Fujian Aonong Biological Technology Group Incorporation Limited's (SHSE:603363) Shares Not Telling The Full Story

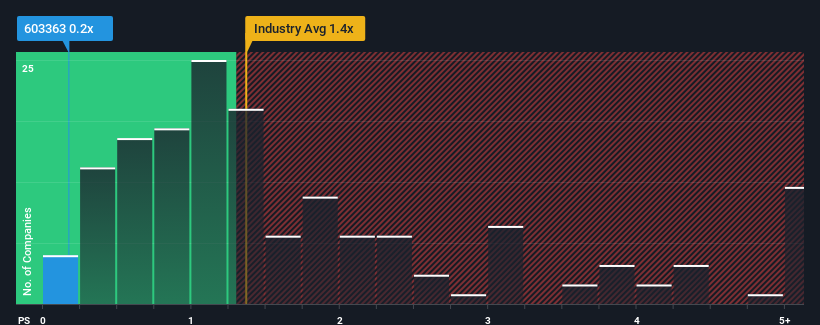

When you see that almost half of the companies in the Food industry in China have price-to-sales ratios (or "P/S") above 1.4x, Fujian Aonong Biological Technology Group Incorporation Limited (SHSE:603363) looks to be giving off some buy signals with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Fujian Aonong Biological Technology Group Incorporation

What Does Fujian Aonong Biological Technology Group Incorporation's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Fujian Aonong Biological Technology Group Incorporation's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Fujian Aonong Biological Technology Group Incorporation's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Fujian Aonong Biological Technology Group Incorporation would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. Regardless, revenue has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 91% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 17%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Fujian Aonong Biological Technology Group Incorporation's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Fujian Aonong Biological Technology Group Incorporation's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Fujian Aonong Biological Technology Group Incorporation's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 1 warning sign for Fujian Aonong Biological Technology Group Incorporation you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603363

Fujian Aonong Biological Technology Group Incorporation

Engages in the feed, pig raising, food, supply chain services, agricultural internet, bio-pharmaceutical, and other businesses in China and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives