Jiangsu Hengshun Vinegar-Industry Co.,Ltd's (SHSE:600305) Share Price Not Quite Adding Up

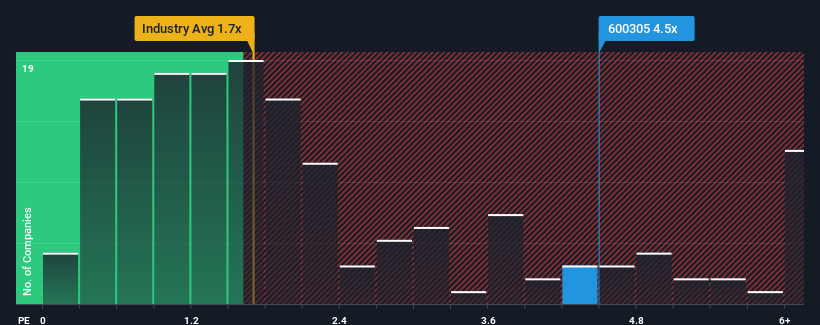

Jiangsu Hengshun Vinegar-Industry Co.,Ltd's (SHSE:600305) price-to-sales (or "P/S") ratio of 4.5x may look like a poor investment opportunity when you consider close to half the companies in the Food industry in China have P/S ratios below 1.7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Jiangsu Hengshun Vinegar-IndustryLtd

How Has Jiangsu Hengshun Vinegar-IndustryLtd Performed Recently?

Jiangsu Hengshun Vinegar-IndustryLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Jiangsu Hengshun Vinegar-IndustryLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Hengshun Vinegar-IndustryLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 5.9% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 16% over the next year. That's shaping up to be materially lower than the 18% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Jiangsu Hengshun Vinegar-IndustryLtd's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Jiangsu Hengshun Vinegar-IndustryLtd currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Jiangsu Hengshun Vinegar-IndustryLtd (1 is potentially serious!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600305

Jiangsu Hengshun Vinegar-IndustryLtd

Produces and sells vinegar products in China.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives