The Price Is Right For Leshan Giantstar Farming&Husbandry Corporation Limited (SHSE:603477) Even After Diving 28%

Unfortunately for some shareholders, the Leshan Giantstar Farming&Husbandry Corporation Limited (SHSE:603477) share price has dived 28% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

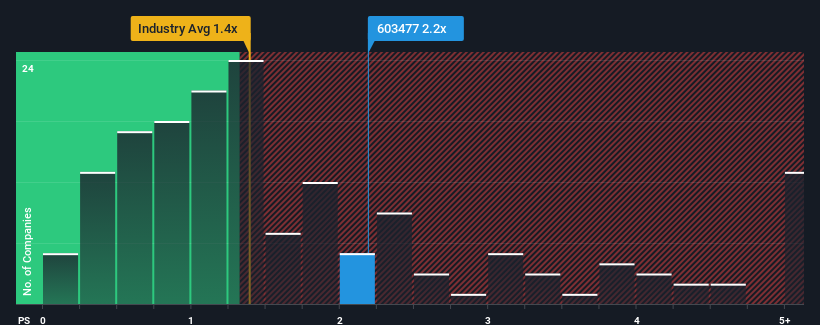

In spite of the heavy fall in price, you could still be forgiven for thinking Leshan Giantstar Farming&Husbandry is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in China's Food industry have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Leshan Giantstar Farming&Husbandry

How Leshan Giantstar Farming&Husbandry Has Been Performing

Leshan Giantstar Farming&Husbandry could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Leshan Giantstar Farming&Husbandry will help you uncover what's on the horizon.How Is Leshan Giantstar Farming&Husbandry's Revenue Growth Trending?

In order to justify its P/S ratio, Leshan Giantstar Farming&Husbandry would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 97% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 85% during the coming year according to the five analysts following the company. With the industry only predicted to deliver 17%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Leshan Giantstar Farming&Husbandry's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

There's still some elevation in Leshan Giantstar Farming&Husbandry's P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Leshan Giantstar Farming&Husbandry shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Leshan Giantstar Farming&Husbandry is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603477

Leshan Giantstar Farming&Husbandry

Engages in livestock and poultry breeding in China.

Fair value with acceptable track record.

Market Insights

Community Narratives