Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, XIANGPIAOPIAO Food Co.,Ltd (SHSE:603711) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for XIANGPIAOPIAO FoodLtd

What Is XIANGPIAOPIAO FoodLtd's Net Debt?

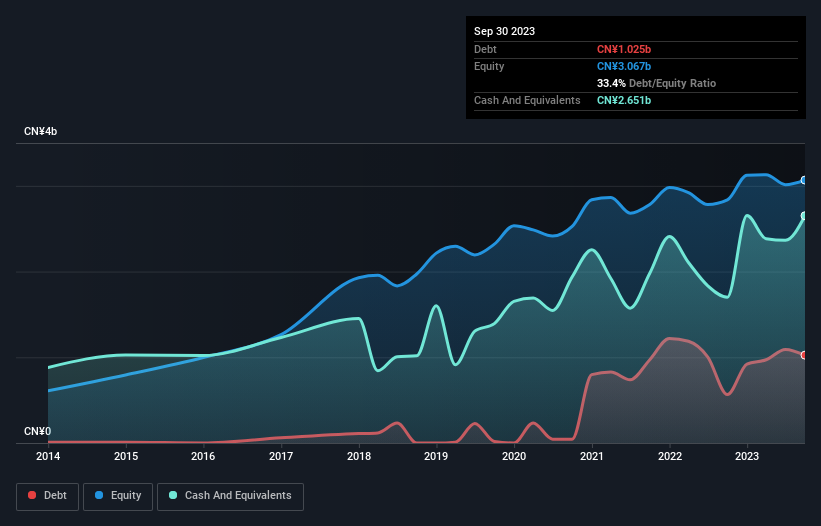

As you can see below, at the end of September 2023, XIANGPIAOPIAO FoodLtd had CN¥1.03b of debt, up from CN¥565.0m a year ago. Click the image for more detail. But it also has CN¥2.65b in cash to offset that, meaning it has CN¥1.63b net cash.

How Strong Is XIANGPIAOPIAO FoodLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that XIANGPIAOPIAO FoodLtd had liabilities of CN¥1.79b due within 12 months and liabilities of CN¥101.6m due beyond that. On the other hand, it had cash of CN¥2.65b and CN¥33.2m worth of receivables due within a year. So it actually has CN¥794.6m more liquid assets than total liabilities.

This surplus suggests that XIANGPIAOPIAO FoodLtd has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that XIANGPIAOPIAO FoodLtd has more cash than debt is arguably a good indication that it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, XIANGPIAOPIAO FoodLtd turned things around in the last 12 months, delivering and EBIT of CN¥229m. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if XIANGPIAOPIAO FoodLtd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. XIANGPIAOPIAO FoodLtd may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last year, XIANGPIAOPIAO FoodLtd actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that XIANGPIAOPIAO FoodLtd has net cash of CN¥1.63b, as well as more liquid assets than liabilities. The cherry on top was that in converted 184% of that EBIT to free cash flow, bringing in CN¥420m. So is XIANGPIAOPIAO FoodLtd's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for XIANGPIAOPIAO FoodLtd that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603711

XIANGPIAOPIAO FoodLtd

Researches, develops, produces, and sells milk tea products in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives