Xinjiang Yilite Industry Co.,Ltd's (SHSE:600197) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Xinjiang Yilite Industry Co.,Ltd (SHSE:600197) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

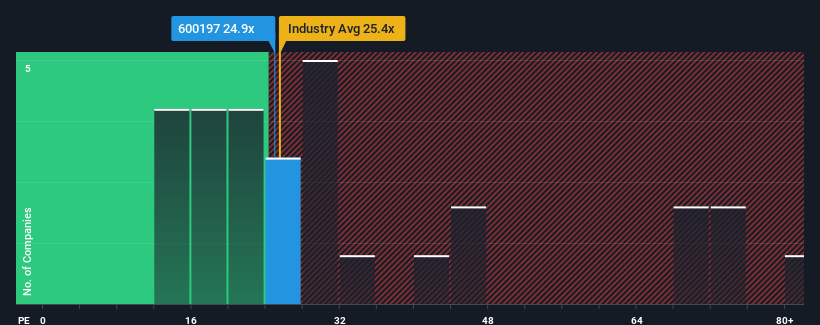

In spite of the firm bounce in price, Xinjiang Yilite IndustryLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 24.9x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 58x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Xinjiang Yilite IndustryLtd as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Xinjiang Yilite IndustryLtd

Does Growth Match The Low P/E?

Xinjiang Yilite IndustryLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 70%. However, this wasn't enough as the latest three year period has seen a very unpleasant 15% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the six analysts following the company. With the market predicted to deliver 19% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Xinjiang Yilite IndustryLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Xinjiang Yilite IndustryLtd's P/E?

Xinjiang Yilite IndustryLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Xinjiang Yilite IndustryLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Xinjiang Yilite IndustryLtd has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600197

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives