Chongqing Fuling Zhacai Group Co., Ltd.'s (SZSE:002507) Share Price Boosted 32% But Its Business Prospects Need A Lift Too

Chongqing Fuling Zhacai Group Co., Ltd. (SZSE:002507) shareholders have had their patience rewarded with a 32% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

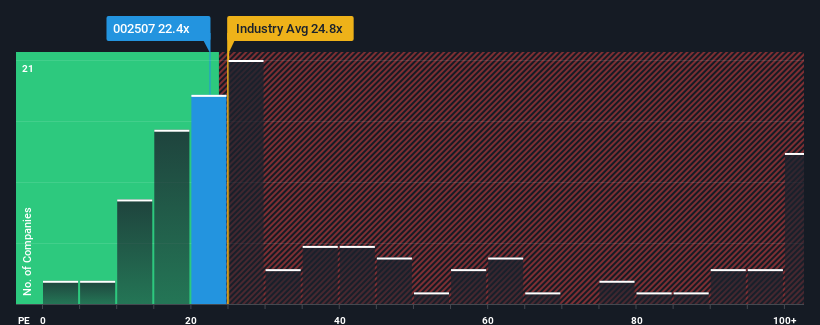

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Chongqing Fuling Zhacai Group as an attractive investment with its 22.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Chongqing Fuling Zhacai Group has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Chongqing Fuling Zhacai Group

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Chongqing Fuling Zhacai Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.8%. As a result, earnings from three years ago have also fallen 3.6% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 7.4% per year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is noticeably more attractive.

With this information, we can see why Chongqing Fuling Zhacai Group is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Chongqing Fuling Zhacai Group's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Chongqing Fuling Zhacai Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Chongqing Fuling Zhacai Group that you should be aware of.

If these risks are making you reconsider your opinion on Chongqing Fuling Zhacai Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002507

Chongqing Fuling Zhacai Group

Researches, develops, produces, and sells convenience foods in China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives