Anji Foodstuff (SHSE:603696) Is Posting Promising Earnings But The Good News Doesn’t Stop There

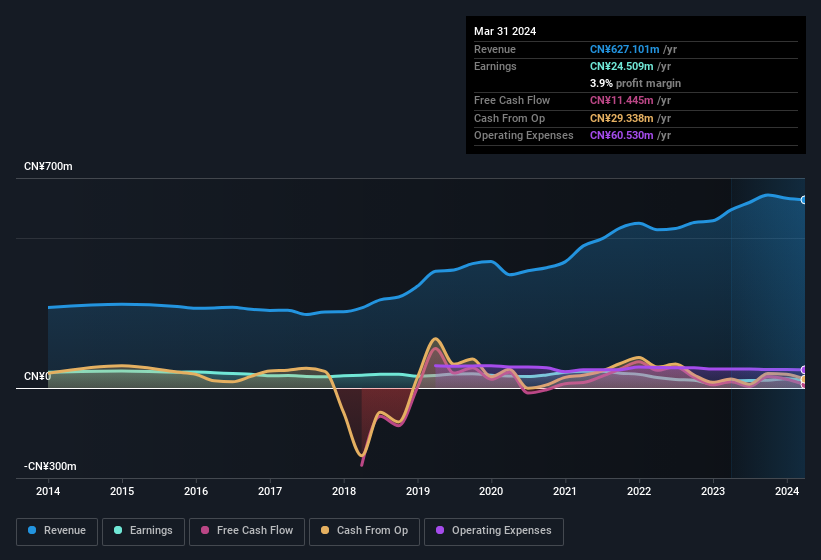

Anji Foodstuff Co., Ltd's (SHSE:603696) solid earnings announcement recently didn't do much to the stock price. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

View our latest analysis for Anji Foodstuff

The Power Of Non-Operating Revenue

Companies will classify their revenue streams as either operating revenue or other revenue. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, Anji Foodstuff had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from CN¥332.0m last year to CN¥377.9m this year. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Anji Foodstuff.

The Impact Of Unusual Items On Profit

On top of the non-operating revenue spike, we should also consider the CN¥15m impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect Anji Foodstuff to produce a higher profit next year, all else being equal.

Our Take On Anji Foodstuff's Profit Performance

In its last report Anji Foodstuff benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may be no more sustainable than low quality coal mining. But on the other hand, it also saw an unusual item depress its profit, suggesting the statutory profit number will actually improve next year, if the unusual expenses are not repeated, and all else stays equal. Based on these factors, we think that Anji Foodstuff's profits are a reasonably conservative guide to its underlying profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. When we did our research, we found 3 warning signs for Anji Foodstuff (1 is potentially serious!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603696

Anji Foodstuff

Engages in the research and development, production, and sale of condiments in China and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives