Subdued Growth No Barrier To Guangdong Jialong Food Co., Ltd. (SZSE:002495) With Shares Advancing 46%

Despite an already strong run, Guangdong Jialong Food Co., Ltd. (SZSE:002495) shares have been powering on, with a gain of 46% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.6% over the last year.

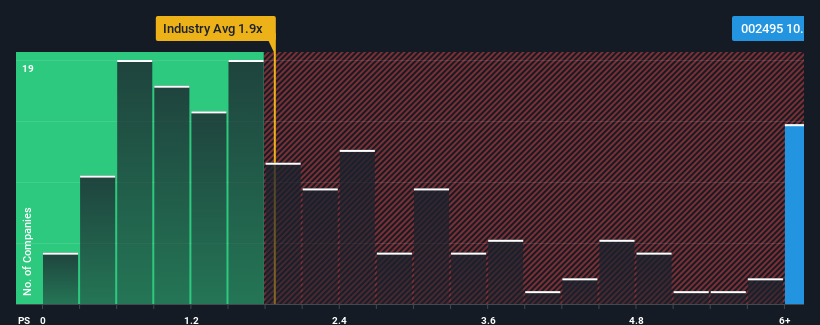

Following the firm bounce in price, given around half the companies in China's Food industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Guangdong Jialong Food as a stock to avoid entirely with its 10.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Guangdong Jialong Food

How Has Guangdong Jialong Food Performed Recently?

We'd have to say that with no tangible growth over the last year, Guangdong Jialong Food's revenue has been unimpressive. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Guangdong Jialong Food, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guangdong Jialong Food's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 20% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 16% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Guangdong Jialong Food is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Guangdong Jialong Food's P/S

Shares in Guangdong Jialong Food have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Guangdong Jialong Food revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Guangdong Jialong Food you should know about.

If these risks are making you reconsider your opinion on Guangdong Jialong Food, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002495

Guangdong Jialong Food

Researches, develops, produces, and sells food products in China.

Flawless balance sheet very low.

Market Insights

Community Narratives