Here's What To Make Of GDH Supertime Group's (SZSE:001338) Decelerating Rates Of Return

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. However, after briefly looking over the numbers, we don't think GDH Supertime Group (SZSE:001338) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on GDH Supertime Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

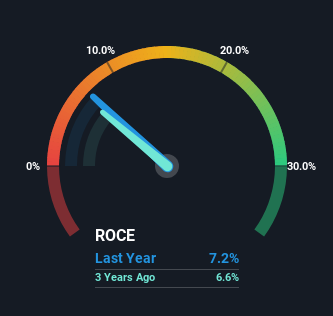

0.072 = CN¥255m ÷ (CN¥4.3b - CN¥795m) (Based on the trailing twelve months to September 2024).

So, GDH Supertime Group has an ROCE of 7.2%. In absolute terms, that's a low return and it also under-performs the Beverage industry average of 18%.

See our latest analysis for GDH Supertime Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how GDH Supertime Group has performed in the past in other metrics, you can view this free graph of GDH Supertime Group's past earnings, revenue and cash flow.

How Are Returns Trending?

There are better returns on capital out there than what we're seeing at GDH Supertime Group. The company has employed 78% more capital in the last five years, and the returns on that capital have remained stable at 7.2%. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

Our Take On GDH Supertime Group's ROCE

As we've seen above, GDH Supertime Group's returns on capital haven't increased but it is reinvesting in the business. And investors appear hesitant that the trends will pick up because the stock has fallen 11% in the last year. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere.

While GDH Supertime Group doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation for 001338 on our platform.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001338

GDH Supertime Group

Engages in the development, production, and sale of malt to beer manufacturers in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives