Fortune Ng Fung Food (Hebei) Co.,Ltd's (SHSE:600965) Shareholders Might Be Looking For Exit

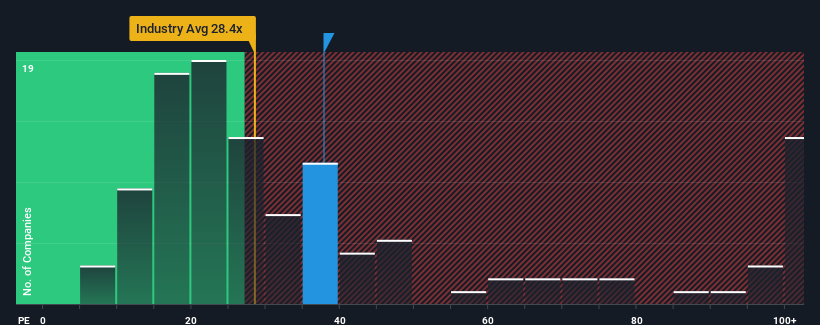

With a price-to-earnings (or "P/E") ratio of 37.8x Fortune Ng Fung Food (Hebei) Co.,Ltd (SHSE:600965) may be sending bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 30x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Fortune Ng Fung Food (Hebei)Ltd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Fortune Ng Fung Food (Hebei)Ltd

How Is Fortune Ng Fung Food (Hebei)Ltd's Growth Trending?

In order to justify its P/E ratio, Fortune Ng Fung Food (Hebei)Ltd would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. The last three years don't look nice either as the company has shrunk EPS by 19% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Fortune Ng Fung Food (Hebei)Ltd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Fortune Ng Fung Food (Hebei)Ltd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Fortune Ng Fung Food (Hebei)Ltd you should be aware of, and 2 of them make us uncomfortable.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600965

Fortune Ng Fung Food (Hebei)Ltd

Engages in the beef cattle breeding and slaughtering, and food processing businesses in the People’s Republic of China and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives