- China

- /

- Construction

- /

- SZSE:002586

3 Intriguing Penny Stocks With Market Caps Over US$400M

Reviewed by Simply Wall St

As global markets navigate a period of fluctuating consumer confidence and mixed economic signals, investors are increasingly on the lookout for opportunities that balance risk with potential growth. Penny stocks, despite their somewhat outdated moniker, continue to capture attention for their unique blend of affordability and growth potential. These stocks represent smaller or newer companies that can offer significant value when supported by robust financials, making them intriguing options for those seeking under-the-radar investment opportunities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,827 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Harbin Gloria Pharmaceuticals Co., Ltd focuses on the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥5.77 billion.

Operations: Harbin Gloria Pharmaceuticals Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥5.77B

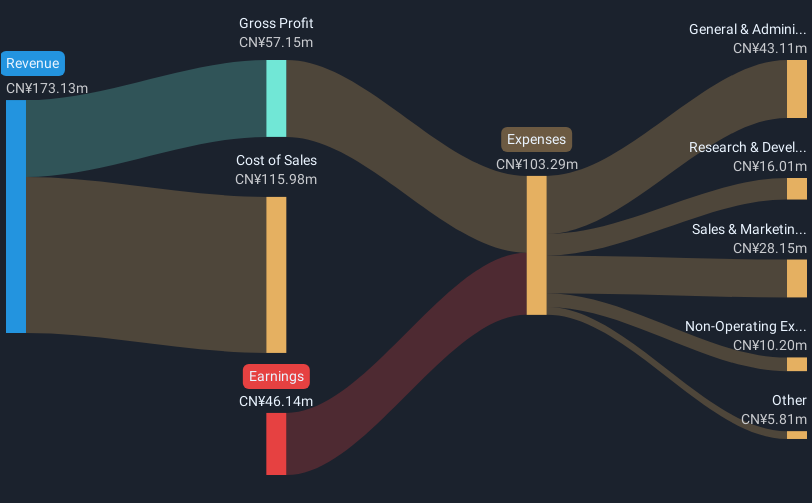

Harbin Gloria Pharmaceuticals has shown notable financial improvements, becoming profitable in the last year with earnings growing significantly over the past five years. Despite a reduction in debt and a strong cash position, its short-term liabilities slightly exceed its assets. The company's board is relatively inexperienced, which may impact governance stability. Recent shareholder activism indicates active engagement in corporate governance, with proposals for board nominations approved. While revenues have decreased compared to the previous year, Harbin Gloria Pharmaceuticals maintains profitability with net income of CN¥183.49 million for the first nine months of 2024 despite facing challenges such as diluted shareholder value and low return on equity.

- Click here and access our complete financial health analysis report to understand the dynamics of HARBIN GLORIA PHARMACEUTICALS.

- Evaluate HARBIN GLORIA PHARMACEUTICALS' prospects by accessing our earnings growth report.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Reclaim Construction Group Co., Ltd., with a market cap of CN¥2.99 billion, operates in the construction industry.

Operations: The company generates revenue primarily from China, amounting to CN¥2.23 billion.

Market Cap: CN¥2.99B

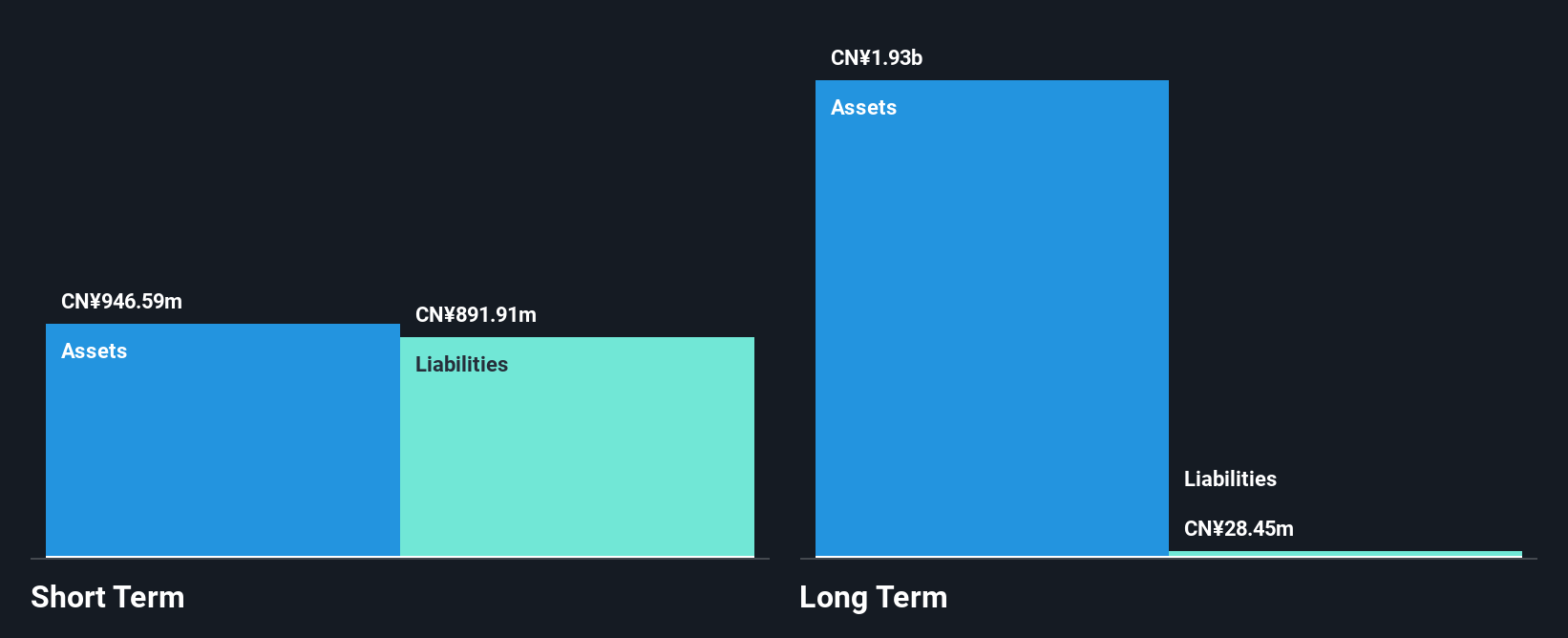

Zhejiang Reclaim Construction Group Co., Ltd. has shown resilience despite being unprofitable, with its debt to equity ratio improving from 48.6% to 32.8% over five years and a cash runway exceeding one year based on current free cash flow. The company's short-term assets match its liabilities, while long-term liabilities are well-covered, indicating financial stability in asset management. Revenue increased to CN¥1.36 billion for the first nine months of 2024 compared to the previous year, though net losses narrowed slightly from CN¥87 million to CN¥83 million, reflecting gradual progress in reducing losses amidst industry challenges.

- Navigate through the intricacies of Zhejiang Reclaim Construction Group with our comprehensive balance sheet health report here.

- Explore historical data to track Zhejiang Reclaim Construction Group's performance over time in our past results report.

Hainan Shennong Seed Industry Technology (SZSE:300189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan Shennong Seed Industry Technology Co., Ltd. operates in the agricultural sector, focusing on seed technology and production, with a market cap of CN¥3.96 billion.

Operations: Hainan Shennong Seed Industry Technology Co., Ltd. does not report distinct revenue segments.

Market Cap: CN¥3.96B

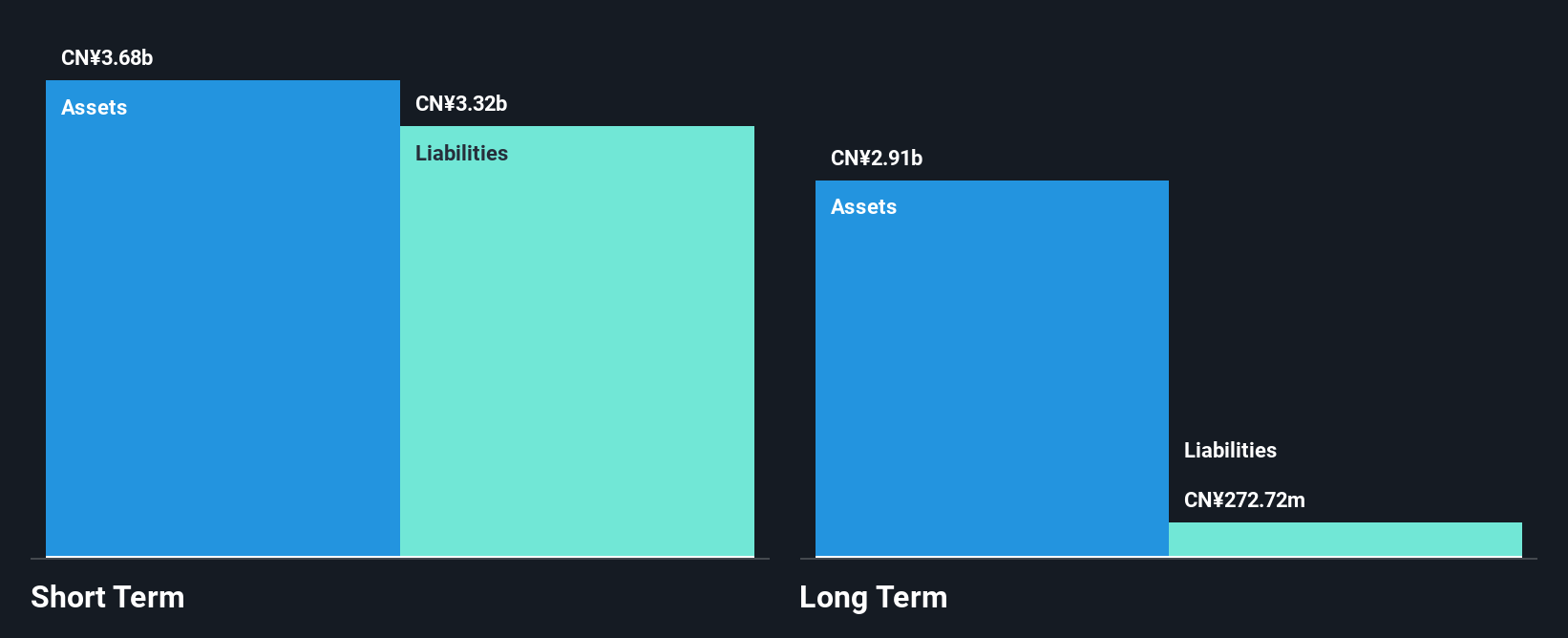

Hainan Shennong Seed Industry Technology Co., Ltd. operates with a market cap of CN¥3.96 billion, showing modest revenue growth to CN¥122.68 million for the first nine months of 2024, up from CN¥116.28 million the previous year, though it remains unprofitable with a net loss increasing to CN¥21.76 million. The company has not experienced significant shareholder dilution recently and maintains more cash than total debt, suggesting prudent financial management despite a volatile share price and limited cash runway under current free cash flow conditions. Short-term assets sufficiently cover both short- and long-term liabilities, indicating solid asset management amidst ongoing challenges in profitability improvement efforts.

- Get an in-depth perspective on Hainan Shennong Seed Industry Technology's performance by reading our balance sheet health report here.

- Understand Hainan Shennong Seed Industry Technology's track record by examining our performance history report.

Make It Happen

- Access the full spectrum of 5,827 Penny Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zhejiang Reclaim Construction Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Reclaim Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002586

Zhejiang Reclaim Construction Group

Zhejiang Reclaim Construction Group Co., Ltd.

Excellent balance sheet and slightly overvalued.