- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3010

3 Prominent Dividend Stocks With Up To 5.6% Yield

Reviewed by Simply Wall St

In the wake of recent U.S. elections, global markets have experienced significant shifts, with major indices like the S&P 500 reaching record highs as investors anticipate favorable economic policies. Amidst this backdrop of optimism and market volatility, dividend stocks remain a compelling option for investors seeking steady income streams and potential stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.02% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Innotech (TSE:9880) | 5.04% | ★★★★★★ |

Click here to see the full list of 1930 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

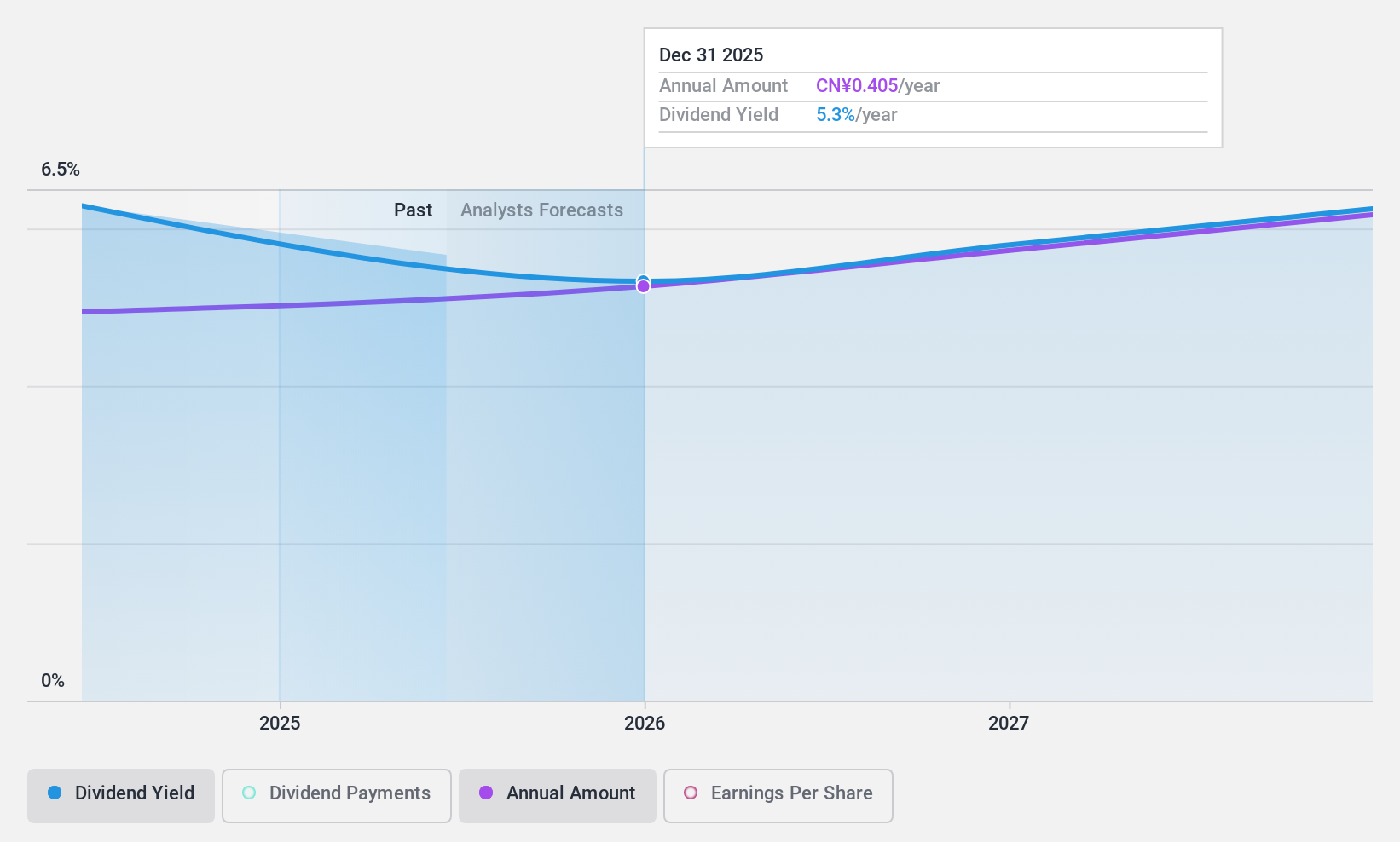

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong manufactures and sells pharmaceutical raw materials, as well as food and feed additives under the Star Lake and Yue Bao brands in China and internationally, with a market cap of CN¥11.17 billion.

Operations: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong generates revenue through its pharmaceutical raw materials and food and feed additives segments.

Dividend Yield: 5.7%

Star Lake Bioscience's dividend yield of 5.65% ranks it among the top 25% of dividend payers in China, supported by a reasonable payout ratio of 72.9% and a low cash payout ratio of 38.3%, indicating sustainability from both earnings and cash flows. Although dividends are newly initiated, making their reliability uncertain, the stock is trading at good value—75.7% below its estimated fair value—while earnings have shown strong growth recently with net income rising to CNY 677.22 million for the first nine months of 2024 from CNY 489.4 million a year ago.

- Get an in-depth perspective on Star Lake BioscienceZhaoqing Guangdong's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Star Lake BioscienceZhaoqing Guangdong's current price could be quite moderate.

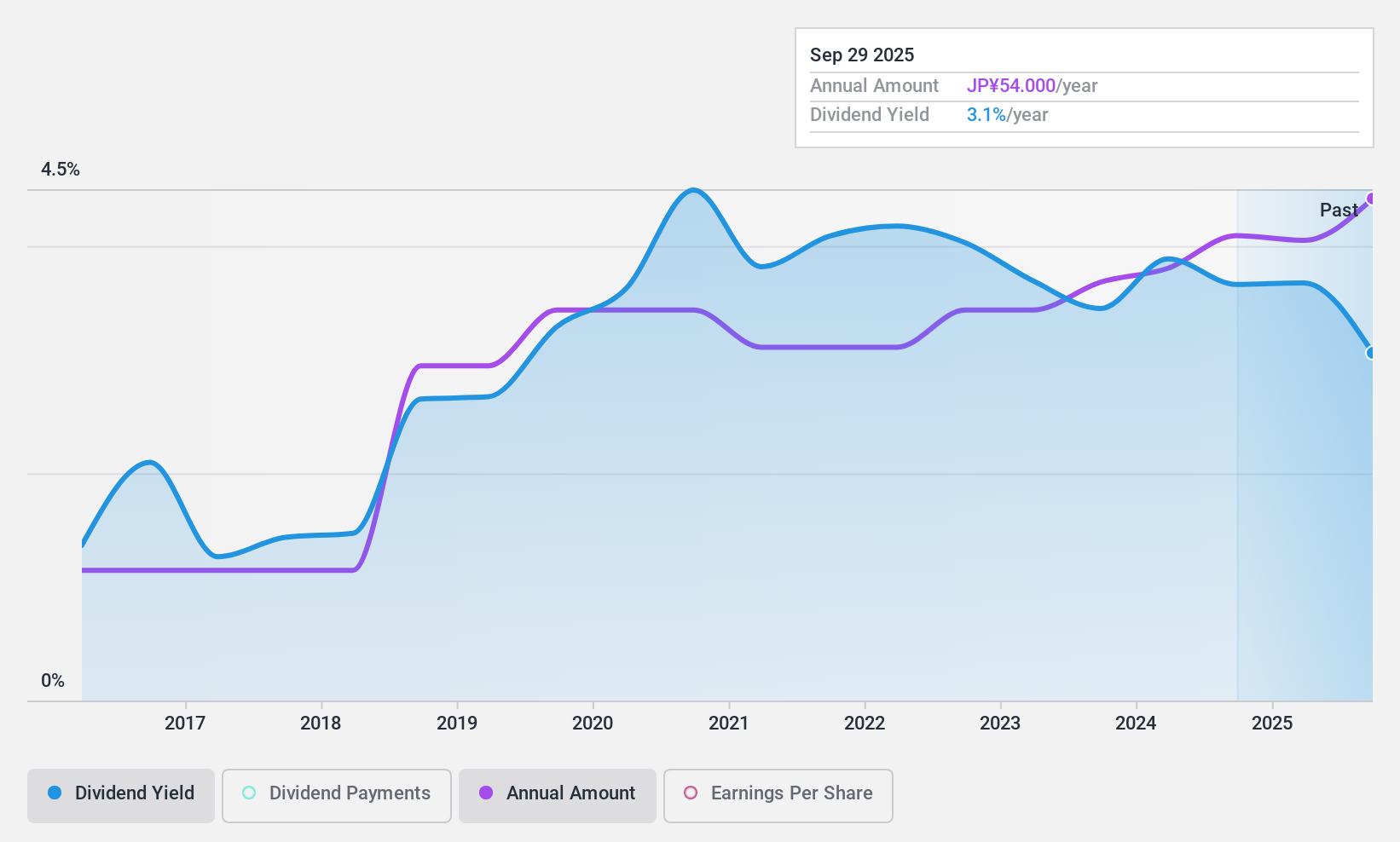

ShinMaywa Industries (TSE:7224)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ShinMaywa Industries, Ltd., along with its subsidiaries, manufactures and sells transportation equipment across Japan, Asia, North America, and internationally with a market cap of ¥90.48 billion.

Operations: ShinMaywa Industries, Ltd.'s revenue is primarily derived from its Specially Equipped Vehicle segment at ¥104.25 billion, followed by the Parking System at ¥44.04 billion, Industrial Machinery / Environmental System at ¥40.21 billion, Aircraft at ¥32.77 billion, and Fluid segment contributing ¥27.24 billion.

Dividend Yield: 3.6%

ShinMaywa Industries' dividend payments have been volatile over the past decade, lacking consistent growth. However, with a payout ratio of 43.7% and a cash payout ratio of 11.5%, dividends are well covered by both earnings and cash flows, indicating potential sustainability despite past instability. The stock trades at a significant discount to its estimated fair value, suggesting it may be undervalued in the market. Its dividend yield is slightly below Japan's top-tier payers at 3.62%.

- Click here and access our complete dividend analysis report to understand the dynamics of ShinMaywa Industries.

- Our comprehensive valuation report raises the possibility that ShinMaywa Industries is priced lower than what may be justified by its financials.

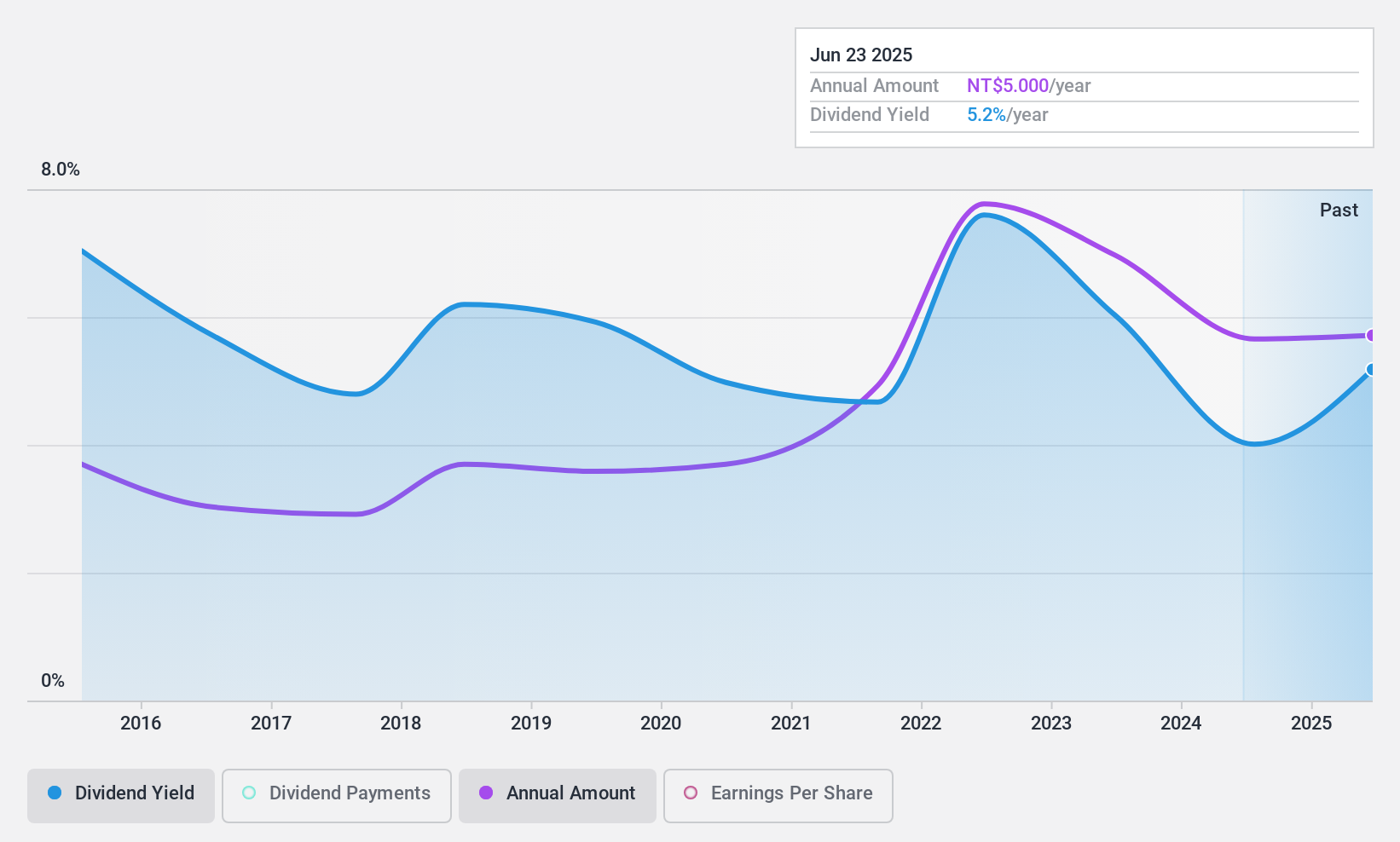

Wah Lee Industrial (TWSE:3010)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Lee Industrial Corporation operates in Taiwan, focusing on manufacturing materials, engineering and functional plastics, semiconductor process materials, and printed circuit boards, with a market cap of NT$32.55 billion.

Operations: Wah Lee Industrial Corporation's revenue segments include contributions of NT$44.12 billion from The Company, NT$13.20 billion from Huagang Company, and NT$14.17 billion from Shanghai Yikang.

Dividend Yield: 3.9%

Wah Lee Industrial's dividend payments have been stable and growing over the past decade, supported by a reasonable payout ratio of 55.6%. However, the dividends are not well covered by free cash flows, raising sustainability concerns. The stock's price-to-earnings ratio of 15.1x is attractive compared to the broader TW market. Despite recent shareholder dilution and a dividend yield below top-tier payers at 3.94%, Wah Lee maintains reliable dividend payments with little volatility.

- Click here to discover the nuances of Wah Lee Industrial with our detailed analytical dividend report.

- Our valuation report unveils the possibility Wah Lee Industrial's shares may be trading at a premium.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1930 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wah Lee Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3010

Wah Lee Industrial

Engages in the manufacturing of materials, engineering and functional plastics, semiconductor process materials, and printed circuit boards in Taiwan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives