have declined by 38% annually over the past five years. The company’s short-term assets of CN¥3.9 billion comfortably cover both short-term and long-term liabilities, indicating solid liquidity management. However, despite having more cash than total debt, its operating cash flow remains negative, suggesting challenges in covering debt through operations alone. The board of directors is experienced with an average tenure of 9.6 years, but recent financial results were impacted by a large one-off loss of CN¥244.9 million as of September 2024.

- Jump into the full analysis health report here for a deeper understanding of Shenzhen Jinjia GroupLtd.

- Examine Shenzhen Jinjia GroupLtd's earnings growth report to understand how analysts expect it to perform.

Chongqing Lummy Pharmaceutical (SZSE:300006)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chongqing Lummy Pharmaceutical Co., Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical products in China with a market cap of CN¥3.79 billion.

Operations: Chongqing Lummy Pharmaceutical Co., Ltd. does not report specific revenue segments, focusing instead on its comprehensive activities in the pharmaceutical industry within China.

Market Cap: CN¥3.79B

Chongqing Lummy Pharmaceutical Co., Ltd. is navigating financial challenges, reporting a net loss of CN¥87.8 million for 2024, up from CN¥8.93 million the previous year, with sales declining to CN¥795.6 million from CN¥895.59 million. Despite being unprofitable, the company has a robust cash position exceeding its total debt and maintains sufficient liquidity to cover both short-term and long-term liabilities comfortably. The management team is experienced with an average tenure of six years, while the board's tenure averages 4.8 years, indicating stability in leadership amidst efforts to reduce losses at a significant rate over five years.

- Get an in-depth perspective on Chongqing Lummy Pharmaceutical's performance by reading our balance sheet health report here.

- Evaluate Chongqing Lummy Pharmaceutical's historical performance by accessing our past performance report.

Hainan Shennong Seed Industry Technology (SZSE:300189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan Shennong Seed Industry Technology Co., Ltd. operates in the agricultural sector focusing on seed production and distribution, with a market cap of CN¥3.68 billion.

Operations: Hainan Shennong Seed Industry Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.68B

Hainan Shennong Seed Industry Technology Co., Ltd. presents a mixed investment profile. The company, with a market cap of CN¥3.68 billion, is currently unprofitable but has managed to reduce its losses by 39.8% annually over the past five years. It maintains a strong liquidity position, with short-term assets of CN¥285.4 million exceeding both short-term and long-term liabilities, and more cash than total debt. However, it faces challenges such as less than one year of cash runway based on current free cash flow and an inexperienced board with an average tenure of 2.9 years.

- Dive into the specifics of Hainan Shennong Seed Industry Technology here with our thorough balance sheet health report.

- Explore historical data to track Hainan Shennong Seed Industry Technology's performance over time in our past results report.

Make It Happen

- Take a closer look at our Asian Penny Stocks list of 1,111 companies by clicking here.

- Interested In Other Possibilities? The end of cancer? These 21 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002191

Shenzhen Jinjia GroupLtd

Engages in the research, development, and production of packaging materials in China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives