Concerns Surrounding CITIC Niya Wine's (SHSE:600084) Performance

The recent earnings posted by CITIC Niya Wine Co., Ltd. (SHSE:600084) were solid, but the stock didn't move as much as we expected. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

An Unusual Tax Situation

CITIC Niya Wine reported a tax benefit of CN¥4.1m, which is well worth noting. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of CITIC Niya Wine.

Our Take On CITIC Niya Wine's Profit Performance

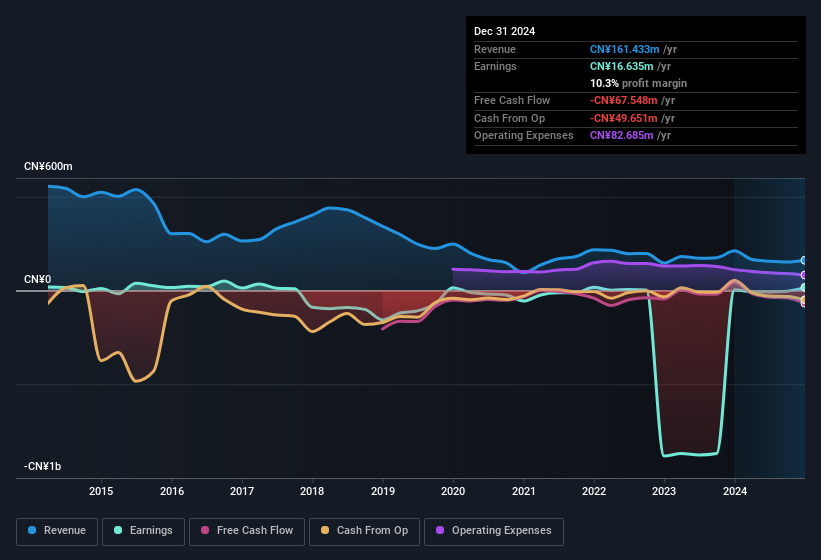

CITIC Niya Wine reported that it received a tax benefit, rather than paid tax, in its last report. Given that sort of benefit is not recurring, a focus on the statutory profit might make the company seem better than it really is. Therefore, it seems possible to us that CITIC Niya Wine's true underlying earnings power is actually less than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. We've done some analysis and you can see our take on CITIC Niya Wine's balance sheet by clicking here.

This note has only looked at a single factor that sheds light on the nature of CITIC Niya Wine's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600084

CITIC Niya Wine

Engages in the planting, production, and sale of grape wine in China.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives