- Taiwan

- /

- Tech Hardware

- /

- TWSE:3032

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

Amid a busy week of earnings and economic data, global markets have experienced some turbulence, with major U.S. indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. As investors navigate these fluctuating conditions, dividend stocks can offer stability through regular income streams, making them an attractive option for those looking to balance growth with consistent returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Globeride (TSE:7990) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

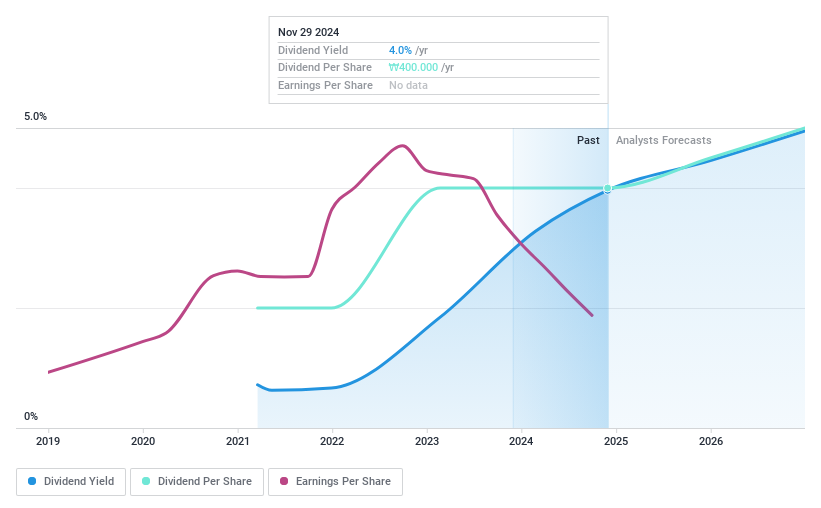

Nature Holdings (KOSDAQ:A298540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Nature Holdings Co., Ltd. is a lifestyle company with a market cap of ₩150.76 billion.

Operations: The Nature Holdings Co., Ltd. generates revenue primarily from its Apparel segment, amounting to ₩543.16 million.

Dividend Yield: 3.9%

Nature Holdings' dividend payments are well-covered, with a payout ratio of 16% and a cash payout ratio of 12.1%, indicating strong earnings and cash flow support. Despite only four years of dividend history, payments have been stable and are in the top 25% in the KR market at 3.92%. Recent share buyback plans aim to enhance shareholder value, though profit margins have decreased from last year. The stock trades significantly below its estimated fair value.

- Take a closer look at Nature Holdings' potential here in our dividend report.

- According our valuation report, there's an indication that Nature Holdings' share price might be on the cheaper side.

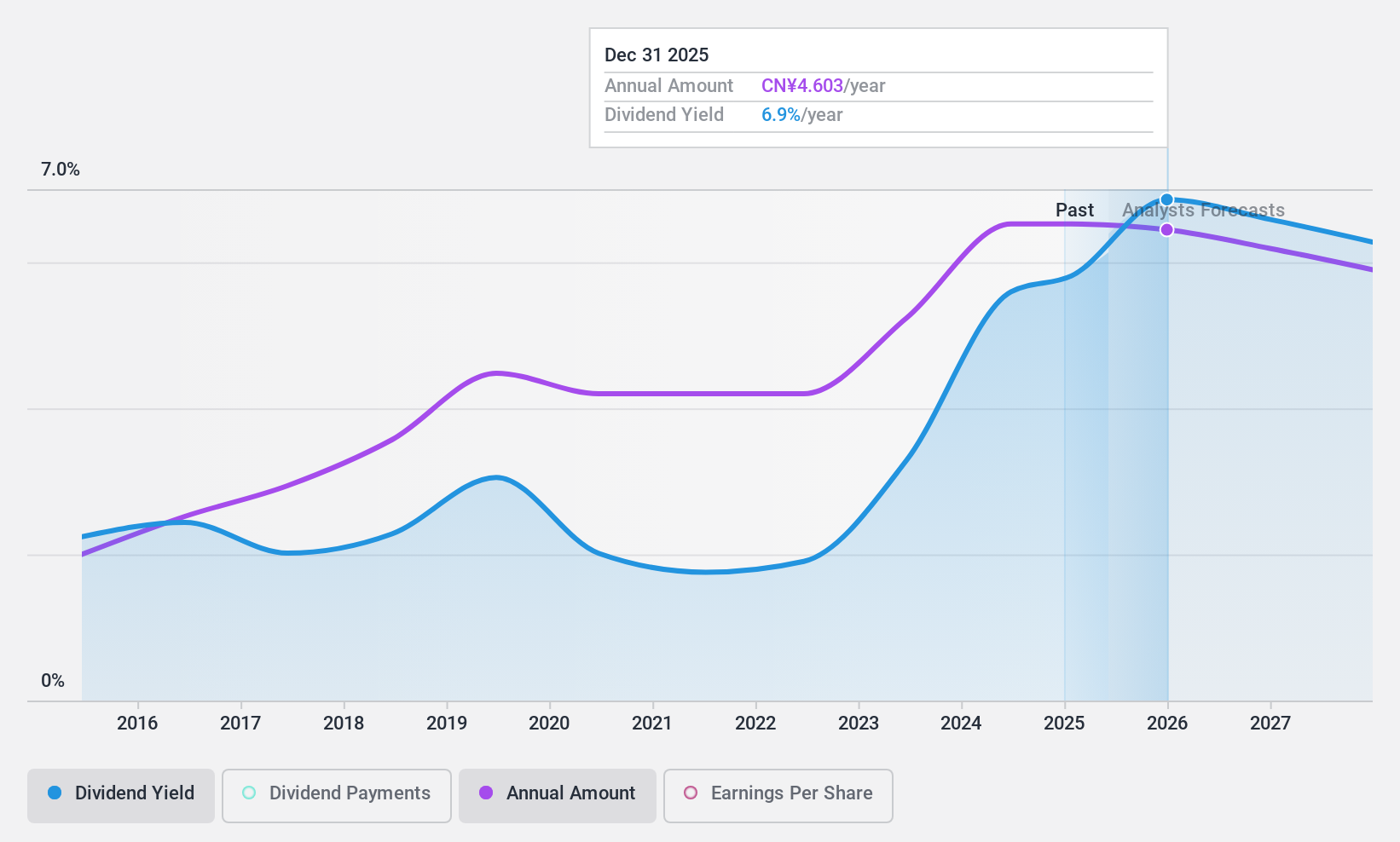

Jiangsu Yanghe Distillery (SZSE:002304)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangsu Yanghe Distillery Co., Ltd. is a company that produces liquors, wines, and spirits with a market capitalization of CN¥132.43 billion.

Operations: Jiangsu Yanghe Distillery Co., Ltd. generates its revenue primarily from the Alcohol Industry, amounting to CN¥29.72 billion.

Dividend Yield: 5.3%

Jiangsu Yanghe Distillery's dividend yield of 5.3% ranks in the top 25% of CN market payers, yet its sustainability is questionable due to a high cash payout ratio of 184.7%, indicating dividends aren't well-covered by cash flows. Despite stable and growing dividends over the past decade, recent earnings have declined, with net income dropping to CNY 8.58 billion for the nine months ending September 2024 from CNY 10.20 billion a year prior.

- Dive into the specifics of Jiangsu Yanghe Distillery here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Jiangsu Yanghe Distillery shares in the market.

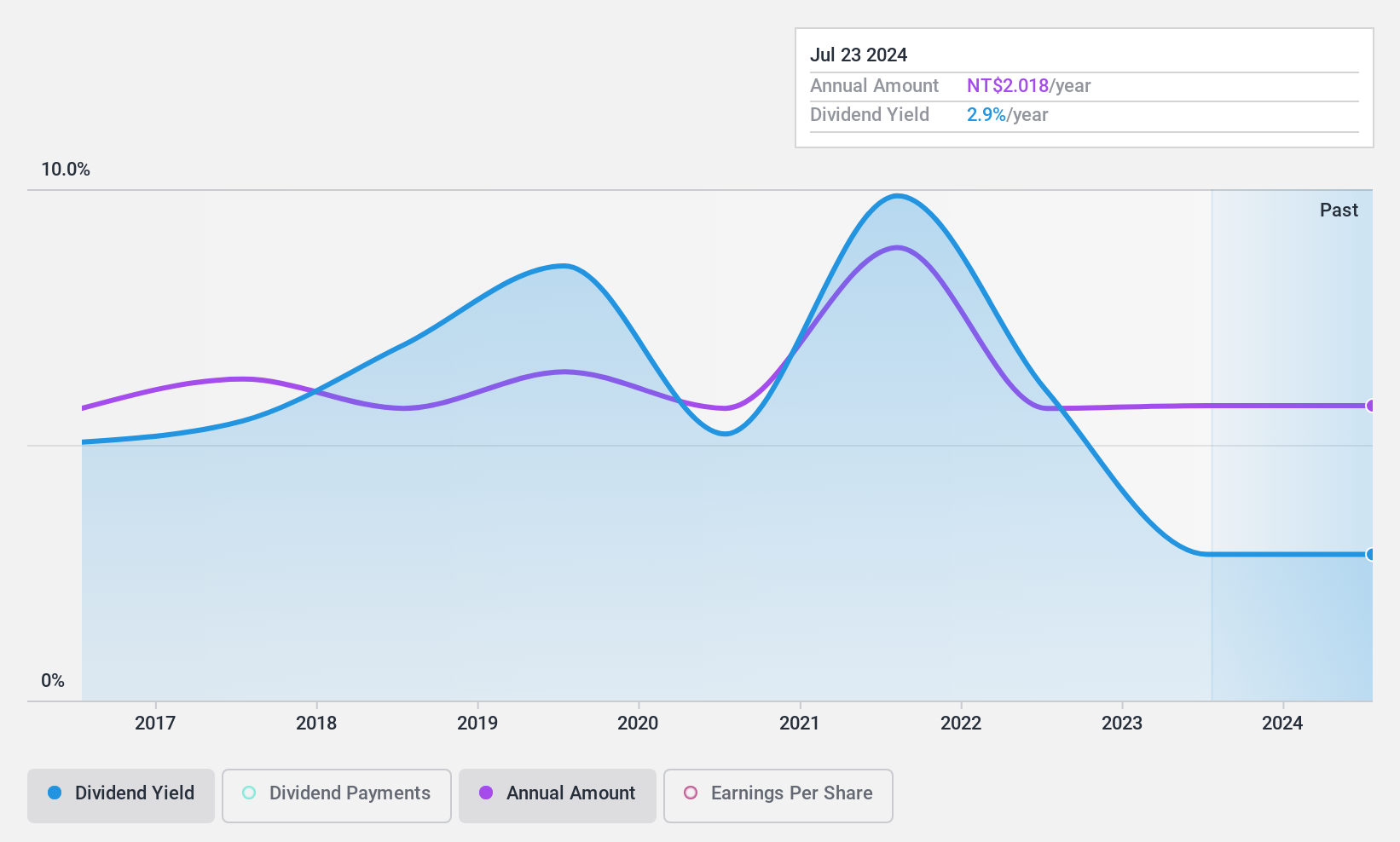

Compucase Enterprise (TWSE:3032)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compucase Enterprise Co., Ltd. designs and manufactures PC cases, power supplies, rackmount chassis, and cabinets globally, with a market capitalization of NT$7.38 billion.

Operations: Compucase Enterprise Co., Ltd. generates revenue primarily from its Operation Headquarters (NT$6.37 billion), Manufacturing (NT$5.47 billion), Server Casing Segment (NT$5.06 billion), Channel (NT$421.59 million), and Medical Equipment Segment (NT$492.61 million).

Dividend Yield: 5.3%

Compucase Enterprise's dividend yield of 5.33% places it among the top 25% in the TW market, supported by a payout ratio of 57.2% and cash payout ratio of 60.9%, suggesting dividends are well-covered by earnings and cash flows. However, despite a decade of increasing dividend payments, their reliability is questioned due to past volatility. Recent financials show declining revenue but improved net income for H1 2024 at TWD 372.44 million from TWD 290.72 million in H1 2023.

- Unlock comprehensive insights into our analysis of Compucase Enterprise stock in this dividend report.

- According our valuation report, there's an indication that Compucase Enterprise's share price might be on the expensive side.

Summing It All Up

- Embark on your investment journey to our 1960 Top Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3032

Compucase Enterprise

Designs and manufactures PC cases, power supplies, rackmount chassis, and cabinets worldwide.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives