Guilin Seamild Foods Co., Ltd's (SZSE:002956) Share Price Not Quite Adding Up

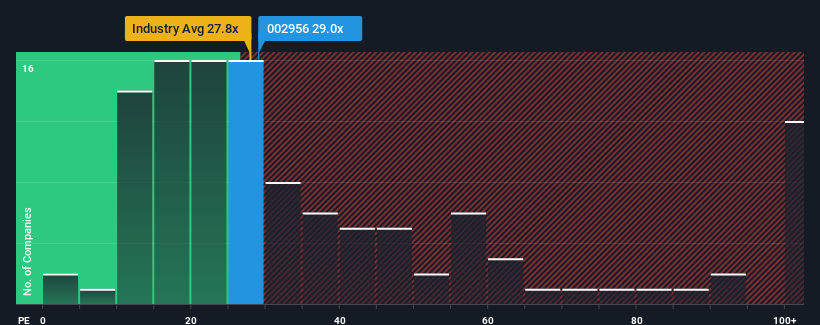

There wouldn't be many who think Guilin Seamild Foods Co., Ltd's (SZSE:002956) price-to-earnings (or "P/E") ratio of 29x is worth a mention when the median P/E in China is similar at about 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

There hasn't been much to differentiate Guilin Seamild Foods' and the market's earnings growth lately. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Check out our latest analysis for Guilin Seamild Foods

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Guilin Seamild Foods' to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 18% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 25% each year growth forecast for the broader market.

In light of this, it's curious that Guilin Seamild Foods' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Guilin Seamild Foods currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Guilin Seamild Foods (at least 1 which can't be ignored), and understanding them should be part of your investment process.

You might be able to find a better investment than Guilin Seamild Foods. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002956

Guilin Seamild Foods

Engages in the research, development, production, and management of oat cereal health food products under the Seamild brand in China.

High growth potential with excellent balance sheet.