Optimistic Investors Push Wanxiang Doneed Co., ltd (SHSE:600371) Shares Up 25% But Growth Is Lacking

Wanxiang Doneed Co., ltd (SHSE:600371) shares have continued their recent momentum with a 25% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

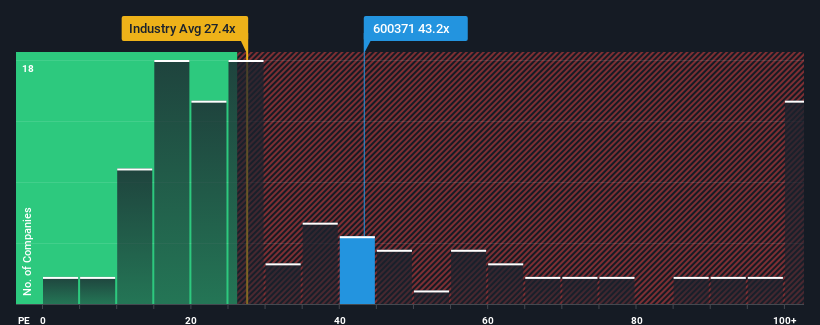

After such a large jump in price, Wanxiang Doneed may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 43.2x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For instance, Wanxiang Doneed's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Wanxiang Doneed

Is There Enough Growth For Wanxiang Doneed?

The only time you'd be truly comfortable seeing a P/E as high as Wanxiang Doneed's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.8%. Even so, admirably EPS has lifted 67% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Wanxiang Doneed's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Wanxiang Doneed shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Wanxiang Doneed currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Wanxiang Doneed has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Wanxiang Doneed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600371

Wanxiang Doneed

Through its subsidiary, engages in the scientific research, development, production, and sale of corn hybrid seeds primarily in China.

Flawless balance sheet second-rate dividend payer.