- China

- /

- Energy Services

- /

- SZSE:300084

Haimo Technologies Group (SZSE:300084 shareholders incur further losses as stock declines 13% this week, taking one-year losses to 25%

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Haimo Technologies Group Corp. (SZSE:300084) share price slid 25% over twelve months. That falls noticeably short of the market return of around 14%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 2.8% in three years. On top of that, the share price is down 13% in the last week.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Haimo Technologies Group

Given that Haimo Technologies Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In just one year Haimo Technologies Group saw its revenue fall by 3.4%. That looks pretty grim, at a glance. The stock price has languished lately, falling 25% in a year. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

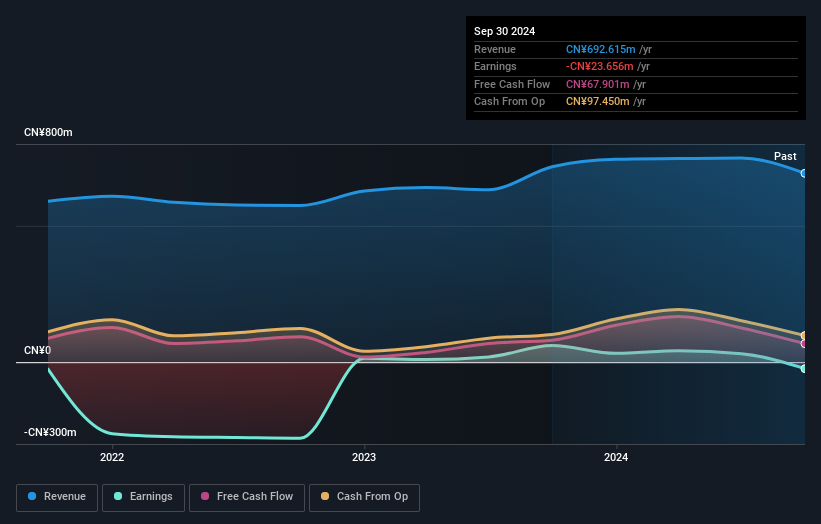

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Haimo Technologies Group shareholders are down 25% for the year, but the market itself is up 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Haimo Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300084

Haimo Technologies Group

Manufactures and sells oilfield equipment and instruments for oilfield service companies in China, the Middle East, North Africa, Central, South and Southeast Asia, and North and South America.

Flawless balance sheet very low.

Market Insights

Community Narratives