- China

- /

- Construction

- /

- SZSE:002551

Undervalued Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

Global markets have recently experienced a surge, with U.S. stock indexes climbing toward record highs and the Nasdaq Composite leading the way. As investors navigate these buoyant conditions, many are considering opportunities beyond traditional large-cap stocks. Penny stocks, often representing smaller or newer companies, can offer intriguing growth potential at lower price points. In this article, we explore three penny stocks that exhibit strong financial health and present compelling opportunities for investors seeking diversification in their portfolios.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.835 | MYR277.17M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,669 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Arbona (NGM:ARBO A)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arbona AB (publ) is an investment company focusing on small and medium-sized listed and unlisted companies in Sweden, with a market cap of SEK1.74 billion.

Operations: The company generates revenue of SEK218.13 million from its operations in Sweden.

Market Cap: SEK1.74B

Arbona AB, with a market cap of SEK1.74 billion and revenue of SEK218.13 million, offers an intriguing profile for penny stock investors. The company's Price-To-Earnings ratio of 4.2x is significantly below the Swedish market average, suggesting potential undervaluation. Earnings growth has been robust at 201.3% over the past year, outperforming both its historical average and industry peers in the Diversified Financial sector. Despite lower net profit margins compared to last year, Arbona's financial health appears sound with more cash than total debt and short-term assets exceeding liabilities, reducing concerns about liquidity or solvency risks.

- Dive into the specifics of Arbona here with our thorough balance sheet health report.

- Assess Arbona's previous results with our detailed historical performance reports.

Fortune Ng Fung Food (Hebei)Ltd (SHSE:600965)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fortune Ng Fung Food (Hebei) Co., Ltd operates in beef cattle breeding, slaughtering, and food processing both within China and internationally, with a market cap of CN¥3.55 billion.

Operations: No specific revenue segments are reported for Fortune Ng Fung Food (Hebei) Co., Ltd.

Market Cap: CN¥3.55B

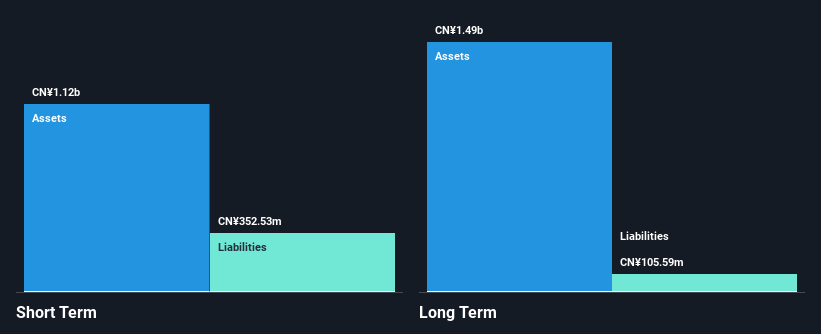

Fortune Ng Fung Food (Hebei) Co., Ltd, with a market cap of CN¥3.55 billion, presents a mixed picture for penny stock investors. The company is unprofitable and has seen losses increase by 21.5% annually over the past five years. Despite this, it maintains financial stability with more cash than total debt and short-term assets exceeding both short- and long-term liabilities. Its board of directors is experienced, averaging 3.8 years in tenure, which may provide strategic stability amidst high share price volatility and recent exclusion from the S&P Global BMI Index due to performance challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Fortune Ng Fung Food (Hebei)Ltd.

- Understand Fortune Ng Fung Food (Hebei)Ltd's track record by examining our performance history report.

Shenzhen Glory MedicalLtd (SZSE:002551)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Glory Medical Co., Ltd. offers hospital construction and medical system integrated solutions both in China and internationally, with a market cap of CN¥2.94 billion.

Operations: Shenzhen Glory Medical Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.94B

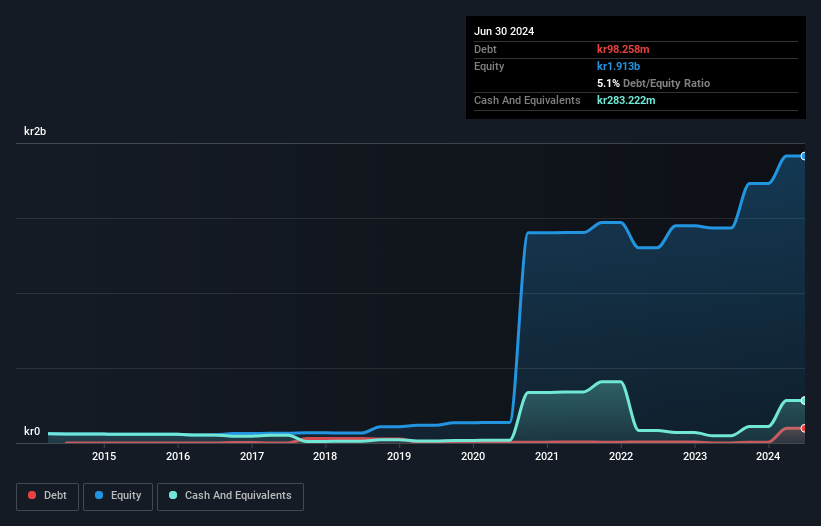

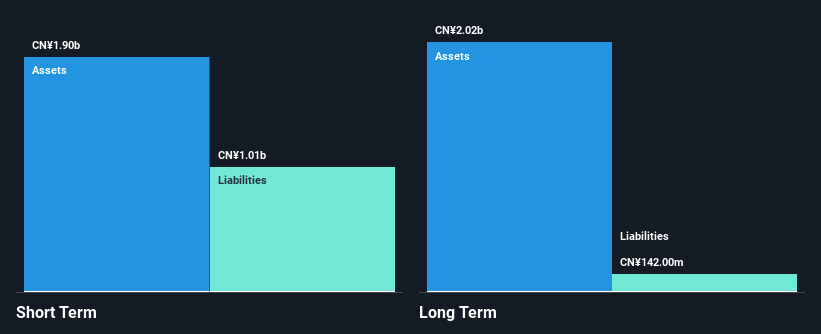

Shenzhen Glory Medical Co., Ltd. has a market cap of CN¥2.94 billion and is currently unprofitable, with earnings declining significantly over the past five years. Despite this, the company maintains financial stability, having reduced its debt to equity ratio from 33.1% to 10.2% in five years and holding more cash than total debt. Its short-term assets of CN¥1.9 billion comfortably cover both short- and long-term liabilities, indicating strong liquidity management amidst high weekly volatility at 7%. The lack of significant revenue streams suggests it might be pre-revenue, presenting both potential opportunities and risks for investors in penny stocks.

- Click to explore a detailed breakdown of our findings in Shenzhen Glory MedicalLtd's financial health report.

- Gain insights into Shenzhen Glory MedicalLtd's past trends and performance with our report on the company's historical track record.

Where To Now?

- Gain an insight into the universe of 5,669 Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002551

Shenzhen Glory MedicalLtd

Provides hospital construction and medical system integrated solutions in China and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives