Potential Upside For Fujian Sunner Development Co., Ltd. (SZSE:002299) Not Without Risk

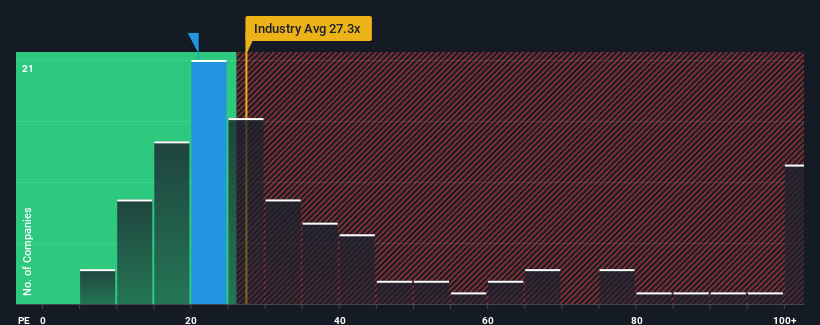

With a price-to-earnings (or "P/E") ratio of 20.9x Fujian Sunner Development Co., Ltd. (SZSE:002299) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 60x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Fujian Sunner Development as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Fujian Sunner Development

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Fujian Sunner Development would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 255% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 70% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 72% over the next year. With the market only predicted to deliver 40%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Fujian Sunner Development is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Fujian Sunner Development's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Fujian Sunner Development's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Fujian Sunner Development that you should be aware of.

If you're unsure about the strength of Fujian Sunner Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002299

Fujian Sunner Development

Engages in breeding, slaughtering, processing, and selling of chicken products in China.

Undervalued with proven track record.

Market Insights

Community Narratives