- China

- /

- Oil and Gas

- /

- SZSE:002221

Oriental Energy Co., Ltd. (SZSE:002221) Doing What It Can To Lift Shares

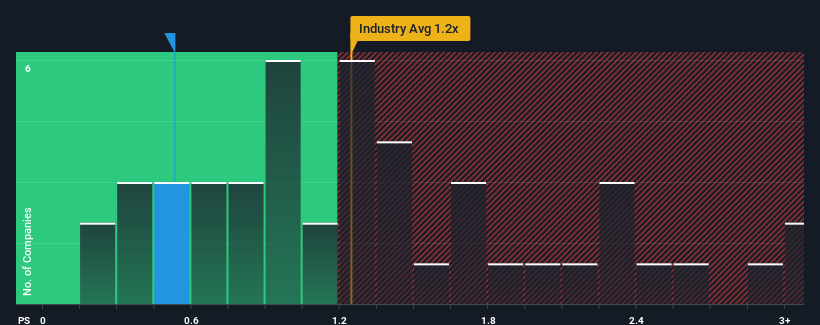

Oriental Energy Co., Ltd.'s (SZSE:002221) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in China have P/S ratios greater than 1.2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Oriental Energy

How Has Oriental Energy Performed Recently?

The recently shrinking revenue for Oriental Energy has been in line with the industry. It might be that many expect the company's revenue performance to degrade further, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Oriental Energy will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Oriental Energy?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Oriental Energy's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.8%. As a result, revenue from three years ago have also fallen 16% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.0%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Oriental Energy's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Oriental Energy currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Oriental Energy (1 is a bit unpleasant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002221

Oriental Energy

Engages in the production and sale of liquified petroleum gas China.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives