Beijing Shunxin Agriculture Co.,Ltd's (SZSE:000860) Shares Lagging The Industry But So Is The Business

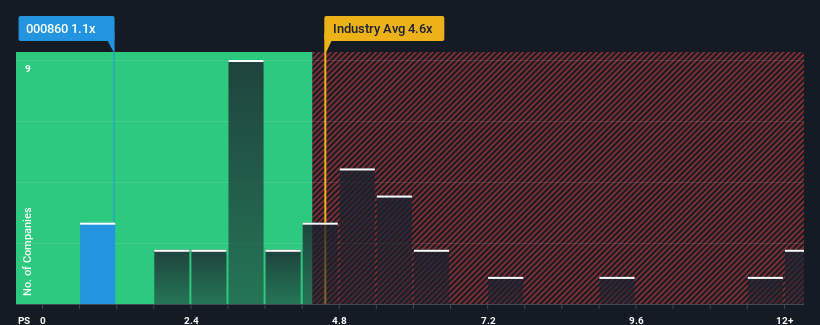

When you see that almost half of the companies in the Beverage industry in China have price-to-sales ratios (or "P/S") above 4.6x, Beijing Shunxin Agriculture Co.,Ltd (SZSE:000860) looks to be giving off very strong buy signals with its 1.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Beijing Shunxin AgricultureLtd

What Does Beijing Shunxin AgricultureLtd's Recent Performance Look Like?

Beijing Shunxin AgricultureLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Beijing Shunxin AgricultureLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Beijing Shunxin AgricultureLtd?

The only time you'd be truly comfortable seeing a P/S as depressed as Beijing Shunxin AgricultureLtd's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. As a result, revenue from three years ago have also fallen 32% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 6.3% over the next year. That's shaping up to be materially lower than the 16% growth forecast for the broader industry.

With this in consideration, its clear as to why Beijing Shunxin AgricultureLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Beijing Shunxin AgricultureLtd's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Beijing Shunxin AgricultureLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Beijing Shunxin AgricultureLtd with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Shunxin AgricultureLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000860

Beijing Shunxin AgricultureLtd

Primarily engages in the brewing and sale of liquor products under the Niu Lanshan and Ningcheng brands.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives