The Market Lifts Shandong Zhonglu Oceanic Fisheries Company Limited (SZSE:200992) Shares 33% But It Can Do More

Shandong Zhonglu Oceanic Fisheries Company Limited (SZSE:200992) shares have continued their recent momentum with a 33% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

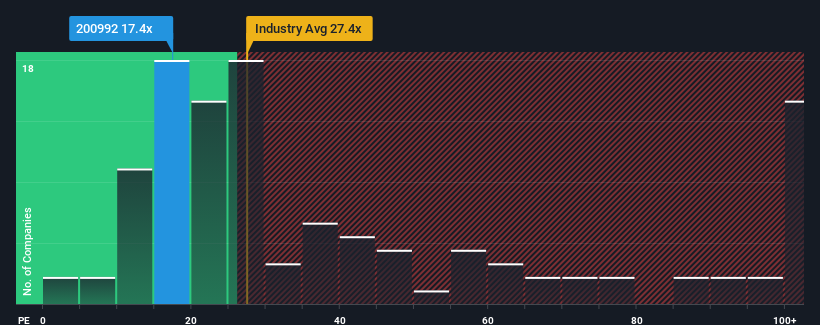

Even after such a large jump in price, Shandong Zhonglu Oceanic Fisheries' price-to-earnings (or "P/E") ratio of 17.4x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 35x and even P/E's above 67x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Shandong Zhonglu Oceanic Fisheries has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Shandong Zhonglu Oceanic Fisheries

Does Growth Match The Low P/E?

Shandong Zhonglu Oceanic Fisheries' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. Pleasingly, EPS has also lifted 673% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Shandong Zhonglu Oceanic Fisheries is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Shandong Zhonglu Oceanic Fisheries' P/E

Despite Shandong Zhonglu Oceanic Fisheries' shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shandong Zhonglu Oceanic Fisheries revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Shandong Zhonglu Oceanic Fisheries (1 is significant!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:200992

Shandong Zhonglu Oceanic Fisheries

Engages in oceanic fishing business in China.

Slight with mediocre balance sheet.