- China

- /

- Energy Services

- /

- SZSE:002423

COFCO Capital Holdings Co., Ltd.'s (SZSE:002423) Business And Shares Still Trailing The Market

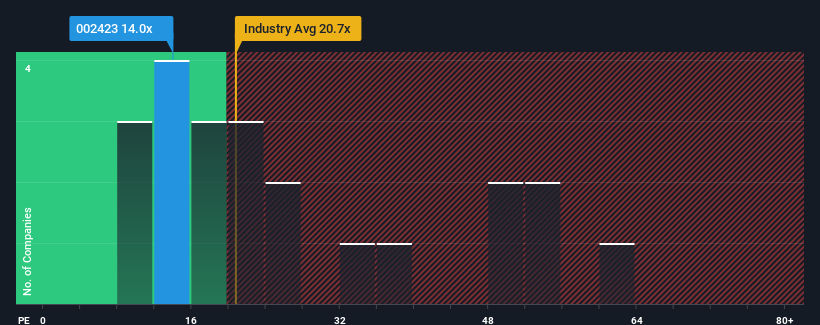

COFCO Capital Holdings Co., Ltd.'s (SZSE:002423) price-to-earnings (or "P/E") ratio of 14x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 52x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, COFCO Capital Holdings' receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for COFCO Capital Holdings

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, COFCO Capital Holdings would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 3.2% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why COFCO Capital Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On COFCO Capital Holdings' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of COFCO Capital Holdings revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with COFCO Capital Holdings, and understanding should be part of your investment process.

You might be able to find a better investment than COFCO Capital Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002423

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives