- China

- /

- Energy Services

- /

- SZSE:300471

Subdued Growth No Barrier To Houpu Clean Energy Group Co., Ltd.'s (SZSE:300471) Price

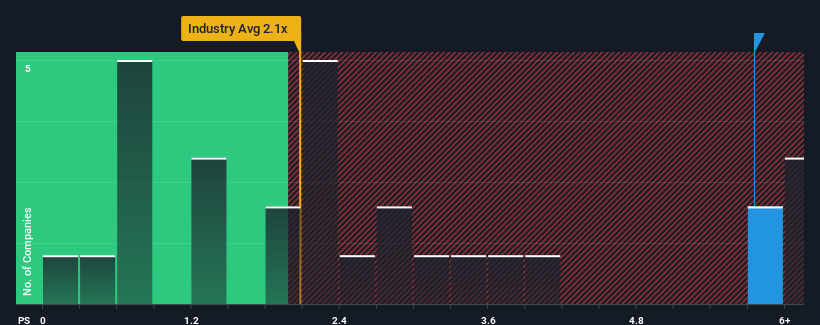

When you see that almost half of the companies in the Energy Services industry in China have price-to-sales ratios (or "P/S") below 2.1x, Houpu Clean Energy Group Co., Ltd. (SZSE:300471) looks to be giving off strong sell signals with its 5.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Houpu Clean Energy Group

What Does Houpu Clean Energy Group's P/S Mean For Shareholders?

Revenue has risen firmly for Houpu Clean Energy Group recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Houpu Clean Energy Group will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Houpu Clean Energy Group?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Houpu Clean Energy Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Pleasingly, revenue has also lifted 64% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 18% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Houpu Clean Energy Group's P/S exceeds that of its industry peers. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What We Can Learn From Houpu Clean Energy Group's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't expect to see Houpu Clean Energy Group trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Houpu Clean Energy Group has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Houpu Clean Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300471

Excellent balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives