As global markets navigate a landscape marked by accelerating U.S. inflation and rising stock indexes, investors are keeping a close eye on dividend stocks as a potential source of stability and income. In this environment, selecting stocks with strong fundamentals and consistent dividend payouts can be an effective strategy for those looking to balance growth with income generation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.94% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1986 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

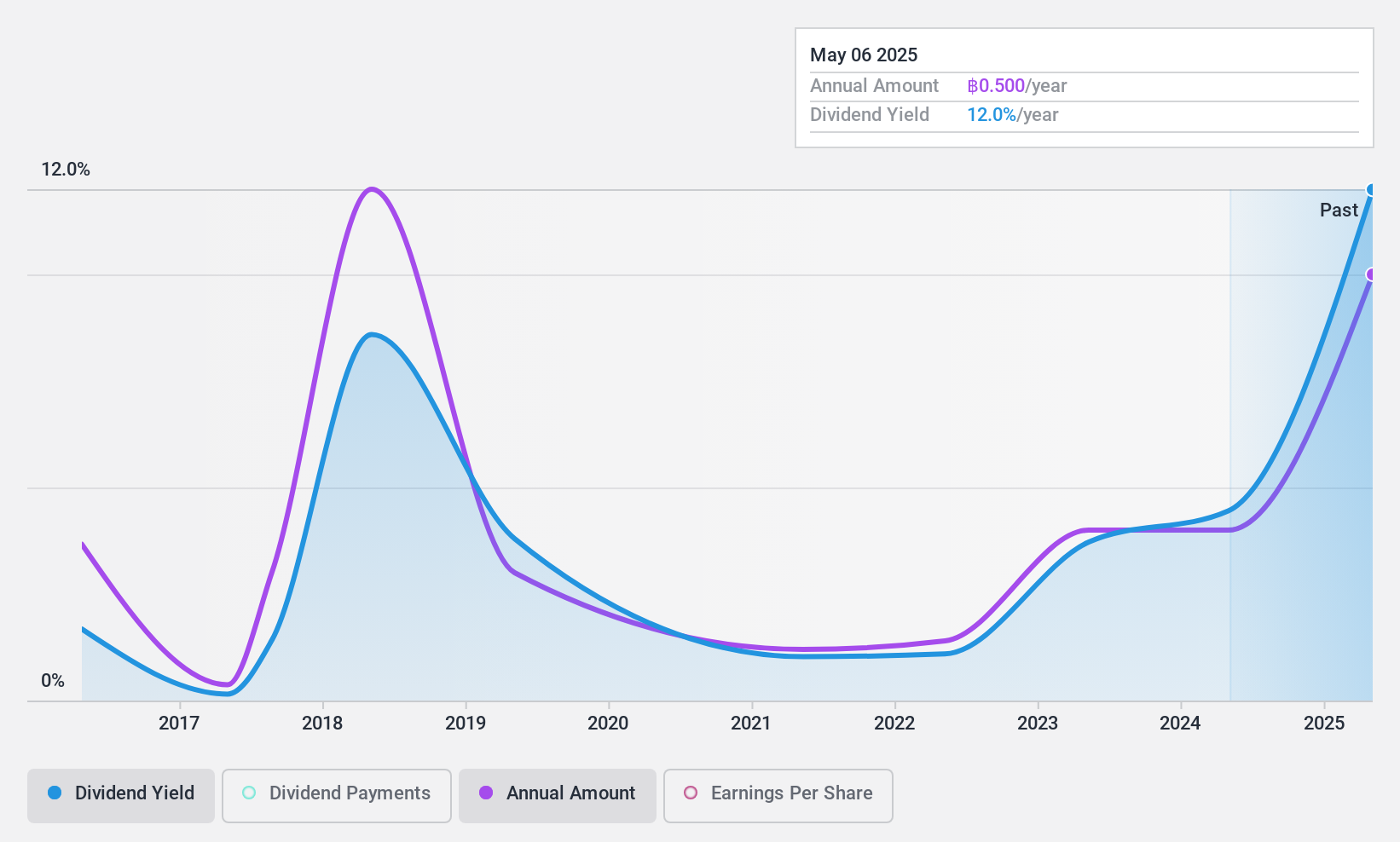

Buriram Sugar (SET:BRR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Buriram Sugar Public Company Limited, along with its subsidiaries, is involved in the production and distribution of sugar and molasses both in Thailand and internationally, with a market cap of THB3.46 billion.

Operations: Buriram Sugar Public Company Limited generates revenue primarily from the production and distribution of sugar and molasses (THB6.18 billion), followed by the distribution of agricultural products (THB1.06 billion) and the production and distribution of electricity and steam (THB851 million).

Dividend Yield: 4.6%

Buriram Sugar's dividend payments are well covered by earnings and cash flows, with payout ratios of 13.4% and 27.9%, respectively, indicating sustainability. However, dividends have been volatile over the past decade and are considered unreliable despite some growth. The current yield is relatively low at 4.61% compared to top-tier Thai dividend payers. While trading below estimated fair value, high debt levels may concern investors seeking stable income streams from dividends.

- Take a closer look at Buriram Sugar's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Buriram Sugar is trading behind its estimated value.

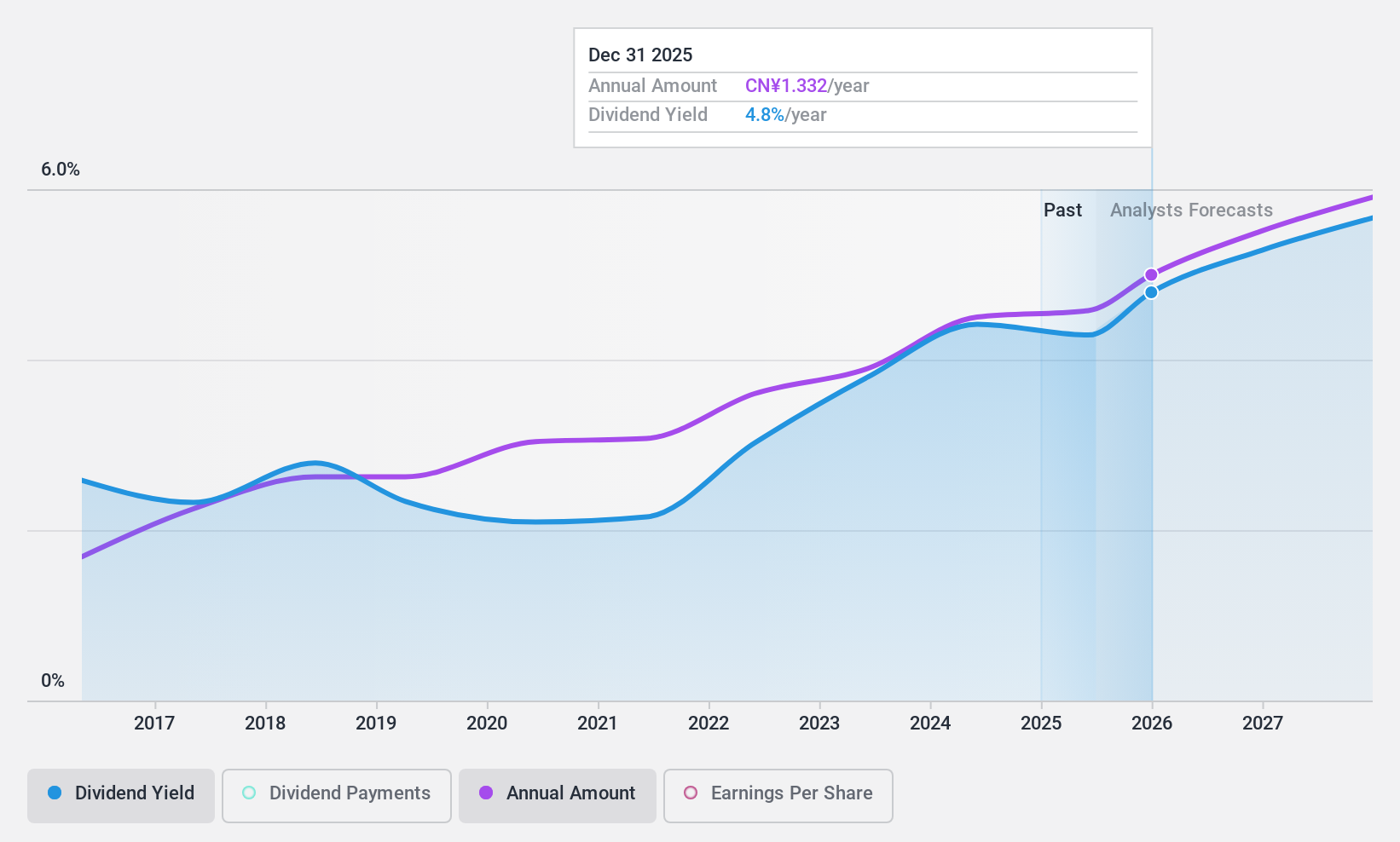

Inner Mongolia Yili Industrial Group (SHSE:600887)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Inner Mongolia Yili Industrial Group Co., Ltd. is a leading dairy producer in China with operations spanning the production and distribution of milk, yogurt, and other dairy products, boasting a market cap of approximately CN¥172.92 billion.

Operations: Inner Mongolia Yili Industrial Group's revenue is primarily derived from its diverse range of dairy products, including milk and yogurt.

Dividend Yield: 4.3%

Inner Mongolia Yili Industrial Group offers a stable dividend profile with payments well-covered by earnings and cash flows, boasting payout ratios of 63.8% and 49.5%, respectively. Dividends have consistently grown over the past decade, providing reliability for investors. The current yield is attractive at 4.27%, placing it among the top dividend payers in China. Despite trading at a discount to its estimated fair value, recent buyback activity has been minimal, potentially impacting future capital allocation strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Inner Mongolia Yili Industrial Group.

- Insights from our recent valuation report point to the potential undervaluation of Inner Mongolia Yili Industrial Group shares in the market.

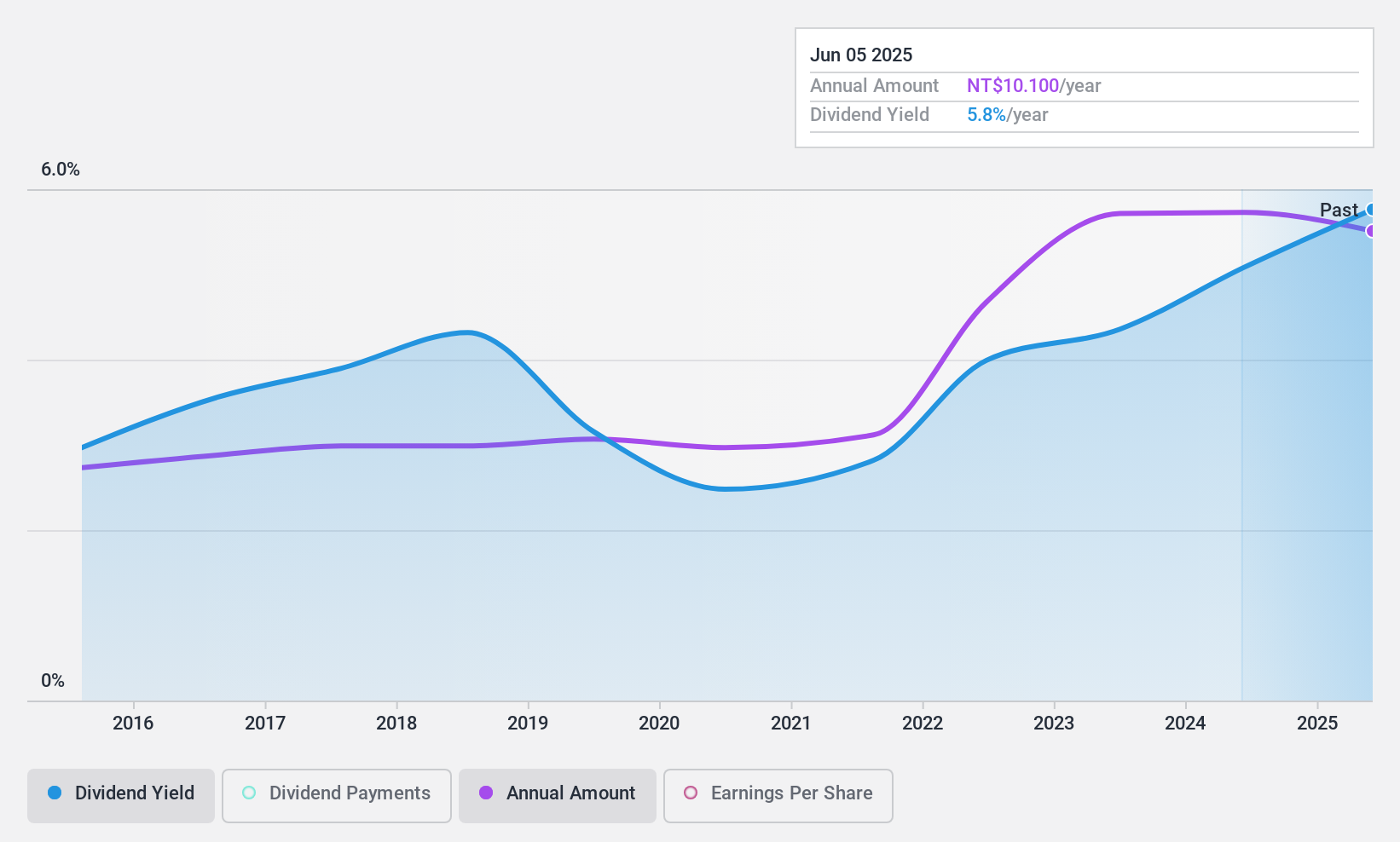

Sporton International (TPEX:6146)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sporton International Inc. offers product testing and certification services both in Taiwan and internationally, with a market cap of NT$21.19 billion.

Operations: Sporton International Inc. generates revenue primarily from its testing certification and verification services, which account for NT$4.15 billion, alongside its parts division contributing NT$438.77 million.

Dividend Yield: 5%

Sporton International offers an attractive dividend yield of 5.04%, placing it in the top 25% of Taiwan's dividend payers. However, its dividends are not well-covered by free cash flows, with a cash payout ratio of 108.2%. While earnings cover the current payout ratio at 83.7%, sustainability concerns persist due to insufficient cash flow coverage. Despite this, Sporton has maintained stable and reliable dividend growth over the past decade, supported by a favorable price-to-earnings ratio of 16.6x compared to the market average.

- Click here to discover the nuances of Sporton International with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Sporton International shares in the market.

Summing It All Up

- Discover the full array of 1986 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buriram Sugar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:BRR

Buriram Sugar

Engages in the manufacture and distribution of sugar and molasses in Thailand and internationally.

Slight risk and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.